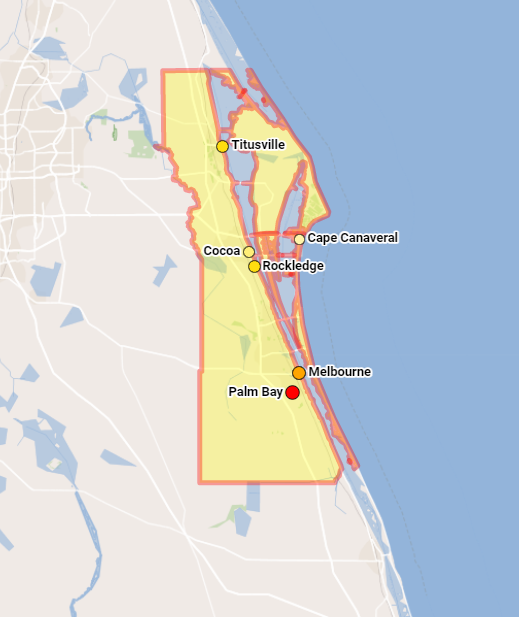

Loan Trust is the premiere Mortgage Broker in Brevard County Florida. We have access to just about any mortgage loan program and it doesn’t matter if you’re a first time homebuyers, real estate investor or looking for lower rates to refinance or cash out. We’re the choice for Brevard County and surrounding communities.

Loan Trust is the premiere Brevard County Mortgage Broker. No matter what type of home loan you need, we’re with you every step of the way. If buying a new home, then you can increase your odds of the winning bid with our cash offer and “The Loan Trust” express home buying program .

Welcome to the official site of Loan Trust. We are a full service mortgage company. We specialize multiple mortgage loan programs, in Brevard County Florida. We also serve the surrounding cities in Montgomery County. Whether you are buying a home or refinancing in any of surrounding cities, we can help you realize your dream of home ownership or save you money when getting your new lower monthly payment.

Contact Loan Trust today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

Contact Loan Trust today to discuss your mortgage loan options, and find out which loan program will best suit your needs. Today’s FHA Rates.

- Cape Canaveral

- Cocoa

- Cocoa Beach

- Grant-Valkaria

- Idialantic

- Indian Harbour Beach

- Malabar

- Melbourne

- Melbourne Beach

- Melbourne Village

- Palm Bay

- Palm Shores

- Rockledge

- Satellite Beach

- Titusville

- West Melbourne

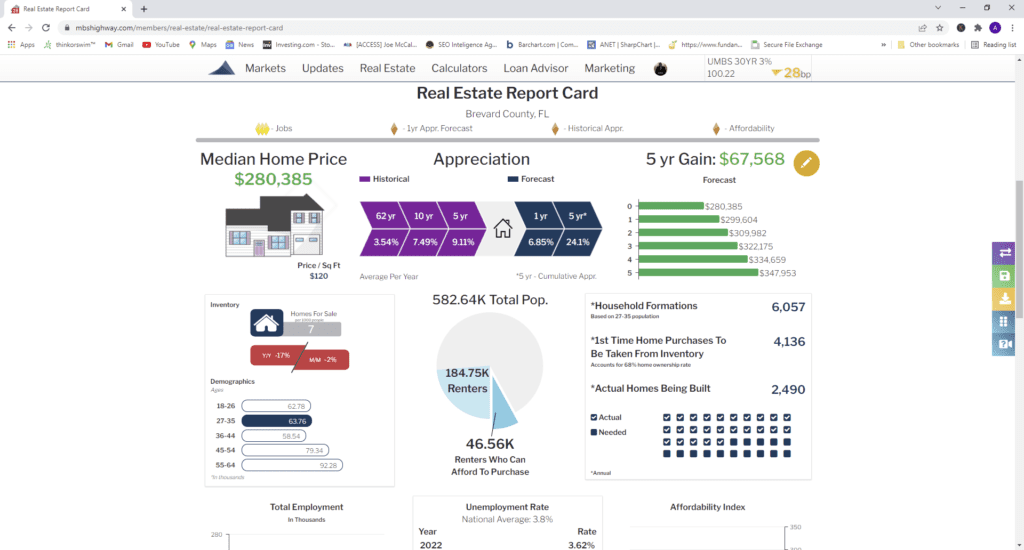

Brevard County Mortgage Real Estate Statistics

Brevard County Mortgage Programs

Conventional Purchase Loans

Conventional Refinance Rate & Terms

Conventional Refinance Cash-Out

Conventional Jumbo Loans 95% LTV

Full Documentation Loans

12 Month Bank Statements Loans

24 Month Bank Statement Loans

3 Month Bank Statement Loans

80% LTV Foreign National Stated Income

Foreign National Full Documentation

ITIN Non-US Citizen Loan

FHA Loans

FHA 3.5% Down LTV With 600 FICO

FHA Loan With 500 FICO

FHA Refinance Streamline

FHA Refinance Cash Out

Down Payment Assistance Programs

Grant Money Programs

Reverse Mortgage Loans

Single-Purpose Reverse Mortgage

Proprietary Reverse Mortgage

Investment Reverse Mortgage

VA Refinance Streamline

VA Streamline (IRRRL)

VA Jumbo Loans

USDA Loans

USDA 100% LTV

USDA Streamline

USDA Home Improvement

No Income Verification Loans

Investment Property Purchase

Investment Property Rental

Commercial Investment Loans

Cash Flow Loans

No Doc Loans

Air BnB Loans

Private Mortgage Money Loan Programs

Real Estate Bridge Loans

Asset Based Loans

Fix & Flip

Fix & Flip Rentals

Construction-to Perm/Interim Financing

Land Loans

Asset Depleation Loans

Condotel Loans

2- 4 Multifamily Unit Loans

5+ Multifamily Units

Commercial Office Loans

Retail Strip Malls/Shopping Centers

Industrial Loans

SBA Loans (Medical, Automotive, Specialty)

Hotel Loans