DSCR Loans Texas: Debt Service Loans Guidelines

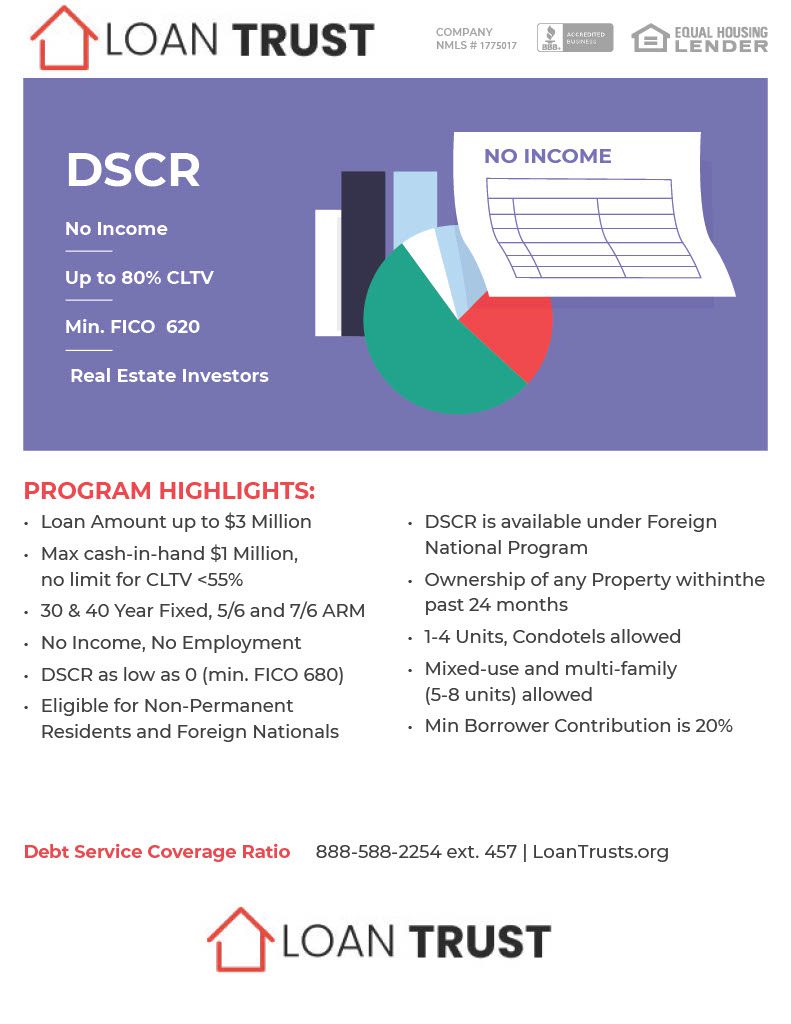

DSCR loans Texas programs are popular for real estate investors seeking DSCR loans in Texas and these investment loans offer capital without verifying personal income and offer DSCR loan down payment with as little as 20% down.

Texas DSCR Loans Offer Flexible Terms and Fees

DSCR Loan offers full 30-year terms without balloon. Most DSCR loans offer optional rates for unsecured loans with no interest. Investors can tailor DSCR loans programs to meet specific investment needs. Investors who plan on retaining their rents long-term may choose a fixed rate and charge greater fees, whereas investors who could soon sell rental properties will opt for ARM rate structures and pay the lower penalty for prepaying.

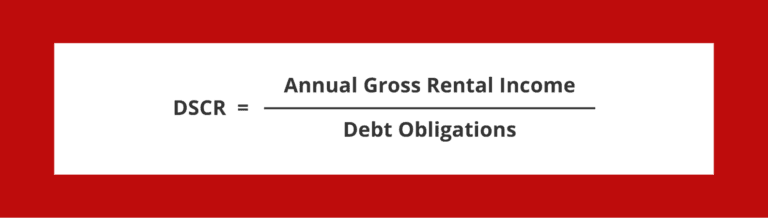

How DSCR Ratios are Calculated

Although certain calculation methods may differ between lending institutions, a common rule of thumb applies: Net Operating Income or NOI divided by Debt Obligations. Computing the Debt Service Coverage Ratio is a simple formula and it has nothing to do with it being short term, long term. However 30 year loan might be less beneficial with the ratio as oppose to interest only.

What DSCR Do Lenders Look for?

When requesting a loan, it is essential that you understand the lender seeks the specific DSCR. For most lenders, that was 1.25. A DSCR 1.0 indicates to the lender that your income from renting should be sufficient for your loan payments as soon as possible. Loan Trusts credit requirements are considerably flexible. Many lenders don’t offer an interest only program and won’t do these loans on short term rentals. Always make sure you don’t have a prepayment penalty if you can. Keep in mind these loans are for rental property only and most DSCR lenders will want to escrow for taxes and insurances.

DSCR Loans Texas Application Process: Step-by-Step

Choosing the best loan for Texas requires many carefully defined steps. Learn the process for the quickest possible start.

Loan Trust: Your Partner for DSCR Loans in Texas

Loan Trust Lending company understands unique needs of investors and offers loan options that meet your needs. Our experts can help guide you through DSCR loans and other financing options. DSCR loans are highly profitable and allow for investors to separate their personal and commercial finances.

Minimum DSCR of 1.00 or Less

DSCR loan programs in Texas can be obtained through a thorough knowledge of DSCR requirements in Texas and provide the conditions for the financing of your property investments. Check if you qualify for Texas Debt Service Coverage Ratio Loan because we can approve your loan with as low .75 which below the standare of 1.00 and means it has negative cash flow.

DSCR Loan Texas: An Attractive Option for Real Estate Investors

You might be interested in the opportunity to invest in property investments in Texas by exploring different financial options. DSCR loan offers borrowers an attractive solution. Knowing the basic components of the program can help you make a better decision about investing in future assets. Loan Trust assist many investors with a real estate portfolio or who have multiple properties for service coverage ratio DSCR programs. Residential real estate investors or a single property real estate investor love our investment loans since we can go off the market rents on a vacant property. This allows us to use the subject property market rents to offset the monthly payments for rental income. Rental rental income is what we use to measure the risk.

Understanding the DSCR Ratio for Texas Real Estate Investments

The DSCR ratio is an important factor when assessing the applicant for DSCR approval. These ratios serve as measuring tools to determine whether investments can generate enough funds to pay off the proposed debt obligations. In Texas, DSCR ratios above 1.0 indicate that the home generates enough income to meet its annual debt and obligations. Texas lenders often require a specific percentage ratio to invest in property. Understanding how the DSCR is calculated is important in the identification of properties suited for investment and investment objectives.

Potentially Quicker Closing Times

Because DSCR lending programs lack income verification or job verification, it offers more rapid closing time as opposed to traditional loans. Improved verification procedures will allow streamlined transactions – a vital advantage in competitive markets, where investments are usually the focus of bidding battles.

Texas DSCR Loan Benefits

If it’s your dream to buy an investment loan in Texas, DSCR investment property loans will give you the best opportunity. You may find that your loan is difficult to obtain or it may require the approval process quicker to complete that traditional loan. DSCR programs are flexible in Texas and are therefore popular choices for investments. It’s not necessary that your income or employment history be verified and the closing time for DSCR lenders will be shorter. Griffin Finance offers interest-only financing.

Application Submission

Send an application to Loan Trust using our designated platform. Online applications have become popular because of the convenience and effectiveness of the system and permit an easy start in an office from anywhere within a few minutes. Loan Trust DSCR’s website is an informational website that explains everything from the program to loan terms, to repayment terms!

Debt Service Coverage Ratio (DSCR): A Key Metric for Lenders

DSCR or loan service coverage ratio is a key measure used by lenders for measuring eligibility. In this analysis we’ll look at whether investments generate sufficient cash flow or enough income to cover proposed obligations. DSCR is calculated as a ratio between the amount of capital generated and the amount invested and the amount of cash available to pay the debt obligations. A DSCR less than 1.0 indicates an inadequate balance to cover the debt. For lenders as well as investors, an increased DSCR ratio means lower risks for the loans.

Loan Offer and Acceptance

After an initial inspection, the loan offer will contain the term, the interest rate, monthly payments, and fees for each loan. Take care to examine these conditions before accepting this offer.

DSCR Loans Dallas Texas: Unlocking Real Estate Investment Opportunities

Investing in Texas could give you an opportunity to build up positive cash flow for your home. When researching the best way of generate sufficient cash flow for financing an investment venture you must consider the various options available. One of these options which is becoming very popular in Texas is the DSCR loan, also called a debt services ratio loan. We can explore further the potential benefits offered through Texas loan programs.

Down Payments for DSCR Loans

Most DSCR guidelines require up to 20 to 25 percent down, according to loan lenders. DSCR programs are less expensive and provide better down payment options compared to other options that demand a full return. It enables investors to diversify their portfolio investment properties and invest in multiple properties simultaneously and thus enhance their cashflow potential and increase the potential.

DSCR Loans Texas Interest Rates

How can we calculate debt service coverage ratios on DSCR loans? This knowledge can shape the value of the loan and shape the investment. In most situations, a DSCR loan program the rate is 9% or higher in today’s current market for mortgages. Remember, these rates can vary from lender to lender. Please verify DSCR loan eligibility. Remember the lower the LTV the lower the risk and mortgage interest rate.

Use DSCR Programs to Grow Your Rental Portfolio in Texas

Texas property investors have begun borrowing to expand their real estate portfolio. DSCRs are calculated by dividing rental income from the rent monthly by the monthly income for each house. This includes principal, interest, taxes, insurance and membership fees. Debt service insurance ratio is basically a measure for evaluating the lender if the debtor can repay his loan. The average loan amount is 1.2, which indicates positive cashflow. This type of lending is ideal in the case of a self-employed investor in a large portfolio. Their simplified lending procedure is designed specifically for the real estate investor.

Are there any fees associated with DSCR loans in Texas?

Some charges apply to Texas DSCR loans. Generally, this includes the originator’s fees, appraisal fees and closing cost. You should always consider this when determining the loan amount.

Are there any restrictions on using the funds from a DSCR loan?

Some lenders require your loan to be used for a particular purpose like financing, buying an investment, constructing new homes, or improving the existing one.

Debt Service Coverage Ratio Loans In Texas: A Guide for Real Estate Investors

Real estate investment in Texas has been on the rise, and many investors are seeking financing options to capitalize on this thriving market. One valuable tool for investors in the Lone Star State is the DSCR loan, or Debt Service Coverage Ratio loan. In this article, we’ll explore what DSCR loans in Texas are, how they work, and why they are an attractive choice for real estate investors.

Understanding DSCR Loans in Texas

DSCR, or Debt Service Coverage Ratio, is a financial metric used by lenders to evaluate the ability of a property to generate sufficient income to cover its debt obligations. Texas DSCR loans are tailored to real estate investors looking to purchase or refinance investment properties. These loans focus on the property’s potential rental income rather than the borrower’s personal income, making them an ideal choice for investors.

The Benefits of DSCR Loans

Focus on Rental Income: DSCR lending guidelines in Texas consider the rental income a property generates as the primary factor for loan approval. This allows investors to secure financing even if their personal income may not meet traditional loan criteria.

Flexible Loan Terms: DSCR lenders in Texas offer flexible loan terms to align with your investment goals. Whether you’re looking for a short-term or long-term investment, there are DSCR loan options to match your specific circumstances.

Lower Down Payment: While traditional loans often require a substantial down payment, DSCR loans typically have lower minimum down payment requirements, making it easier for investors to enter the market.

No Tax Returns or Pay Stubs: DSCR underwriting guidelines do not rely on tax returns or pay stubs, making them accessible to investors who might not meet the documentation requirements of traditional loans.

Cash Out Refinance: DSCR loans in Texas can be used for cash-out refinancing, allowing investors to tap into the equity they’ve built in their investment properties to fund other projects or investments.

Calculating DSCR

To determine if a property qualifies for a DSCR loan, lenders calculate the Debt Service Coverage Ratio. This ratio is the property’s annual net operating income divided by its annual debt service (mortgage payments). Lenders typically require a minimum DSCR, often 1.20 or higher, to ensure there’s a positive cash flow from the investment.

Finding DSCR Lenders in Texas

Many private lenders in Texas specialize in DSCR loans, and some traditional banks also offer them. It’s essential to shop around and compare loan terms and interest rates to find the best fit for your investment.

Closing Thoughts

Texas is a hotbed for real estate investment, and DSCR loans offer a valuable financing option for real estate investors looking to capitalize on the market’s potential. These loans focus on the property’s rental income, offer flexibility in terms, and require lower down payments, making them a popular choice among investors in cities like Dallas, Fort Worth, and San Antonio. However, it’s crucial to understand the specific requirements of DSCR loans and how they can benefit your investment success in the dynamic Texas market. Whether you’re a seasoned investor or just starting, DSCR loans can be a valuable tool in your real estate investment toolkit.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington