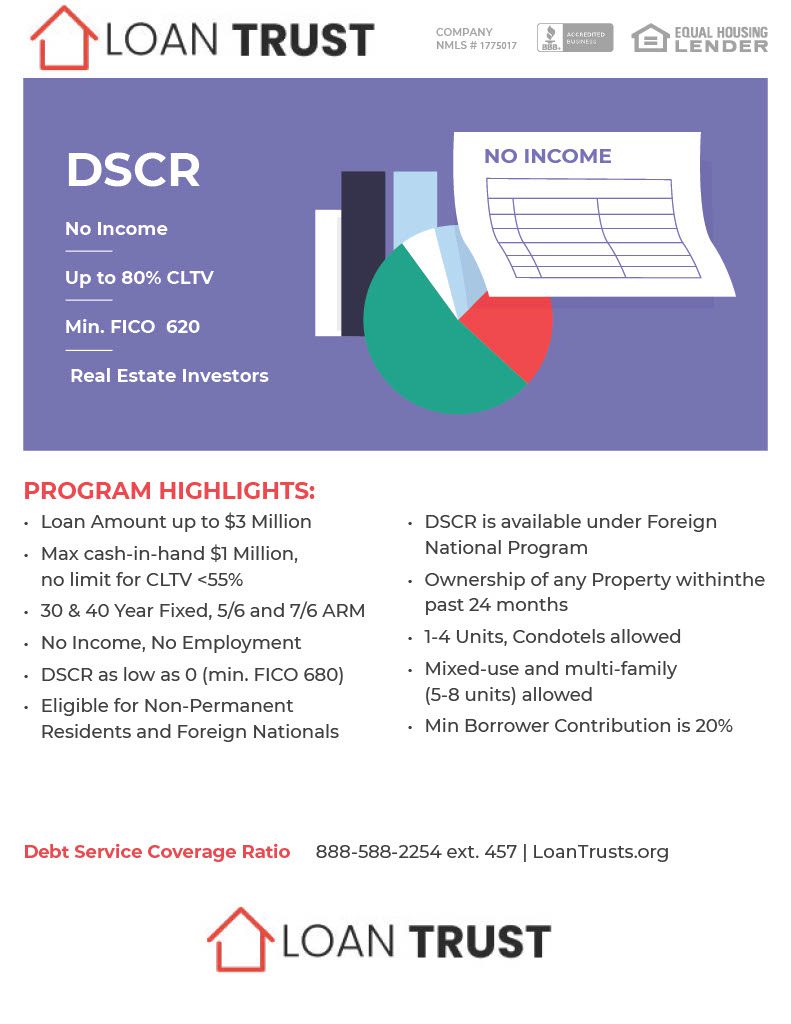

DSCR Loans Ohio | Grow Your Real Estate Portfolio, No Income Verification

Our DSCR loan Ohio programs are just what most are looking for when it comes to investment properties in Ohio. A debt service coverage ratio (DSCR) loan may be suited to your circumstances. DSCR loans allow real estate investors to borrow cash to fund their properties. The DSCR lending process is relatively easy for all Ohio real estate investors to get qualified for without verifying any personal income.

Exploring a Property Example in Ohio

Sara, who wants to invest in Hilliard, Ohio, has considered acquiring property. This area is home-owner friendly and the houses have an average price around $300,000. Rent opportunities have been favorable since rent reaches $2000 a month. A 20% down payment is equivalent to $60k. Investors could pay another $244,000 in interest. Your mortgage payments would average a month’s salary of roughly $1660. The median monthly rent is $2000 and the rental earnings exceed the monthly mortgage payment.

5 best areas to invest in Ohio

Ohio is the sixth largest and most popular U.S. state. The Buck Eye State hosts several attractions and activity venues such as the American National Military Museum, The Rock and Roll Hall of Fame, Cedar Point Amusement Park, and the American Military Museum. Ohio continues to expand in recent years as a whole. The country is estimated to have 1.174 million inhabitants and around 33 percent of them rent apartments. Cleveland is a popular property rental and property location throughout Ohio. Located along Lake Erie’s Bank, the Cleveland Job Marketplace has attracted a large number of skilled workers.

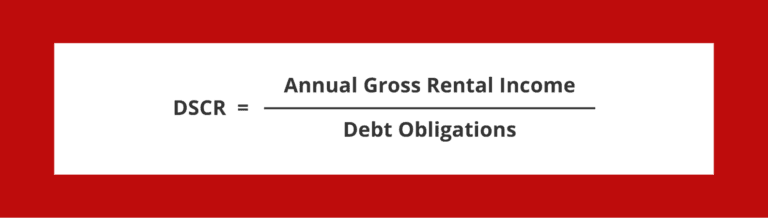

Examples of

calculating DSCR

Meet Jason, an investor looking for information on DSCR. His home was in Mason, Ohio and he earned $60,000 with no interest. Total debt service includes mortgages, other debts and other debt totaling $45,000 a year. DSCR is calculated as total debt service divided in two: Total debt service = $40,000 and $40,000. In the following example the result is 1.31 DSCR. Jason’s real estate revenues are about 1.33 times the total amount of debt. It reveals an adequate cash flow and shows that his real estate is sufficient to secure his debt.

Requirements for a DSCR Loan in Ohio

In order to qualify for Ohio DSCR lending you must meet a minimum DSCR requirement. However, this requirement differs between the lenders. Loan Trust allows for a DSCR ratio of as little as 0.75. But if the DSCR is smaller the greater the interest you’re paying, and thus we advise a ratio of around 1.0. If it was 1.0 your earnings were equal to the credit card debt, which ultimately meant the loan could be repaid. DSCR lending requires the minimum deposit, credit scores or appraisals to determine the loan amount. Unlike traditional loans our lenders can’t guarantee your earnings on home loans.

Loan-to-value (LTV) ratio of 75% to 80%

The lender generally sets LTV ratio between 75% – 80 allowing for loans of up to 75% – 80 / 80% of the appraised value of the property. A lower LTV ratio indicates more borrowing than the property value of the property. It helps reduce the potential loss on the lender’s assets. LTV limits allow lenders to reduce risk while enabling investors to retain sufficient equity in the property.

DSCR Loan Interest Rates

Currently a high rate of loan repayments is based on dsr loan rates and compared to other traditional loans – including bank and investment loans. During times of economic uncertainty, the market for mortgage securities may become unstable. DSCRs are often used in aggregates to securities businesses during times of increased volatility, and where companies may want higher yields. Eventually.

How Do You Apply for an Ohio DSCR Loan?

Griffin Finance helps you get Ohio DRCR loans quickly and efficiently. Approvals are made using the borrower’s property income and not the personal income, which requires us verify certain data about the property rather than the borrower. Please contact DSCR Loans for more information.

DSCR Loan Down Payment

DSCR loans offer 80% LTV on all purchases. Many landlords seek 85 percent LTV, so it’s worth being cautious with the mortgage company that claims to have 85 percent of the total LTV. The lender does the liquidity checks and can demand a bank statement in three months. You can also use brokerage accounts as well as retirement accounts to prove your cash reserves are adequate enough income enough for a downpayment and closing costs.

DSCR Loan Credit Score

A loan from DSCR depends highly on borrowers’ credit rating. DSCR requires an average of 660 credit scores. The less credit you have, the lower LTV the more you can pay interest rates. Almost every bank requires an average of 720 to qualify for maximum DSCR loan requirements and LTVs. Typically, DSCR loans require combining three separate reports, which makes it difficult to get all three credit bureaus to report the same report. The higher the lowest scores, the more the middle scores used are not taken into account.

Benefits of DSCR Loans in Ohio

The Ohio property investment sector has several advantages over DSCR loans such as positive cash flow investment strategies:

Calculating DSCR and submitting the 1007 rent schedule

The DSCR lender will assess your debt service cover ratio (DSCR). The mortgage lender may also obtain a rental schedule to check whether rental income supports the mortgage payment by determining the fair market rental.

Research DSCR Lenders

Find a DSCR lender in Ohio. Find experienced lenders who work with real estate investors and understand the DSCR lending requirements. A lender should be familiar with the complex processes involved in evaluating income-generating properties.

DSCR Loan vs Conventional Loan

DSCR Loans in Ohio offer an alternative to conventional financing for real estate and business ventures. Unlike conventional mortgages, DSCR loans focus on the Debt Service Coverage Ratio (DSCR), a vital metric for lenders. DSCR loans near me are becoming popular for investors and entrepreneurs.

Conventional loans rely heavily on credit scores and personal financial history, while DSCR loans emphasize property income. Ohioans can benefit from DSCR loans, especially when their properties generate steady cash flow. This non-traditional approach widens the path to financial success, allowing borrowers to leverage their investment’s potential. In Ohio, DSCR loans present an innovative and practical choice for those seeking funding beyond the boundaries of conventional financing.

DSCR loans in Ohio have become increasingly popular among real estate investors seeking to expand their portfolio of rental properties in the state. These loans, which are specifically tailored to assess a property’s Debt Service Coverage Ratio (DSCR), have emerged as a viable financial solution for those looking to invest in rental properties across Ohio. With DSCR loans in Ohio, investors can secure the necessary financing to acquire or improve rental properties while ensuring that their rental income comfortably covers the property’s operating expenses and loan repayments. This financial tool has provided a valuable avenue for individuals and businesses to grow their real estate ventures in Ohio, making it an attractive option for those looking to capitalize on the state’s dynamic rental market.

What is DSCR Loan in Ohio?

Usually DSR loans are used for real estate investments in order to reduce debt. The lenders concentrate on the income generated on the asset, subject property, not merely on individual income or creditworthiness of the borrowers.

DSCR Minimum Loan Amount

Almost every DSCR lender offers a loan of up to 75k. Our minimal loan amount at Loan Trust is now $50,000 for a single family property.

Property Management

Many lending institutions do not include property ownership in DSCR calculations, while property management does not make up for its cost. When choosing an DSCR lender, it’s best for yourself to decide the amount of the loan you want and take a decision before it’s issued to your bank.

Connect with the Best DSCR Lenders

Get quotations from different lenders to compare and choose a good lender! This service is free for you!

DTI (Debt-to-Income) ratio doesn’t hold you back

Unlike traditional mortgage loans, DSCR loans are flexible and offer no interest on debt-out-of-income ratios. These are ideal for those borrowers that do not meet the traditional DTI requirement. With DSCR loans, the focus of the loan is the property’s cashflow, which enables people with high DTI ratios and unconventional income sources to get a loan from the lender’s real property investors.

Finding the Best DSCR Lenders in Ohio

Finding DSCR loan providers is critical as this may greatly affect your loan application and your overall experience. The process is however challenging, despite the numerous loans available. We have some amazing updates! Loan Trust will help you find your perfect DSCR mortgage loan from lender in Ohio!

5 tips for real estate investors in Ohio

Investing is different from region to region. What is your investment advice? Lack of planning causes many problems for investors. Tell me the desired asset type and why. Make a property offer before making a purchase or selling offer and assess the potential DSCR. You might be happy when you purchase your Ohio investment property and don’t do enough research to find it. Look for neighborhoods that may appeal to your interest; consider values, demographics and educational institutions.

Interest rates 1% to 2% higher

DSC loan prices for borrowers in Ohio vary between 1% and 2.5% but may vary depending upon lender. Property type and loan cover are important factors. Comparison of rates is critical to making an accurate choice. Get the current rate for DSCRs.

Providing documentation to prove the property’s cash flow

If you have DSCR financing in place, provide documentation verifying the property’s cashflow. These may include financial statements, rent rolls, lease agreements demonstrating the property’s earnings potential. Having these documents on file is a good way to boost an applicant’s application and instill confidence in property’s financial viability.

How does a DSCR mortgage loan in Ohio work?

In Ohio the DSCR mortgage loans evaluate the properties cash flows and determine the ability to borrow rather than simply relying on personal income. The lender calculates the debt service cover ratio (DSR) that compares the net operating income of rental property to the debts of the business. If the property’s earnings are covered by debt payments, the likelihood of obtaining a mortgage increases significantly.

Secure financing for multiple Ohio properties

If your goal is achieving DSCR loan success, you can use it to increase your portfolio and increase profits. The loan breaks out of conventional loan limitations. With a DSCR loan, you can finance multiple properties simultaneously, allowing you to capitalize on potential market opportunities and build an attractive portfolio. So take advantage of Ohio’s real estate industry and grow the investment portfolio at Buckeye.

Compare Rates from Best DSCR Lenders

Make an investor-qualified loan by comparing the rental income of the property to its potential.

What is the minimum DSCR required in Ohio?

In Ohio, a DSCR of 1 will usually be required to obtain DSCR loans. It also means the property’s net operating profit equals the balance of its loans and debts and provides sufficient cashflow for its obligations in the future.

Overview of the Ohio Housing Market 2023

The Columbus housing market shows intriguing trends accompanied by intriguing dynamism. In Ohio the national average per property cost is about 230,778, which provides valuable insight into the state’s property market. Generally speaking, rental income rates are dependent upon location and condition of the property. Usually the average monthly rent should be $1,200 for an attractive property or apartment. Remember that real prices can vary depending upon specific circumstance and rental market in diverse regions.

Do DSCR loans in Ohio require a down payment?

Yeah. A DSCR loan in Ohio typically involves a 20% down payment of the property value.

DSCR Loan Ohio Real Estate Investment Loans

Understanding DSCR Loans in Ohio DSCR loans in Ohio are financing options for real estate investors that focus on the property’s cash flow and rental income potential. These loans prioritize the Debt Service Coverage Ratio (DSCR) when determining loan eligibility.

Benefits of DSCR Loans for Real Estate Investors DSCR loans offer several benefits for real estate investors in Ohio. They provide financing options for investment properties, consider the property’s cash flow, and allow investors to build a strong real estate portfolio.

The Importance of Cash Flow in DSCR Loans Cash flow plays a crucial role in DSCR loans. Lenders carefully evaluate the property’s income potential to ensure that the rental income generated is sufficient to cover the loan payments and maintain a positive cash flow.

Investment Properties and DSCR Loans DSCR loans are specifically designed for financing investment properties in Ohio. Whether it’s residential rental properties or commercial buildings, these loans cater to real estate investors looking to generate income from their properties.

Finding DSCR Lenders in Ohio When seeking DSCR loans in Ohio, it’s important to work with lenders who specialize in these types of loans. DSCR lenders have expertise in evaluating investment properties and can offer tailored financing solutions.

Understanding the Debt Service Coverage Ratio The Debt Service Coverage Ratio (DSCR) is a key factor in DSCR loans. Lenders calculate this ratio by dividing the property’s net operating income by the annual debt service payments. A higher DSCR indicates a property’s ability to generate sufficient income to cover its debt obligations.

Income Verification for DSCR Loans While DSCR loans may not require extensive personal income verification, lenders still assess the borrower’s ability to generate income from the investment property. This may involve reviewing rental income documentation, leases, and other relevant financial information.

Considering Property Values and Cash Flow Property values and cash flow are crucial considerations in DSCR loans. Lenders evaluate the property’s cash flow potential to ensure that it can generate sufficient income to cover the loan payments and maintain a positive cash flow.

Evaluating Rental Income for Loan Approval

Rental income is a key factor in DSCR loan approval. Lenders analyze the property’s rental income to determine if it is stable, consistent, and capable of meeting the loan payment obligations.

Personal Income Documentation for DSCR Loans While personal income verification is not the primary focus of DSCR loans, lenders may still request personal income documentation to assess the borrower’s overall financial situation.

Understanding Closing Costs When securing a DSCR loan in Ohio, borrowers should consider closing costs. These costs may include appraisal fees, origination fees, title insurance, and other expenses associated with loan processing and property acquisition.

Exploring Interest-Only Loans Interest-only loans are sometimes available for DSCR loans in Ohio. These loans allow borrowers to make lower monthly payments during a specified period, providing flexibility in managing their cash flow.

Minimum Down Payment Requirements While DSCR loans offer flexibility in income verification, most lenders still require a minimum down payment. The down payment amount may vary depending on the loan program and the borrower’s financial profile.

Working with a Property Management Company Real estate investors in Ohio may benefit from working with a property management company. These professionals can help ensure the property’s cash flow and rental income are optimized, which strengthens the borrower’s loan application.

Exploring DSCR Loan Programs There are different DSCR loan programs available in Ohio. Real estate investors should explore various options and choose the program that best aligns with their investment goals and financial needs.

Comparing DSCR Loans to Traditional Mortgages DSCR loans differ from traditional home loans. Traditional mortgages typically focus on the borrower’s personal income and credit score, while DSCR loans prioritize the property’s cash flow and rental income potential.

The Role of Bank Statements Lenders offering DSCR loans in Ohio may require bank statements to evaluate the borrower’s financial stability and cash flow. Bank statements provide insights into the borrower’s income and expense patterns.

Considering Conventional Loans for DSCR Conventional loans may also be suitable for financing investment properties in Ohio. Real estate investors should explore both DSCR loans and conventional loans to determine the best fit for their investment strategy.

Evaluating the Property’s Cash Flow Potential The property’s cash flow potential is a critical factor in DSCR loan approval. Lenders assess the property’s rental income, operating expenses, and other financial factors to determine its ability to generate sufficient cash flow.

Understanding the Ohio Real Estate Market Understanding the Ohio real estate market is essential for real estate investors. Factors such as rental demand, property values, and market trends can impact the success of an investment property and the viability of a DSCR loan.

Considering the Borrower’s Credit Score Although most DSCR lenders’ loans prioritize the property’s income, the borrower’s credit score still plays a role in loan approval. A higher credit score increases the borrower’s credibility and enhances the chances of securing a DSCR loan.

Managing Loan Payments DSCR loans require borrowers to manage their loan payments effectively. It is important for investors to have a clear understanding of their monthly mortgage payment obligations and ensure they have sufficient rental income to cover those payments.

Building a Real Estate Portfolio DSCR loans in Ohio provide opportunities for real estate investors to build a diverse and profitable real estate portfolio. By leveraging the income potential of multiple rental properties, investors can maximize their investment returns.

Assessing the Property’s Ability to Generate Income The property’s ability to generate income is a key consideration in DSCR loans. Lenders evaluate the property’s rental income potential and its ability to sustain positive cash flow over the loan term.

The Role of Net Operating Income Net Operating Income (NOI) is an important factor in DSCR loan calculations. Lenders analyze the property’s NOI to determine its income-generating potential and the ability to cover the loan payment obligations.

Considering Property Taxes Property taxes are a crucial expense that impacts the property’s cash flow. Lenders take property taxes into account when calculating the DSCR and evaluating the property’s ability to generate sufficient income.

Understanding Loan-to-Value Ratio The loan-to-value (LTV) ratio is another factor that lenders consider in DSCR loans. Lenders assess the LTV to determine the loan amount relative to the property’s value, which affects the borrower’s equity and risk exposure.

Providing Pay Stubs and Tax Returns While DSCR loans focus on the property’s income, lenders may still request pay stubs and tax returns to evaluate the borrower’s overall financial situation and income stability.

The Importance of the Property’s Ability to Generate Income The property’s ability to generate income is crucial for loan approval. Lenders assess the property’s rental income potential, vacancies, and expenses to ensure there is sufficient cash flow to cover the loan payments.

Considering Hard Money Loans In some cases, real estate investors in Ohio may opt for hard money loans, which provide more flexibility in lending criteria and faster funding options. However, these loans often come with higher interest rates and shorter repayment terms.

Understanding Debt-to-Income Ratio Debt-to-income (DTI) ratio is another factor that lenders consider in DSCR loan applications. Lenders evaluate the borrower’s DTI to assess their ability to manage their debt obligations in relation to their personal income.

Meeting DSCR Loan Requirements To qualify for a DSCR loan in Ohio, borrowers need to meet the specific requirements set by the lender. These requirements may include a minimum DSCR, a satisfactory credit history, and sufficient cash reserves.

Exploring Investment Opportunities Ohio offers various investment opportunities for real estate investors. From residential properties to commercial buildings, investors can leverage DSCR loans to capitalize on the state’s diverse and growing real estate market.

The Role of Interest Rates Interest rate and rates play a significant role in DSCR loans. Investors should compare rates from different lenders to secure the most competitive terms and lower borrowing costs.

Evaluating Market Rent Market rent is an essential consideration for real estate investors in Ohio. Understanding the rental rates in the local market helps investors determine the income potential of their investment property and calculate the DSCR.

Considering Prepayment Penalties Some DSCR loans in Ohio may come with prepayment penalties. Borrowers should carefully review the loan terms and understand any potential penalties associated with paying off the loan early.

Working with Knowledgeable Lenders Working with experienced and knowledgeable lenders is crucial for obtaining a DSCR loan in Ohio. These lenders have a deep understanding of the local market, loan products, and can provide valuable guidance throughout the loan process.

Calculating DSCR Calculating the DSCR is a fundamental step in obtaining a DSCR loan in Ohio. Investors should accurately calculate the DSCR by dividing the property’s net operating income by the annual debt service payments.

Determining the Loan Amount The loan amount for a DSCR loan is typically based on the property’s income potential and the lender’s loan-to-value requirements. Lenders evaluate the property’s cash flow and set a maximum loan amount accordingly.

The Role of Lease Agreements Lease agreements are vital documents in DSCR loan applications. Lenders review lease agreements to assess the stability of the rental income and verify the terms and conditions of the loan based on the rental agreements.

Considering the Purchase Price and Investment Potential When evaluating potential investment properties in Ohio, investors should consider the purchase price of rental properties in relation to the property’s income potential and the loan terms offered by DSCR lenders.

Finding the Best DSCR Lenders To secure the best DSCR loan in Ohio, investors should research and compare different lenders. Factors to consider include the lender’s reputation, loan terms, interest rates, and their understanding of real estate investments.

In summary, DSCR loans in Ohio provide real estate investors with financing options that prioritize the property’s cash flow and rental income potential. By considering various factors such as the property’s income, debt service coverage ratio, market rent, and loan terms, investors can secure DSCR loans that align with their investment goals and maximize their returns in the Ohio real estate market.

The availability of DSCR loans has been a game-changer for aspiring property investors in Ohio’s major cities. In Cleveland, where the real estate market is on the rise, DSCR loans provide investors with the financial flexibility needed to seize opportunities. Columbus, with its growing rental market, benefits from DSCR loans that help landlords expand their portfolios. Cincinnati’s eclectic housing scene becomes more accessible through these loans, supporting both first-time buyers and seasoned investors. Toledo’s industrial real estate market gains traction with DSCR loans fueling commercial development. Akron’s historic charm and affordable properties are made more attainable thanks to these loans, and in Dayton, a city of innovation, DSCR loans foster growth in the real estate sector. In every corner of Ohio, DSCR loan Cincinnati programs are instrumental in catalyzing real estate ventures and economic progress.

DSCR Loan Ohio and No Doc Loans

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington