DSCR Loan Washington State Programs Find Out the Lending Guidelines

Is it possible to get an investment loan with a DSCR? This guide will give you a thorough understanding of the DSCR Loan Program. We discuss who is eligible, the eligibility requirements, the loan application process and the maximum loan amount. You can also contact your Loan Trust to get your loan started.

Washington State, like any other state in the United States, has various financial institutions, banks, and lending organizations that offer DSCR loans for real estate and commercial real estate investors and property financing. The availability and terms of such DSCR mortgage loans may vary depending on the lender, the specific property, and the borrower’s financial situation.

DSCR Loans in Washington State

Washington State remains a key area of investment in real estate. The state of Washington economies have been among the strongest in recent years. The state had an estimated net migration of 93300 between 2022 and 2023. All these things mean housing demand will remain in high demand in the near future. Washington investors find an innovative way to use its DSCR loans to leverage property value for its growing growth. Approvals will be based on the rental income of the house and not the individual income of the buyer.

What is the Minimum DSCR Ratio Required to Qualify for a DSCR Loan in Washington State?

DSCR loans require all properties have a minimum DSCR ratio of 1.00 but we can make exceptions down to .50 depending on each individual rental property. It can easily be accomplished in a property where rental prices are highly demanded. DSCR Ratio Formula. DSCR = Net Operating Profit / Total Debt Services.

Are there Penalties for Early Repayment?

If a borrower takes an DSCR loan in Washington State you could face a penalty for late fees or paying the loan off early. Some lenders may ask for additional fees when you repay your loan at an interest rate at a later date than agreed-upon terms. Now, this penalty is typically based on Steps Down. Imagine this as a 2-1-1 deal. Hence penalties decrease slowly. You should know the hidden costs in advance. The late payment fee is similar to a pre-payment penalty and there can be additional charges for late payments. Hence keeping your cash payments on track is the best practice.

What is a DSCR mortgage loan?

DSCR means debt service coverage ratio. A DSCR (Debt Service Coverage Ratio) Loan is a financial product commonly used in real estate and commercial property financing. This type of loan assesses the borrower’s ability to meet their debt obligations by evaluating the relationship between a property’s net operating income (NOI) and its total debt service, including principal and interest payments. The DSCR ratio, which is calculated by dividing NOI by debt service, helps lenders gauge the risk associated with a particular property investment. A DSCR ratio of 1.0 or higher indicates that the property generates sufficient income to cover its debt payments, making it a crucial metric in the underwriting process for commercial real estate loans.

How Do You Calculate DSCR?

It’s really simple to determine a DSCR number to determine if your loan is approved. DSCR is a financial metric used by lenders to assess a borrower or property’s cash flow and ability to cover their debt obligations. DSCR is calculated by dividing the property’s net operating income (NOI) by its total debt service (principal and interest payments). A DSCR of 1.0 or higher indicates that the property generates enough income to cover its debt payments.

Here are some reasons to consider a DSCR mortgage loan in Washington

Higher loan amounts: The lending company evaluates properties earnings possibilities and decides how much of the loan is available for each property. DSCR loans have lower down payment requirements and allow your bank to save your cash to make more investment decisions. Flexible underwriting. The DSCR loan may have less rigid underwriting requirements than the traditional loan.

Determining DSCR payment

You have to use the “all-in” payment which entitles the loan owner to pay interest. Includes all taxes but no additional expenses like electricity or property maintenance. Example. Increasing rent can increase DSCR loan amounts.

Ready to Invest in Wisconsin Real Estate with a DSCR Mortgage Loan?

Contact Loan Trust today for information on financing your Washington State home investment. Our team is trained to answer all your questions about lending. Get started on developing your property portfolio right now!

Is it Possible to Use DSCR for Multiple Properties in Washington?

That’s correct! DSCR loans allow you to finance a variety of property types, unlike conventional mortgages that usually limit the amount of money. This flexibility is a great tool to increase investments in the long term.

Are there Flexible Repayment Options Available for DSCR Loans in Washington?

Flexible payment terms will vary by the lender. Your home can be rented out to a large number of lenders and can be offered flexible terms. Usually this doesn’t happen, and it might be necessary for the borrowers who rent out to follow what terms their lender provides.

How to qualify for a DSCR loan in Washington

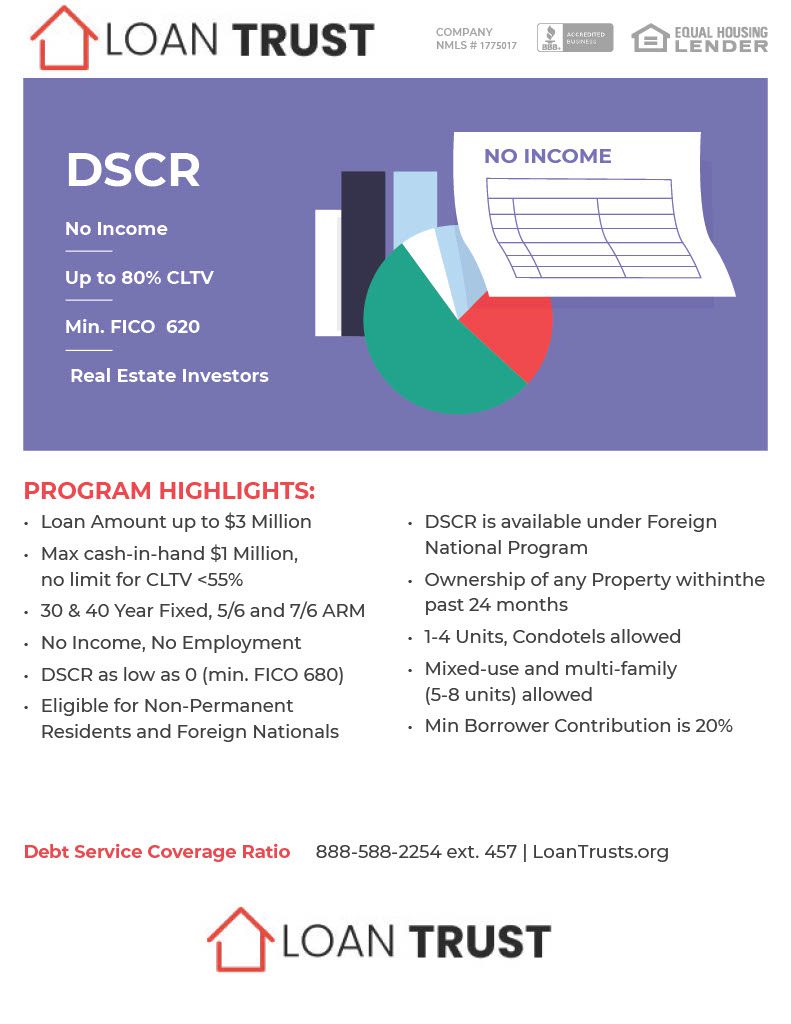

Various lending institutions have differing rules, but the guidelines below apply in the case of Washington DC. Loan-to-market value: 75% to 80%, which means you need 20% of your loan to fund your application. You may also use the DSCR mortgage refinance if your home still has 20% equity plus cash value. Credit scores: From 660 for the majority, although Loan Trust range is between 620-680. Purchase, refinancing or cash out. Type of property allowed: One-family residences and condominium units. Commercial properties, including apartments and condos with 5 or more units or offices may be approved. Investments properties only.

How do DSCR Lenders Assess the Property’s Value to Give a DSCR Loan?

This property valuation tool is used by lenders to assess your real estate value. If your house is located in a very desirable neighborhood, then you are in a great position for a DSCR loan. Some people refer to these as No Doc Loans.

Compare Rates from Best DSCR Lenders

Get qualified for Investor Cash Flow Mortgage, according to your residential rental property income and not your personal income.

What are the Current Interest Rates for DSCR Loans in Washington?

DSCR loans are attractive to consumers, however, there is a downside: they usually have higher the interest rate than traditional loans. You may notice 2% more competitive rates up to 15% higher interest rates on traditional loan types. Check DSCR rates.

How does the DSCR ratio impact DSCR mortgage loan eligibility?

The DSCR ratio is the lender’ main decision factor. If your DSCR is above one, then the loan approval process will go smoothly. Having minimum credit score with a DSCR below 1.00 is a difficult task to achieve but Loan Trust offers options.

Can I refinance an existing loan with a DSCR loan in Washington?

Yeah. Refinancing your existing loans with DSCR loans is the right move for borrowers. It can help with better terms, lowering possible interest rates and even freeing up money for investment or expenditures beyond personal income.

5 best areas to invest in Washington State

Home Bay listed five areas where investors should consider investing in property. Make sure you understand what the most profitable investment is for you. the most valuable investment. Get into a specific field and learn a new subject or two. Learn about the rental properties and rates in this region, finding the most interesting deals and then taking DSCR loans for the acquisition. The top best cities in Washington State for other investments are Seattle, Tacoma, Bellevue, Spokane, and Bellingham.

Is the DSCR ratio influenced by the property’s net operating income?

Yes, your DSCR ratio will have a significant impact upon the net earnings you generate. The higher the NOI the better the ratio gets.

DSCR Loans in Washington State

Washington State, like many others, offers a variety of financial tools for real estate investment, and one of these tools is the DSCR mortgage loan. DSCR stands for Debt Service Coverage Ratio, a critical metric used by lenders to assess the borrower’s capacity to cover their debt obligations, making it a pivotal factor in acquiring property loans.

Understanding DSCR Ratio At its core, the DSCR ratio calculates the relationship between a property’s net operating income (NOI) and its total debt service, encompassing both principal and interest payments. Lenders in Washington State, as elsewhere, use this ratio to evaluate the risk associated with financing a particular property. A DSCR ratio of 1.0 or higher indicates that the property generates enough income to pay off its debt, a reassuring sign for lenders.

Qualifying for DSCR Loans To qualify for DSCR loans in Washington State, potential borrowers must provide financial documentation showcasing the property’s NOI, expenses, and existing debt. Lenders also assess the borrower’s creditworthiness. Borrowers need to demonstrate the property’s potential to generate sufficient income to meet debt obligations, ensuring lenders their investment is secure.

Investment Opportunities DSCR loans open doors for various real estate investments in Washington State, whether for purchasing commercial spaces, apartment rentals, or even refinancing existing properties. By securing these loans, investors can expand their real estate portfolios, fueling economic growth and development in the region.

Property Insurance and Capital Moreover, DSCR loans often require property insurance and capital reserves to protect the lender’s interests. This ensures that the property remains a viable and profitable asset, safeguarding both the borrower’s and lender’s investments.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington