Debt Service Coverage Ratio Loans | DSCR Loans Oregon

One of the reasons that many real estate developers are interested in DSCR loans in Oregon is due to the return on investment (ROI). Hawaii is a prominent exclusive tropical state in the pacific realm that offers many attractions for families with many opportunities. Art, food and culture that attracts visitors from all over the world. DSCR loans may aid in the entry into this lucrative real estate business because the approval is based upon the property’s revenue and not the borrower’s personal income. Multifamily DSCR Loans are uniquely custom Built for Oregon Investors.

Loan Trust offers Debt Service Coverage Ratio Loans in Portland, Salem, Eugene, Gresham, Hillsboro, Beaverton, Bend, Corvallis, Tigard Keizer, Lake Oswego, Grants Pass, Oregon City, McMinnville, Tualatin, West Linn, Woodburn, Forest Grove, Wilsonville, and Newberg Oregon.

Secure Funding for Your Investment Properties with Oregon’s Top Mortgage Broker

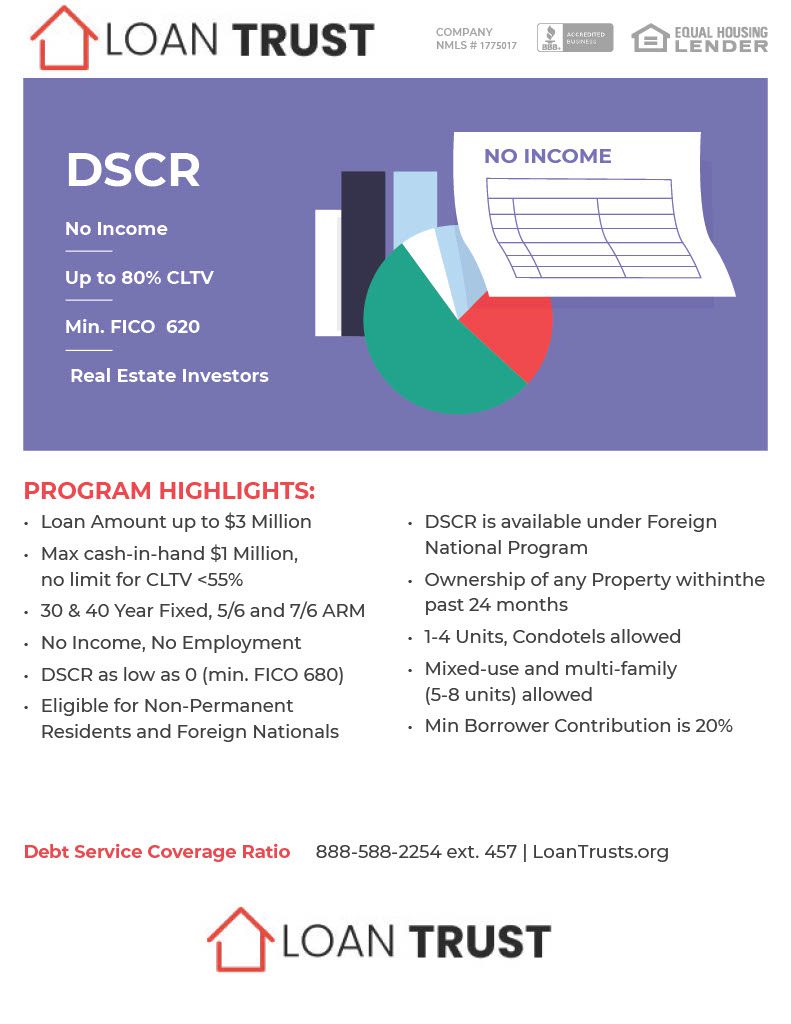

Welcome to Loan Trust – the premier mortgage lender in Oregon. Dedicated to offering customized loan options that fit every client’s specific needs, we offer the right products and services. This section introduces DSCR loan programs that are ideal for the financing of residential and commercial rental.

Oregon DSCR Loans – Frequently Asked Questions

What type of rented properties are available to borrow from Loan Trust Finance? We lend for single-family, 1-room condominiums and townhouses. How much does Loan Trust Financial charge for the Oregon DSCR rate? Loan Trust Financial offers competitive rates on DSCR loans. Rates vary depending upon the investor’s history of investments. Get the cheapest rates by calling us now. How long does my DSCR loan application take to get an approval? The average turnaround time on our loan is about two weeks to one week for a potential loan applicant. Can a bank close its loans in less time? DSCR loans usually can get approved within 24 hours. Almost every DSCR loan closes in within 6 weeks.

What Is a DSCR Loan?

“DSCR” typically stands for Debt Service Coverage Ratio, which is a financial metric used to assess the ability of a borrower to meet their debt obligations, including interest and principal payments, based on their income or cash flow. Lenders often calculate the DSCR when evaluating loan applications, especially for commercial real estate loans.

How To Find Debt Service Coverage Ratio Mortgage Lenders in Oregon?

Finding mortgage lenders in Oregon who can help you determine your Debt Service Coverage Ratio (DSCR) involves a few steps:

Compile Your Financial Information: Before approaching lenders, gather all your financial documents, including income statements, tax returns, rental income (if applicable), and any existing debt obligations.

Research Lenders: Start by researching mortgage lenders in Oregon. You can use online resources, ask for recommendations from friends or family, or consult with a real estate agent who may have lender recommendations.

Contact Lenders: Reach out to potential lenders and express your interest in getting a mortgage. You can do this by phone, email, or by visiting their websites and filling out online forms.

Ask About DSCR Calculation: When you contact the lenders, inquire about their experience with DSCR calculations. Not all lenders may be familiar with this ratio, especially if you’re seeking financing for commercial or investment properties. Make sure to explain your specific situation and the need for DSCR assessment.

Schedule Meetings or Consultations: Once you’ve identified lenders who understand DSCR and your needs, schedule meetings or consultations with them. During these discussions, they can explain their lending criteria and how they calculate DSCR.

Provide Financial Information: Be prepared to share your financial information with the lenders. They will need this data to calculate your DSCR accurately. The lender will typically look at your income, expenses, and existing debt obligations to determine if you meet their lending criteria.

Compare Offers: After meeting with multiple lenders, compare their offers, including interest rates, terms, and DSCR requirements. Choose the lender that offers the best terms and aligns with your financial goals.

Complete the Application Process: Once you’ve selected a lender, follow their application process, which will involve submitting detailed financial documentation, undergoing credit checks, and meeting other requirements.

Work with Professionals: If your situation is complex or involves commercial properties, consider working with financial advisors, accountants, or real estate professionals who can help you navigate the process and ensure you meet DSCR requirements.

Remember that the specific DSCR requirements and lending criteria may vary among lenders, so it’s essential to shop around and find a lender who best suits your needs and financial situation. Additionally, the lending landscape can change, so staying up-to-date on mortgage options and lender offerings in Oregon is crucial.

Non-QM Loans for Borrowers with Low DSCR

If your DSCR is low you can still take advantage of DSCR loans although the higher the ratio the better your terms will be for your loan. You can look at alternative financing options including unsecured loans and credit event loans for the same.

What Is a Good DSCR Ratio?

DSCR ratios should be between 1.25 and 1.6 in rental. Rent is 25 per cent more than the home’s mortgage payments. A ratio of 1 indicates the property has the same rent income for a property as the mortgage payments, and a ratio below 1.00 indicates the property has fewer rents than the mortgage. These are not only necessary in a mortgage-lending situation, but they should also be a useful guide to investors looking to repay investments in the future.

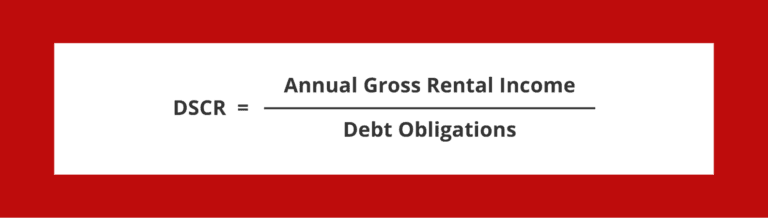

How Is DSCR Calculated?

DSCR is calculated by dividing the rents of the properties in the aggregate and the debt services paid by them. The lender has no idea what NO. The DSCR ratio does not contain any other expense, except debt service costs and charges of revenue for these activities. In rental property, DSCR calculates based on the rental revenue of the property by dividing its gross rent income by its total mortgage payments.

What Do DSCR Lenders Look for?

DSCR lending companies evaluate debt service coverage ratios, gross rent, and mortgage payments when assessing an offer. A loan lender will probably consider credit scores, past debt history, property value and location. The lender will look at rental markets to ensure the rental economy has enough demand for the property for its gross rent.

Apply for Non-QM Investment Property Loan in Bend

Application for a loan is easy. Call us today for a free consultation and start a fast, simple and efficient process. You’ll be able to call us to arrange your visit or you can begin your online application by following our instructions.

DSCR mortgage loans are ideal for investors

Buy rental property Refinancing the property of another renter. • Buying commercial properties • Refinancing old business.

Why choose a DSCR mortgage loan?

DSCR mortgage loan can help with your investment or repurchase. Contrary to conventional mortgage loans the DSCR mortgage loans never depend on your personal credit score. In fact, their only income sources depend on the property’s earnings. Some people refer to these as No Doc Mortgages.

How Does an Oregon DSCR Loan Work?

Loan DSCRs are available in Oregon as well as in other states of America. The borrower must also have fair credit scores and realistic plans for renting the house. For investors interested in financing a rental property, a lender will also analyze rental demand and determine whether the property will sustain its rent-in. The majority of DSCR loans require a minimum of 20% of the balance. It also affects cashflows regularly.

DSCR Loans in Oregon: Empowering Real Estate Investors

Introduction

Real estate investment has long been a favored avenue for wealth accumulation, offering the promise of steady income and capital appreciation. In Oregon, as in many other parts of the United States, real estate investors often seek financing options that align with their investment goals. One such financing solution gaining prominence in Oregon’s real estate market is the Debt Service Coverage Ratio (DSCR) loan. DSCR loans provide real estate investors with a unique approach to financing investment properties, allowing them to leverage a property’s cash flow as the primary determinant of loan eligibility. This essay explores the significance of DSCR loans in Oregon, their advantages for real estate investors, and their impact on the real estate investment landscape.

DSCR Loans: A Primer

DSCR loans, also known as DSCR mortgage loans, are designed to assess a property’s ability to generate sufficient income to cover loan payments. Unlike traditional loans that heavily rely on a borrower’s credit score, DSCR loans place greater emphasis on the property’s cash flow. In essence, DSCR loans focus on the property’s potential to generate revenue rather than solely relying on the borrower’s creditworthiness.

Real estate investors in Oregon often encounter situations where their credit score might not accurately reflect their ability to manage and profit from their investment properties. This is especially true for investors who own multiple rental properties, as their real estate portfolio’s cash flow can be a more reliable indicator of their financial stability and investment potential than their individual credit scores.

The Advantages of DSCR Loans for Real Estate Investors

Cash Flow-Based Eligibility: DSCR loans are particularly beneficial for real estate investors because they assess a property’s cash flow to determine eligibility. This means that investors with strong rental income streams can secure financing more easily, even if their personal credit score does not meet the stringent criteria of conventional loans. This opens up opportunities for investors to expand their portfolios and seize lucrative real estate opportunities.

No Income Loans: DSCR loans offer the advantage of ‘no income’ or ‘stated income’ options. This is especially beneficial for real estate investors who may not have traditional sources of income, such as salaried employment, but rely on the rental income from their investment properties. By relying on the property’s cash flow and the borrower’s ability to manage their real estate investments as a business entity, DSCR loans provide a more flexible financing option.

Lower Down Payments: Conventional loans often require substantial down payments, making it challenging for some real estate investors to acquire additional properties. DSCR loans, on the other hand, may offer more lenient down payment requirements, making it easier for investors to allocate their capital across multiple investment properties.

Non-QM Loans: DSCR loans often fall under the category of Non-Qualified Mortgage (Non-QM) loans. Non-QM loans are not subject to the stringent regulations imposed on traditional loans, providing greater flexibility for borrowers. This is particularly valuable for real estate investors, as they can secure financing for a wide range of property types, including commercial properties, which may not be eligible for traditional loans.

Enhanced Investment Potential: By evaluating a property’s net operating income and cash flow, DSCR loans empower real estate investors to make informed decisions about their investments. Investors can more accurately assess the profitability and sustainability of potential investment properties, leading to better investment choices and, ultimately, greater returns on their real estate portfolios.

Challenges and Considerations

While DSCR loans offer numerous advantages to real estate investors in Oregon, they are not without their challenges and considerations. It’s essential for investors to weigh these factors before pursuing this financing option:

Interest Rates: DSCR loans may come with slightly higher interest rates compared to conventional loans. Investors should carefully assess the long-term cost of financing and determine whether the property’s cash flow justifies the higher interest expenses.

Property Performance: Investors must maintain the property’s cash flow to meet loan payments. Economic downturns or unforeseen circumstances can impact rental income, potentially putting investors at risk if they do not have contingency plans in place.

Documentation: While DSCR loans offer flexibility in income verification, borrowers are still required to provide adequate documentation to support their loan applications. Investors should be prepared to provide bank statements and financial records related to their real estate investments.

Credit Score Importance: Although DSCR loans rely less on the borrower’s credit score, it still plays a role in the loan approval process. Investors with exceptionally low credit scores may face challenges securing favorable loan terms.

Conclusion

DSCR loans have emerged as a valuable financing option for real estate investors in Oregon, offering a cash flow-based approach that aligns with the nature of real estate investments. By focusing on a property’s income-generating potential and the borrower’s ability to manage their real estate portfolio, DSCR loans provide a pathway for investors to expand their property portfolios, seize investment opportunities, and build wealth.

Real estate investors in Oregon should consider DSCR loans as a viable alternative to traditional loans, especially when their credit scores do not accurately reflect their investment potential. However, it is crucial for investors to conduct thorough due diligence, assess the long-term financial implications, and ensure they have strategies in place to maintain property performance throughout the loan term. With the right approach, DSCR loans can be a powerful tool for unlocking the full potential of real estate investments in the beautiful state of Oregon.

Other Loan Programs

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington