DSCR Loans Michigan

Real estate investor DSCR loans in Michigan with no income verification. Fast Approvals!!

DSCR loan Michigan: Private Lender DSCR Loans

How does the DSCR Loan work for property owners? What are their benefits? The guide below is the most comprehensive guide to lenders offering DCR loans for students in Michigan. This comprehensive guide explains the process for applying for DSCR loan and compares lenders offering DSCR loans in Michigan. This comprehensive guide is designed to assist real estate investors in choosing the best lending institution. So, we’ll show you how to get approved for a DSCR loan program in Michigan.

Loan Trust DSCR Loans in Michigan Allow Real Estate Investors to Finance Up To 20 Properties By Using The Monthly Rental Income to Qualify.

Real estate investors exclusive Debt Service Coverage Ration (DSCR) loan programs in Michigan. Loan Trust offers DSCR loans with a 0.00 and the property can be vacant. We use the market rent analyses for rental income to compute the DSCR. So we don’t need a rental income lease for you to qualify and we certainly don’t need any borrower’s personal income. Our programs have a minimum credit score of 620. We’re the premiere lender for real estate investment loans. We have multiple programs to help find the right loan payments for your real estate investment property. We offer programs without prepayment penalties and with prepayment penalties to exchange for a better pricing.

DSCR Loan Michigan Guidelines for Real Estate Investors

DSCR Program | DSCR Ratio | Reserve Required | Min FICO | Max LTV | Min Loan Amount |

|---|---|---|---|---|---|

DSCR Loan 100B | 0.80 or Greater | 12 Months | 660 | 70% | $100,000 |

DSCR Loan 110O | 0.00 No Minimum | 3 Months | 660 | 80% | $75,000 |

DSCR Loan 120P | 1.00 or Greater | 3 Months | 660 | 80% | $50,000 |

DSCR Loan 130Y | 0.00 No Minimum | 6 Months | 620 | 80% | $50,000 |

DSCR LOAN INVESTOR

LP-100-B

- 660+ FICO up to 70% LTV

- Loan amounts starting at $100,000 up to $2M

- Minimum debt service coverage ratio of .80

- Eligible on investment purchases, rate/term and cash-out refinances

- Finance up to 20 properties

- Minimum of 12 months’ reserves required

- Additional 6 months’ reserves required per financed property

- Pre-payment penalty options: 3/2/1, 2/1, 1/1

- Appraisals from two different appraisers required for loans over $1.5M

DSCR LOAN INVESTOR

LP-110-O

- 660+ FICO up to 80% LTV

- Loan amounts starting at $75,000 up to $2M

- Minimum debt service coverage ratio of 0.00

- Eligible on investment purchases, rate/term and cash-out refinances

- Finance up to 20 properties

- Minimum of 3 months’ reserves required

- Minimum of 6 months’ reserves required for loan amounts greater than $500,000

- Pre-payment penalty options: 3/2/1, 2/1, 1/1

- Appraisals from two different appraisers required for loans over $1.5M

- Eligible to close in an LLC (Limited Liability Company)

DSCR LOAN INVESTOR

LP-120-P

- 660+ FICO up to 80% LTV

- Loan amounts starting at $50,000 up to $3M

- Minimum debt service coverage ratio of 1.00

- Eligible on investment purchases, rate/term and cash-out refinances

- No limit on the number of financed properties

- Minimum of 3 months’ reserves required

- Pre-payment penalty options: 3/2/1, 2/1, 1/1

- Eligible to close in an LLC (Limited Liability Company)

DSCR LOAN INVESTOR

LP-130-Y

- 620+ FICO up to 80% LTV

- Loan amounts up to $2M

- Minimum debt service coverage ratio of 0.00

- Eligible on investment purchases, rate/term and cash-out refinances

- Finance up to 20 properties

- Minimum of 6 months’ reserves required

- Pre-payment penalty options: 3/2/1, 2/1, 1/1

- Appraisals from two different appraisers required for loans over $1.5M

- Eligible to close in an LLC (Limited Liability Company)

Benefits of DSCR Loans Michigan for Real Estate Investors

Michigan’s real estate market is growing, and DSCR Loan programs provide the ideal solution. How does DSCR Loans in Michigan help with real estate investments? Example. Michigan average homes prices are 3000. You make a 20% down payment and get the loan with a 7% interest rate over 30 years. Similarly, Michigan has average rent income of $3200. Normal expenses are $500. Currently if you add something like Net Profit/Debt Obligations in your calculation, you get a 1% debt coverage ratio for debt service. It gives an average home price and excellent amount of income in terms of money, It helps you to obtain the loan quickly. Get approve for a DSCR loan in with terms.

Finally, a no-tax-return loan for real estate investors in Michigan

Michigan draws in real estate investors to attract more jobs, a growing economy and acclaimed attractions. The state is the 12th lowest cost of living state in the nation based on average house prices. This allows the buyer to find an investment home faster than in many other areas. DSCR loans are one of Michigan’s best instruments for mortgage and property owners to invest. The DSCR loans approval is based on the buyer’s incomes and not the buyer’s income. This allows investors to make a decision on what goals are needed.

DEBT SERVICE COVERAGE MICHIGAN INVESTOR LOANS

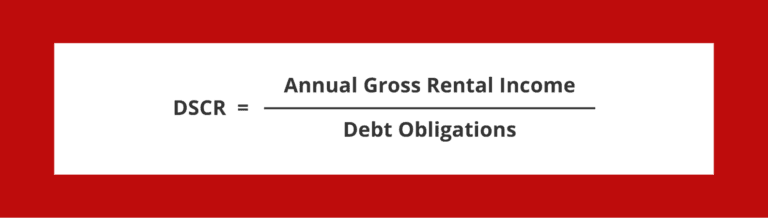

Michigan commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

No Tax Returns Required for Michigan Real Estate Investors

DSCR loans offer borrowers with no property tax obligation to file their financial reports and make it an accessible financing solution for securing investments in commercial properties.

Benefits of Michigan DSCR Loans

Getting the right loan is very crucial. Michigan’s debt service coverage ratio loans are one of the most attractive loan available. Get started now and get an accurate estimate today! Please submit your application today.

Variety of Lenders

Various lenders offer loan amount for DSCR lending to property investors in Michigan. It will help them find the best solution. If you want your DSCR loan in Michigan, please contact Loan Trust so we can help with any mortgage loan questions.

Find the Best DSCR Lender in Michigan

Become eligible for an Investor Cash Flow Loan for rentable income.

Michigan DSCR Eligibility Requirements

Applicants who apply with Michigan DSCR need at least an DSCR above the required threshold for the loan. Different lenders are required to have different DSCR calculation requirements but it must always happen unless the borrower wants it to happen. The minimum credit scores and down payments required for a secured loan must also include the DSCR threshold. We require a 20% deposit and a bigger deposit is required to lower our DSCR ratio. Although some DSCR lending is required, these requirements are very flexible. DSCR loans are good alternatives in Michigan.

Eligibility Criteria and Loan Terms for DSCR Loans Michigan

DSCR loans in Michigan have certain criteria everyone must meet. Here are the requirements for borrowing. The property must have sufficient income to cover the debt is the most important factor.

DSCR Loan in Michigan Requirements

See current rate of interest on DSCR loans.

Prepayment Penalties

In Michigan, payday loans are subject to payment penalties. The penalty can be between 10% and 3% and is applicable in situations of late repayment or late payment. These penalties protect the lenders who have repaid the loans on time from possible loss. In most situations refundable payment penalties are refunded when an applicant refinances traditional loans or sells the investment property within one business day of the expiration.

Steps to Get DSCR Loans in Michigan

This guide describes the process for applying for DSCR loans from Michigan. Please consult one of our Loan Officers for a DSCR Loan or to get more information.

What Is the Importance of DSCR for Real Estate Investment Loans?

DSCR, debt service coverage ratios, is a measure of rental income versus annual loan debt. When you have rent income that is above the amount that you have to repay each month, it can show that your borrower’s creditworthiness and rating is good. Lenders offer loans geared toward buying rental properties that can help pay your monthly loans. DSCRs are calculated by measuring the rent that’s taxable or higher. Almost all lending institutions require you to meet the DSCR to qualify for loans, although these numbers vary from bank to bank and are generally the same.

Terms of DSCR Loans Michigan

DSCR loans in Michigan provides property investment property investors with an innovative financing solution. Learn more about Michigan loans and their coverage rates.

Repayment Periods & Interest Rates

DSCR loan programs typically offer 30-year terms. Although interest rates on these loans are variable, they can vary depending on several factors. Most loans with DSCR have interest rates up to 1-2% above typical lending rates. Check latest DSCR Loans Rates on our site! If you’ve got an DSCR loan in Michigan, Home

Compare Rates from Best DSCR Lenders

Make sure investors have cash flow loans pre-qualified based on rental income.

Loan Trust has an enormous network of lenders.

What is the minimum DSCR ratio requirement for getting a DSCR loan in Michigan?

A. The credit score for a DSCR Loan in Michigan should be 600 or better. Some lenders will accept your DSCR loan with a lower credit score, but the down payment and interest maybe higher.

How Does a DSCR Loan Work?

Understanding how loan servicing coverage ratios work is a very important first step. The DSCR loan reflects non-QM borrowing and is a conventional loan that has less restrictive requirements and approved procedures than the conventional mortgage. Non-QM loan programs can serve a wide range of customers, from individuals to property investors to individuals with high incomes. The Non-QM lending system provides alternative conditions that can be easily approved. Contrary to other non-QM types such as asset-based loans, recent credit events loans, and bank statement loans, DSCR loans specifically target real property investors.

Debt Service Loans: A Multi-State Perspective

Debt Service Coverage Ratio (DSCR) loans stand as a linchpin in real estate investment across several states. From Oregon’s natural beauty to the vibrant markets of Alabama and Illinois, the thriving economies of North Carolina and South Carolina’s specialized programs, and Ohio’s diverse prospects, DSCR loans facilitate strategic property investments by evaluating a property’s income potential.

In Oregon, DSCR loans serve as financial enablers, aiding investors in navigating the state’s picturesque but varied real estate market. These loans act as catalysts, providing essential capital for leveraging investments in Oregon’s scenic properties.

Alabama and Illinois feature robust real estate markets, where DSCR loans play a pivotal role. These loans empower investors by assessing a property’s income-generating capabilities, ensuring informed and secure investment decisions based on the property’s rental income.

North Carolina’s growing economy benefits from DSCR loans, which aid in property acquisition and development. These loans offer investors a comprehensive view of a property’s income potential, aligning with the state’s upward trajectory in real estate.

South Carolina boasts specialized DSCR loan programs designed to assist investors in navigating property investment intricacies. These programs offer diverse financing options, considering personal income and specific property rental incomes to support investment endeavors.

In Ohio, DSCR loans are fundamental tools for investors exploring urban and suburban real estate prospects. Assessing the Debt Service Ratio helps investors evaluate investment viability based on a property’s rental income, establishing a solid financial base.

Evaluating personal income intertwines with DSCR loan assessment, playing a significant role in loan approval. It, alongside the property’s rental income, forms a balanced approach to approving loans, ensuring financial stability in investments.

Additionally, DSCR investment loans tailored for condominiums open unique avenues for investors. These loans assess the rental income potential of condos, guiding investors in making informed decisions when investing in such properties.

In conclusion, DSCR loans play a pivotal role in shaping strategic property investments across states. From the captivating landscapes of Oregon to the thriving real estate markets of Alabama and Illinois, the growing economies of North Carolina and South Carolina’s specialized programs, and Ohio’s diverse prospects, DSCR loans serve as instrumental tools for investors, evaluating the income potential of properties and enabling informed decision-making.

Navigating the Real Estate Terrain: DSCR Loan Programs in Michigan

Within the realm of real estate investment in Michigan, savvy investors seek to leverage an array of financial tools to seize opportunities and bolster their portfolios. Among these instruments, DSCR loans have emerged as a linchpin, facilitating the strategic acquisition and management of income-generating properties.

DSCR Loan Landscape in Michigan: Michigan’s vibrant real estate market beckons investors, offering diverse opportunities from residential rental properties to investment ventures. The state’s DSCR loan landscape caters to the discerning needs of real estate investors, specifically evaluating a property’s ability to generate income to cover debt obligations. This financing avenue has become indispensable for those aiming to capitalize on the potential of rental income within the Michigan real estate market.

Empowering Real Estate Investors: Real estate investors in Michigan, drawn by the allure of rental properties, often explore traditional loans as a foundation for property acquisition. However, DSCR loans stand out by focusing on the property’s cash flow rather than solely relying on the borrower’s personal income verification. This avenue proves advantageous for investors eyeing income-generating properties with no borrower’s personal income or employment verification.

Customized Financing Options: Unlike conventional mortgages that heavily rely on a borrower’s credit score, minimum down payment, and income or employment verification, DSCR loans offer flexibility. They evaluate the income generated by the subject property, enabling investors to secure financing even with a minimum credit score or lower down payment, pivoting the focus to the property’s rental income potential. You can qualify with a down payment as little as 20%. Remember the lower your down payment the higher the leverage. We specialize with DSCR loans in Michigan due to the smaller loan sizes in most cases for real estate investments and residential rental property.

Lenders and Loan Structure: In Michigan, most lenders providing DSCR loans comprehend the dynamics of real estate portfolios, whether they encompass single-family homes, condos, or vacation rentals. These lenders, including private and direct lenders, cater to investors by assessing the subject property’s market rent and income documents, providing tailored financing solutions.

The Edge of DSCR Loans: DSCR loans extend beyond the conventional lending framework, offering non-QM loans that transcend the constraints of personal finances. They facilitate access to competitive interest rates, supporting investors in maintaining a positive cash flow and effectively managing loan payments through income-generating properties.

The Michigan Advantage: Michigan’s DSCR loan programs not only empower real estate investors but also serve as a catalyst for their financial growth. The state’s real estate market thrives with these innovative lending solutions, allowing investors to harness the potential of rental income without being solely reliant on traditional lenders and their stringent requirements.

In conclusion, DSCR loans in Michigan redefine the landscape of real estate financing, ushering investors into a realm where the property’s potential to generate income takes precedence. As the Michigan real estate market flourishes, these specialized loan programs offer a conduit for investors to expand their portfolios, leveraging the income potential of rental properties while navigating the diverse avenues of real estate investment.

Fast approval DSCR loans in Michigan, Massachusetts, and Washington can be a game-changer for investors looking to secure financing for their investment properties. These specialized loans, also known as Debt Service Coverage Ratio loans, prioritize the property’s income-generating potential, making them an attractive option for real estate ventures in these states. With quick approval processes, investors can seize timely opportunities in these competitive real estate markets, ensuring they have the necessary financing in place to pursue their investment goals.

DSCR Loans in Michigan for Investors: A Comprehensive Guide

In the dynamic world of real estate investment, securing the right financing is a key element of a successful strategy. Among the myriad financing options available, DSCR (Debt Service Coverage Ratio) loans stand out as a particularly appealing choice for investors in Michigan. These loans, which have gained popularity in states like Maryland, Colorado, and Hawaii, offer a unique proposition for investors aiming to expand their portfolios. They do so by focusing on the income-generating potential of properties rather than the personal income of the borrower. This article delves into the nuances of DSCR loans, including their presence in Maryland, Colorado, and Hawaii, and discusses the concept of the minimum loan amount, providing a tailored guide for investors in Michigan.

Understanding DSCR Loans

DSCR loans are specially designed for real estate investors, prioritizing the income that an investment property is expected to generate over the personal financial circumstances of the investor. These loans evaluate the Debt Service Coverage Ratio, a key metric that measures the cash flow available to cover a property’s debt obligations, including mortgage, interest, taxes, and insurance. Ideal for acquiring properties that are expected to generate sufficient rental income to cover these costs, DSCR loans offer a solution for investors to finance properties without the stringent income verification processes of traditional loans.

Geographic Variations in DSCR Loans

Though the fundamental concept of DSCR loans is consistent, there are geographic differences that investors should note. For example, a DSCR loan in Maryland might come with different underwriting criteria or interest rates than a DSCR loan in Colorado or a DSCR loan in Hawaii. Factors such as the local real estate market dynamics, regulatory environment, and economic conditions can all influence the specifics of DSCR loans. In Colorado, DSCR loans are adapted to the state’s diverse real estate market, catering to properties ranging from bustling urban centers to tranquil mountain escapes.

The Minimum Loan Amount

A crucial factor for investors considering DSCR loans is the minimum loan amount required by lenders. This figure can vary widely between lenders and may also be influenced by the property’s location. The minimum loan amount is an essential consideration for investors, impacting the types of properties they can invest in, their financing strategies, and the overall cost-effectiveness of the loan. Investors in Michigan, as well as those in Maryland, Colorado, and Hawaii, need to carefully assess the minimum loan requirements when planning their investment projects.

Advantages for Michigan Investors

For investors in Michigan, DSCR loans present several benefits. These loans offer more flexibility in financing options, allowing investors to capitalize on the rental income potential of their properties. This is particularly advantageous in Michigan’s diverse market, which offers a range of investment opportunities from urban apartments in Detroit to vacation homes along the Great Lakes. DSCR loans also provide a financing pathway for investors who may not qualify for traditional loans due to self-employment or fluctuating income.

Conclusion

DSCR loans offer a compelling financing option for real estate investors across the United States, including Michigan. By focusing on the income-producing potential of investment properties, DSCR loans facilitate a route to real estate investment that circumvents some traditional financing limitations. Whether considering a DSCR loan in Maryland, exploring DSCR loans in Colorado, or assessing opportunities in Hawaii, investors must understand the specific terms and conditions, including minimum loan amounts, that apply in their targeted investment locale. For Michigan investors, DSCR loans could unlock new opportunities and propel them toward their real estate investment objectives.

Understanding Michigan DSCR Loans: A Guide for Real Estate Investors

Introduction to Michigan DSCR Loans

Michigan DSCR loans offer a unique financing solution, focusing on the rental income of the property rather than the personal income of the investor. This approach enables more investors to enter the real estate market, particularly those interested in managing short-term rentals and other investment properties across Michigan.

Key Features of Michigan DSCR Loans

Rental Income Focus The core of a Michigan DSCR loan is its emphasis on the property’s ability to generate rental income. This method calculates the potential monthly rental income against mortgage obligations, making it an attractive option for properties with high income potential.

Minimum Credit Score Requirements Unlike traditional loans that often require high credit scores, Michigan DSCR loans cater to a broader audience with more lenient credit score criteria. This inclusivity opens doors for more investors to achieve their real estate ambitions.

Understanding Minimum Down Payment Investors should anticipate a minimum down payment that typically surpasses traditional loan requirements. This aspect reflects the lenders’ risk management strategy, given the loan’s reliance on the investment’s income generation capabilities.

Loan to Value (LTV) Ratio The LTV ratio plays a pivotal role in determining the maximum loan amount for an investment property. It signifies the loan’s proportion in relation to the property’s market value, influencing the loan’s terms and approval.

Maximum Loan Amount Flexibility The flexibility in the maximum loan amount allows investors to pursue a wide range of real estate investment goals, from acquiring modest single units to extensive property portfolios, demonstrating the adaptability of DSCR loans to various investment scales.

Interest Rates Overview The interest rates for DSCR loans might be slightly higher compared to traditional loans, reflecting the unique risk profile centered around the property’s rental income rather than the borrower’s financial history.

Navigating Michigan DSCR Eligibility Requirements Eligibility for a DSCR loan in Michigan encompasses several factors, including the property’s income potential, the borrower’s credit score, and the down payment amount. Lenders may also require documentation like bank statements to verify the property’s income.

Expanding Portfolios with Multiple Properties One of the standout benefits of Michigan DSCR loans is the ability to finance the acquisition of multiple properties. This feature is especially valuable for seasoned investors aiming to expand their real estate portfolio without being constrained by their personal income levels.

Conclusion

Michigan DSCR loans represent a significant shift in real estate financing, emphasizing the investment property’s income over the investor’s personal financial situation. By catering to a wider range of credit scores and offering flexibility in loan amounts, these loans empower investors to realize their real estate investment goals, from single-unit purchases to managing extensive property portfolios.

DSCR Loan FAQ

The debt service coverage ratio (DSCR) is the ratio of an investment’s net operating income to its total debt service. It is a way of determining whether a borrower has enough cash flow to pay its current debt obligations.

Debt service coverage ratio (DSCR) is a metric that lenders use to determine your ability to repay the loan. Real estate investors typically have lower net incomes after deducting expenses on their taxes, which can affect their chances of getting approved for a conventional loan. As a result, the adjusted income ends up being much lower, and many lenders have strict requirements that prevent them from being able to lend to these types of borrowers.

A debt service coverage (DSCR) loan is one that qualifies borrowers through an investment property’s cash flow rather than the borrower’s income. DSCR loans are also known as investor cash flow loans — are frequently used by real estate investors to qualify for mortgages and buy investment properties.

DSCR can have applications in business, government, and personal finances. Like DSCR loans, this ratio is often used in real estate to determine whether an investment property’s cash flow can cover its mortgage payments.

The higher the DSCR, the better the ratio. A DSCR above 1 means that an investment property has positive cash flow and enough net operating income to cover its debts. As a general rule, anything above 1.20 is considered a good DSCR.

When your borrower applies for a mortgage loan, we look at their income to determine how much they can afford as a monthly payment. The key figure examined is the debt-to-income ratio (DTI), which is the percentage of their monthly income that goes toward debt.

But in the case of investment properties, Loan Trust offers DSCR loans. Rather than looking at a borrower’s income, we consider the expected monthly rent from the property. And instead of using the DTI to determine eligibility, we look at the DSCR.

Many DSCR loan programs may not have the exact same requirements as Conventional mortgages, there are still guidelines real estate investors will have to meet to qualify.

Unlike Conventional mortgages, DSCR mortgages are not backed by entities like Fannie Mae and Freddie Mac. Therefore, there are no standardized requirements. However, there are a few things that we will look at.

- DSCR. Generally speaking, most lenders require a DSCR between 1 and 1.5 to qualify for a DSCR loan, with the most common minimum requirement being a DSCR of 1.25. We go as low as zero!

- Credit score. Each lender will require a specific credit score, with minimum requirements typically ranging from 620 to 700. We go down to 620.

- Down payment. Most DSCR loans have a maximum LTV of 80% — you will need a down payment of at least 20% to qualify. We offer LTVs up to 80%!

- Cash reserves. Like other investment properties, DSCR loan lenders require a certain amount of cash reserves, often equal to six months of payments. We only require 3 months of reserves!

- Loan amount. The maximum they can borrow for a DSCR loan depends upon the lender, but many financial institutions offer loans up to $2 million. We offer a maximum of $3 million!

- Prepayment penalty. Unlike Conventional loans and typical investment property loans, many lenders charge prepayment penalties on DSCR loans. We can offer up to 5 years of prepayment penalties!

Property eligibility. DSCR loans can be used for investment properties with one, two, three, or four units. In certain cases, we have been able to approve up to eight units!

DSCR loans have multiple advantages including:

- Different eligibility requirements. DSCR loans use the rental income from a property, rather than the borrower’s income to qualify. This means that they can buy an investment property even if their income makes them ineligible.

- No limit to the number of loans. There is a limit to how many rental properties a borrower can buy with Conventional mortgages, but they can generally take out as many DSCR loans as they want.

- Quicker closing. DSCR loans may have quicker closing times than Conventional mortgages because of simplified documentation.

- No employment verification. Because the borrower’s income is not used to qualify for a DSCR loan, there is no employment verification required.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington