DSCR Loan Alabama: Debt Service Coverage Ratio (DSCR)

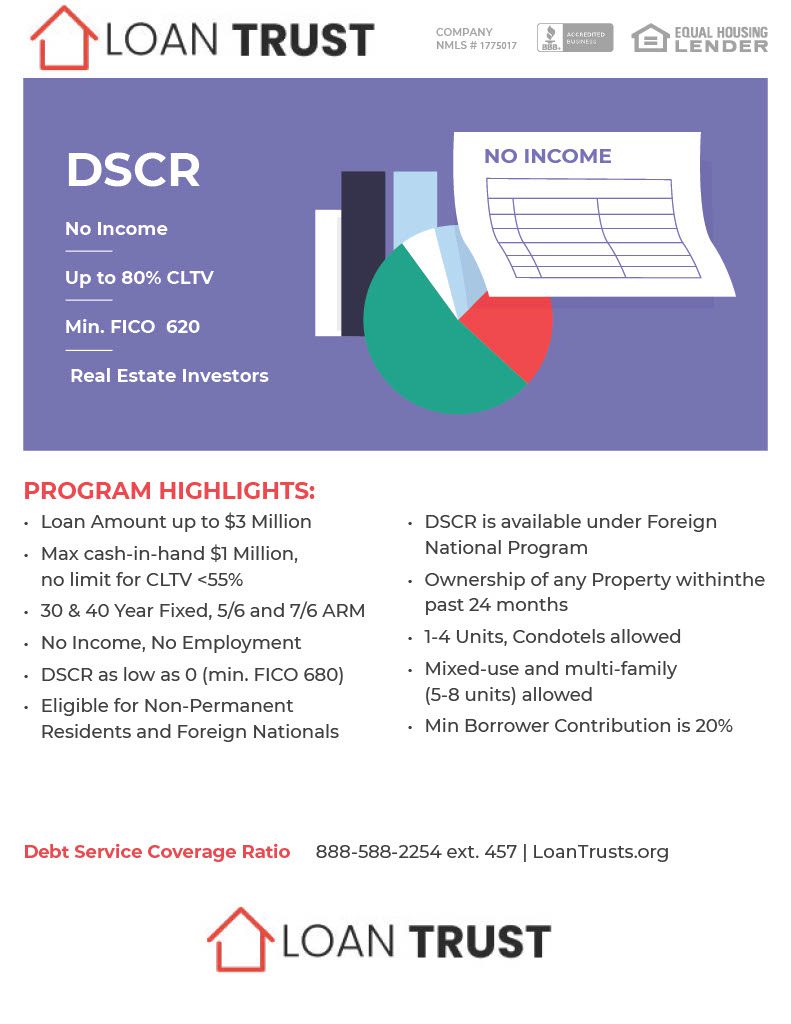

Loan Trust offers a premiere DSCR Loans in Alabama that real estate portfolio investors easily qualify without showing any income verification and the property can be vacant. Our investment property loans don’t require and personal income as long as the property has higher rents than the mortgage payment. Or it can be based on market rents from the real estate schedule 1007 from the appraisal.

DSCR: No-Income Mortgage Loan

Apply for DSCR mortgage with no tax return. For investors, it is easier to get a debt service coverage investment mortgage loan than an unsecured private loan. Qualify for loans according to schedule rents of your property, rather than a fixed rate on your earnings. Investing is a very efficient way to expand the portfolio of a business with no risk. Find out about DSCR loan requirements.

HOME AND CONDO DSCR INVESTMENT LOANS

We are a Direct Mortgage Lenders and Brokers for DSCR Investing, and DSCR JUMBO Loans. We offer DSCR JUMBO Investing Property LOANS up to 5 million in Condo, multi-unit homes.

DSCR Mortgages are based on the property’s Debt Service

Loan Trust offers a DSCR loan in investment property mortgage markets. If you earn income from renting investment properties and you are paying for debt services, then you qualify. You can obtain 30-year fixed interest rates between $150,000 and $30 million. You will not need to submit a 4506. We also offer “No-rate loans” to people with no income to pay off their debt. Get in touch to learn more about Truss and get rid of your hard money loans.

Determining DSCR income

For property investments, the income is the monthly income. For commercial investment property income means total gross profit without operating expenses including maintenance, utilities and other costs. In this case, the loan amounts are calculated using fixed interest rate used by PITIA. PITIA is a real estate acronym that stands for Examples and how lower payment can improve the DSCR. Example : Why lower payment will be beneficial for the DSCR? How can I increase my DDCR?

DSCR mortgages are based on the property’s Rental Income

Why get a DSCR loan in Alabama in 2023?

DSCR loans are an investor-friendly lending product that allows borrowers to receive loans based on property rental income and no tax returns needed. We also don’t need personal income. Many buyers forget Alabama is an affordable investment market in the U.S. In Alabama the average home value is $207,000 compared to a $355,000 average. DSCR Mortgage Loans offer an easy and quick method for investors to build an investment portfolio despite no tax returns or income checks.

HOME AND CONDO DSCR INVESTMENT LOANS

DSCR Loans Are Ideal For Investors

DSCR loan products offer low risk solutions to increase property investments as compared to other loans.

How To Qualify for DSCR Loan Program?

The guide below is the most comprehensive guide to lenders offering DSCR loan in Alabama. This comprehensive guide explains the process for applying for DSCR loan and compares multiple lenders offering DSCR mortgage loans in Alabama. This comprehensive guide is designed to assist real estate investors in choosing the best lending institution. So, we’ll show you how to get approved for a DSCR loan program in Alabama.

DSCR Loan Example

You purchased a 4-unit home with annual gross rental rates in excess of $60,000 annually with annual payments of $50,000. Your DSCR ratio would have been 1.20 and your income generated would have risen 20% from the expenses of the business. A DSCR loan will have sufficient income to help your bank maintain an up credit score and adequate cash flow in your home.

Another example: For example, a property with $150,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.50 ($150,000 ÷ $100,000 = 1.50). The ratio helps lenders determine the maximum loan size based on the cash flow generated annual debt due by the property.

No Doc Mortgages

No Doc home loans require no proof of income and are only available in certain markets in specific situations. If possible, a home loan that doesn’t need income verification will require a No Doc loan. However, we sometimes have options to help you get cash out even if you don’t have a job or no income. A DSCR loan is a close as a NO DOC Mortgage as you can get in this market, because you don’t have t have a job or have a business so that eliminates income verification. We don’t even need bank statements if it’s a cash out refinance because we can use the cash out for reserves to qualify. Basically, the property just has to have market rents that will support the interest rate and debt service on the property.

Where is the best place to get a DSCR loan?

Not every bank offers loan terms with debt coverage ratios and service levels. You may be eligible for DSCR mortgage loans from various banks private lenders traditional banks, or credit unions. This lending company can provide DSCR investment mortgage loans for the purchase, construction, or renovation of new houses. Loan Trust offers one of the most competitive loan programs available in the market. Our mortgage specialists are going to be here with you during the discovery meeting so that we can learn more of how best to serve you.

What is the minimum down payment on a DSCR loan?

These loans can be obtained with as little as 20% down. If you wish to reduce all interest payments you could also pay more for the loan amount than the down payment, which would mean lower payments per month.

Can I Get a DSCR Loan as a First Time Investor?

Yes, you could buy or sell a property first and be eligible for a loan with Loan Trusts. DSCR mortgage loans are available to many investors and anyone with no mortgage experience.

DSCR Mortgage Loans in Alabama: Financing Your Real Estate Investments

The world of real estate investment often requires astute financial management and strategic planning. One essential tool that real estate investors in Alabama often employ is the Debt Service Coverage Ratio (DSCR) loan. DSCR investment loans play a pivotal role in empowering both new and seasoned investors to expand their real estate portfolios and secure investment properties. This essay delves into the realm of DSCR investment loans in Alabama, shedding light on loan types, their significance, application, and the factors that influence their availability.

Understanding DSCR Loans

DSCR, which stands for Debt Service Coverage Ratio, is a financial metric that evaluates a borrower’s ability to cover their debt obligations, including mortgage payments, from their property’s income. DSCR investment loans are specialized financial products designed to cater to the needs of real estate investors, particularly those seeking to finance investment properties. These loans consider the property’s income potential, rather than solely relying on the borrower’s personal income.

The Appeal of DSCR Loans for Real Estate Investors

Real Estate Investment Focus: DSCR investment loans are tailor-made for real estate investors. Unlike traditional loans that heavily rely on income personally and creditworthiness, DSCR investment loans prioritize the investment property’s income potential.

Cash Projections: For real estate investors, positive cash rental flow is the holy grail. DSCR mortgage loans are structured to ensure that the rental income from the investment property is sufficient to cover all debt obligations, leading to a positive cash flow.

Larger Real Estate Portfolios: DSCR investment loans enable investors to grow their real estate portfolios by financing multiple properties. This flexibility can be invaluable for those looking to diversify their investments.

No Personal Income Requirement: DSCR mortgage loans don’t require borrowers to demonstrate high personal income. Instead, they rely on the property’s income potential, making them accessible to investors with varying income levels.

Lower Closing Costs: In many cases, DSCRmortgage loans may have lower closing costs compared to traditional mortgage loans, making them an attractive option for real estate investors.

Key Factors Influencing DSCR Loans in Alabama

DSCR Ratio: The DSCR ratio, which is calculated as the property’s net operating income divided by the annual debt service (loan payments), plays a crucial role in determining eligibility and loan terms. Lenders typically require a minimum DSCR ratio to ensure sufficient cash flow.

Property Type: Different lenders may have preferences for specific property types. Some may specialize in single-family residences, while others may focus on multi-unit properties, short-term rentals, or other property types.

Loan Type: DSCR loans come in various types, including hard money loans, bank statement loans, and more. The choice of loan type can impact interest rates, loan amounts, and eligibility criteria.

Credit Score: Although DSCR loans emphasize property income, some lenders may still consider the borrower’s credit score and financial history when making lending decisions.

Income Verification: While DSCR loans require income generated by the investment property to cover debt payments, some lenders may still require income verification or documentation of personal financial information.

Interest Rates: DSCR loans can have variable or fixed interest rates, and rates may vary depending on the lender, the borrower’s qualifications, and market conditions.

Maximum Loan Amount: Lenders determine the maximum loan amount based on factors such as the property’s income potential, DSCR ratio, and the borrower’s financial profile.

Loan Options: Investors can explore a range of loan options, including loans for new and seasoned investors, foreign nationals, and those with diverse property types in their portfolios.

Local Lenders: Alabama boasts a diverse lending landscape, with local lenders often offering specialized DSCR loan products tailored to the state’s real estate market.

Calculating DSCR: Investors should understand how to calculate DSCR to evaluate their investment properties effectively and determine their eligibility for DSCR loans. The DSCR formula is straightforward: DSCR = Net Operating Income / Annual Debt Service.

DSCR Investment Loans in Alabama: Empowering Real Estate Investors

In the vibrant real estate landscape of Alabama, investors are continually seeking financial tools that can propel their ventures to new heights. Among the arsenal of options available, DSCR (Debt Service Coverage Ratio) investment loans have emerged as a powerful tool, particularly for those aiming to expand their real estate portfolios.

DSCR lenders in Alabama understand the unique needs of real estate investors. Instead of solely assessing a borrower’s debt to income ratio or focusing on the borrower’s personal financial standing, these lenders prioritize the property’s income potential. This shift in perspective can be a game-changer for investors, as it allows them to secure financing based on the property’s ability to generate income rather than their own earnings.

One critical factor that DSCR lenders consider is the debt to income ratio, which reflects the property’s ability to cover its mortgage payment and other associated expenses. This ratio, often calculated as net operating income divided by the mortgage payment, helps lenders determine whether the rental property is generating sufficient income to support the loan.

DSCR loans are not limited to specific property types in Alabama. Investors can utilize these loans for various real estate endeavors, including single-family homes, vacation rentals, or even construction projects. This flexibility makes DSCR investment loans a versatile choice for those with diverse real estate interests.

When exploring DSCR loans in Alabama, investors should be aware of some key aspects. Most lenders will have minimum requirements, such as a specific DSCR ratio that the property must meet to qualify for financing. Additionally, some lenders may impose prepayment penalties, origination fees, or other costs that should be factored into the decision-making process.

While DSCR loans offer numerous benefits, they also come with considerations. Investors must carefully calculate DSCR to ensure the property generates enough income to cover expenses, including the mortgage payment. Falling short on this calculation can result in losing money on the investment.

In terms of loan terms, investors can choose between short-term and long-term options. Some may opt for a 30-year fixed-rate loan, providing stability and predictability in their financial planning. Others may prefer short-term loans for construction projects or vacation rentals, where quick returns on investment are anticipated.

In summary, DSCR investment loans in Alabama stand as a valuable resource for real estate investors seeking to amplify their portfolios. These loans offer a shift in perspective, focusing on property income potential rather than personal financial standing. Whether you’re interested in single-family homes, vacation rentals, or long-term investments, DSCR lenders in Alabama provide opportunities to secure financing on favorable terms. However, investors should approach these loans with careful consideration of DSCR calculations and potential costs, ensuring that their real estate ventures flourish in the ever-evolving Alabama market.

Conclusion:

In conclusion, DSCR loans are a vital tool for real estate investors in Alabama, offering a pathway to expand their portfolios and capitalize on investment opportunities. These loans prioritize property income and positive cash flow, making them an attractive choice for those seeking to grow their real estate holdings. However, investors should carefully consider factors such as property type, loan type, and eligibility criteria when exploring DSCR loan options. With the right financial strategy and a thorough understanding of DSCR, real estate investors can harness more cash flow through the power of DSCR loans to achieve their investment goals in Alabama’s dynamic real estate market.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington