DSCR Loan Hawaii Programs in 2023 | How To Break Into The Hawaii Real Estate Market With DSCR Loans

One of the reasons that many real estate developers are interested in DSCR loans in Hawaii is due to the return on investment (ROI). Hawaii is a prominent exclusive tropical state in the pacific realm that offers many attractions for families with many opportunities. Art, food and culture that attracts visitors from all over the world. DSCR loans may aid in the entry into this lucrative real estate business because the approval is based upon the property’s revenue and not the borrower’s personal income. Multifamily DSCR Loans are uniquely custom Built for Hawaii Investors

Loan Trust offers the best investment options in the region. Loans are generally from $1 Million – $100 Million + 5 years or 10 years term Call protection or locks out varies according to loan duration. Up to 70% of IO value and amortization options. 1.20 x IO.

In Hawaii, DSCR loans have gained prominence as a financing option for commercial properties. DSCR loans in Hawaii are designed to evaluate a borrower’s credit score and assess the property’s Debt Service Coverage Ratio, making them a suitable choice for investors looking to secure financing for their commercial ventures in this scenic state. These loans not only take into account the borrower’s creditworthiness but also ensure that the rental income from commercial properties comfortably covers the loan’s repayment. As Hawaii continues to attract businesses and entrepreneurs, DSCR loans have proven to be a valuable tool for those seeking to invest in and develop commercial properties amid the picturesque backdrop of the Hawaiian Islands.

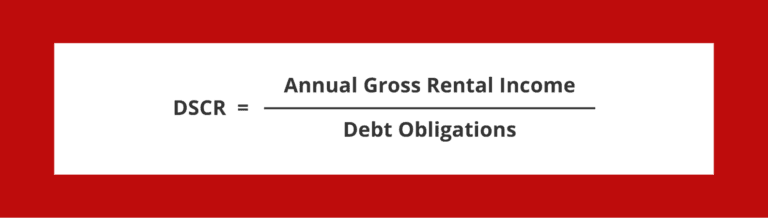

How Do You Calculate DSCR?

Before applying for your Hawaii DSCR loan, it must be clear that DSCR was actually calculated within guidelines. Fortunately, there exists a very straightforward formula for calculating DSCR on rental property loans. A high percentage of DSCR indicates your rent income is above your debts and that your loan is has lower risk to the lender to cover the debt.

Who Is a DSCR Loan Best Suited for?

The DSCR loans were not designed to be matched by any QM lender but were intended to help homeowners invest in homes. It’s essential that you invest in multiple properties at the same time, so you get to make the money available. This loan is often difficult to obtain due to high interest rate requirements from the borrowers, as well as the strict borrower requirements. It is difficult to secure a loan if the borrower property doesn’t meet the ratio guidelines. Investing in real estate based on rental income or personal money will be financed using DSCR loans.

DEBT SERVICE COVERAGE RATIO

Hawaii commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

Made with Visme Infographic Maker

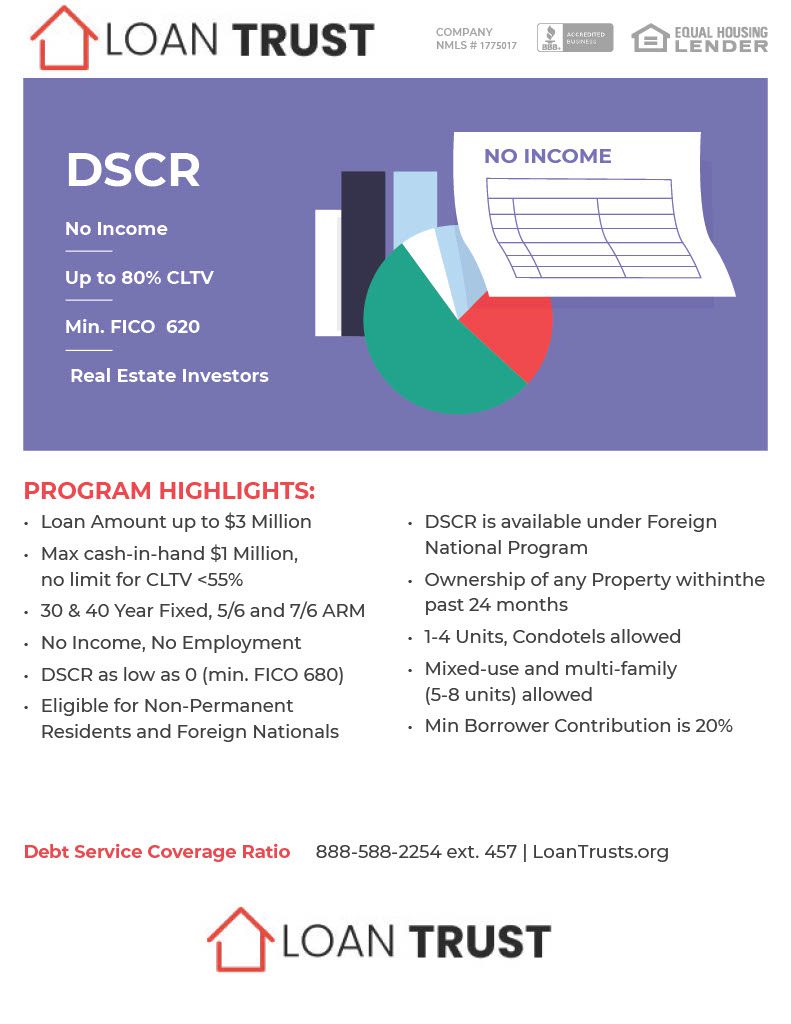

Hawaii DSCR Investment Loans

Hawaii DSCR Loan Requirements

Keep in mind the debt service cover ratio is the most important thing lenders are looking at when underwriting the loan. The rules and procedures regarding the DSCR loan are the same regardless of your investment, Hawaii or elsewhere. The main determinants of change are average property values and average rates of rent in different states. Most lenders require that DSCR’s be above 1.20 or greater depending on the loan amount. Loan Trust is a direct private lender and is is a little less restrictive in terms of DSCR loans. If you have the DSCR of at least 0.75 then you can get a loan approved, but usually require a lower loan-to-value ratio in the Hawaii real estate market from Loan Trust.

DSCR Loan Programs in Hawaii

1. Understanding Debt Service Coverage Ratio (DSCR) The Debt Service Coverage Ratio (DSCR) is a financial metric used by lenders to assess the ability of borrowers to cover their debt obligations. It is calculated by dividing the property’s net operating income by the total debt service.

2. Benefits for Residential Investment Properties DSCR loan programs in Hawaii are designed to cater to real estate investors looking to finance residential investment properties. These programs provide a unique opportunity to leverage rental properties for income generation and long-term wealth accumulation.

3. Tailored for Real Estate Investors Unlike traditional loans, DSCR loan programs in Hawaii are specifically tailored to meet the needs of real estate investors. Lenders take into account the rental income potential of the property rather than relying solely on personal income verification.

4. Financing Options for Investment Properties With DSCR loan programs, real estate investors in Hawaii have access to financing options that cater specifically to investment properties. These loans allow investors to expand their portfolios and take advantage of the lucrative real estate market in the state.

5. Maximizing Rental Income One of the key factors that lenders consider when evaluating DSCR loan applications is the property’s rental income potential. Real estate investors in Hawaii can maximize their chances of loan approval by showcasing strong and consistent rental income from their properties.

6. Calculating Cash Flow Cash flow plays a significant role in DSCR loan programs. Lenders assess the property’s ability to generate sufficient cash flow to cover loan payments. Real estate investors must calculate the cash flow accurately, taking into account rental income, expenses, and potential vacancies.

7. Alternative to Traditional Loans DSCR loan programs in Hawaii offer an alternative financing option for real estate investors who may not qualify for traditional loans. These programs consider the property’s cash flow potential rather than relying heavily on personal credit scores or income verification.

8. Building a Strong Investment Portfolio By utilizing DSCR loan programs, real estate investors in Hawaii can build a strong investment portfolio. These loans enable investors to secure multiple properties and diversify their holdings, thereby increasing their potential for long-term wealth accumulation.

9. Long-Term Rental Opportunities Investors who aim to finance long-term rental properties in Hawaii can benefit greatly from DSCR loan programs. These loans provide the necessary funds to acquire and maintain single-family homes, condos, or other suitable properties for long-term rental purposes.

10. Collaboration with Local Lenders Hawaii-based lenders familiar with the local market can be valuable partners for real estate investors seeking DSCR loans. These lenders have a deep understanding of the unique dynamics of the Hawaii real estate market and can provide tailored financing solutions.

11. Requirements for Loan Approval To qualify for DSCR loan programs in Hawaii, real estate investors must meet specific requirements. Lenders typically look for a DSCR ratio of at least 1.25, a stable rental income, and a solid credit history. Having a comprehensive business plan and financial projections can further enhance the chances of loan approval.

12. Exploring Financing Options Real estate investors in Hawaii have several financing options within the DSCR loan programs. These options include fixed-rate mortgages, adjustable-rate mortgages, and interest-only loans. Each option has its own advantages and considerations, depending on the investor’s long-term goals and risk tolerance.

13. Refinancing Opportunities Existing property owners in Hawaii can also explore DSCR loan programs for refinancing purposes. Refinancing can help lower interest rates, extend loan terms, or access additional funds for property improvements or other investment opportunities.

14. Partnering with Local Professionals To navigate the complexities of DSCR loan programs in Hawaii, it is advisable for real estate investors to collaborate with local professionals. Mortgage brokers, real estate attorneys, and financial advisors with expertise in the Hawaii market can provide valuable guidance and streamline the loan application process.

In conclusion, DSCR loan programs in Hawaii offer attractive financing options for real estate investors looking to capitalize on residential investment properties. By understanding the concept of DSCR, maximizing rental income, and partnering with local professionals, investors can qualify for these loans and expand their investment portfolios in the dynamic and lucrative Hawaii real estate market.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington