DSCR Loan Florida

A DSCR Loan Florida Program also known as Debt Service Coverage Ratio (DSCR) are popular for Debt Service Coverage Ratio Loans in Florida. The Florida DSCR Loans are utilize for Real Estate Investment Properties and not for primary residences. This program allows the monthly or annual rents from leases to utilize and income documentation. Primarily the mortgage lender wants to insure that the income or specifically the Net Operating Income is more than enough to cover the mortgage payment or Debt Service.

Quick Steps to Get the Loan

How Does a DSCR Loan in Florida Work?

DSCR Loans are not QM loans meaning they don’t involve a traditional mortgage application. DSCR Loan Programs offered by Loan Trust are easy to qualify for real estate investors. Hence, you’re not required to produce credit reports or provide income coverage in order to obtain any DSCR mortgage loans. The lender wants to know if you intend to use property purchased with the loans you have secured. In Florida, the net operating income of an DSCR property must exceed its debt obligations annually. The difference is known as ‘Debt Service Protection ratio’ – which should exceed 1 – 2.50.

What are the qualifying guidelines for the DSCR loan?

DSCR Loan Guidelines : | ||

|---|---|---|

|

DEBT SERVICE COVERAGE RATIO

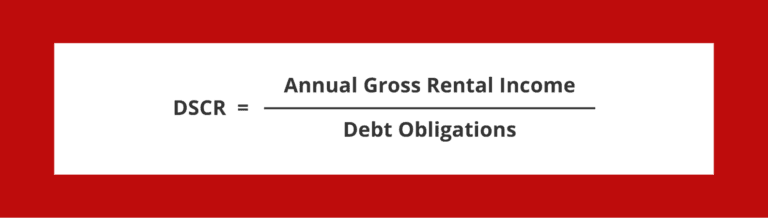

Florida commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1.00 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

DSCR Loans for Investors

How To Calculate Your DSCR?

Calculate your DSCR by multiplying the NOI of your property by the debt service of your loan (as determined annually). Find your net profit based upon subtracting the reasonably necessary operating cost of your home from the gross rental income derived. Calculation of DSCR and NOI Debit Services. Keep in mind that the monthly rental income generated is a huge factor.

How to Analyze the Property in Florida for DSCR Loan?

Analyses for DSCR loans properties differ from preapproved loans in many respects. The lending company wants information about the potential for earning money. They are interested in information as follows:

Why are DSCR Loans Significant to Investors?

Also called investment property loans Non-QM loans, or rent-a-car loans, DSCR Loans, have become popular over the last few years. Why does everything seem to be happening? While conventional loans or money are available via the smaller banks, this financing can be complicated to qualify for and has large liquidity requirements. DSCR loans are designed to meet your professional investment needs. Let us examine this more carefully. DSCR loans are secured by the gross rents rather than the personal finances of its borrowers. Each commercial real estate and market is different but almost all investors like not having to produce tax returns, because their tax returns usually don’t show enough income on the tax returns.

How Do DSCR Loans in Florida Work?

DSCR loans or DSCR lending is a type of loan that has been developed to meet non-QM conditions and is offered to any real estate investor and property investors seeking financing. Non-QM loans are designed for homebuyers who do not have an established home loan history. In addition, other loans may have other incentives such as low monthly repayments that provide an alternative option for people who cannot afford their home loan. Loan Trust also offers borrowers with non-QM financing options including asset loans and bank statements. Does anyone need loans to get started? Tell me the answer. Get in touch with us. do we have borrowers eligible?

Potential Rental Income

When analyzing properties on an RDSR loan, it’s advisable to calculate rental income first. If a monthly rent amount of 12 months is multiplied by 12. Analyses of the annual rent income clearly showed how it could generate revenues.

What makes a good Debt Service Coverage Ratio?

A debt servicing coverage ratio of 1.5 or more is very good. If the DSCR ratio is one the rental is equal to the monthly payments of principal taxes, taxes, insurance fees and association fees if any.. A debt service insurance rating above 1 will help to subsidize PITIA. We have several different examples.

DSCR Loans formula: DSCR = NOI/Annual Debt Payments,

Where we enclose interest and other items such as income, expenses, interest and amortization. All year-long debt includes leased interest payments, along with capital repayments. For example, a DSCR of 1.75 if Mr. Lord wants an investment of $40,000. The Lord’s other real estate property produced 25 per cent more income than was necessary to service its debt obligations.

What Are Florida DSCR Loans?

DSCR loans provide an alternative to typical Florida home loans designed specifically by real estate investors. Rather than qualifying through income verification or employment history, you will qualify for loans by calculating a credit-return ratio. This ratio shows how much rent your home generates against the debts incurred annually in buying a rental home. DSCR loans offer a variety of conditions that aren’t for normal buyers. This loan is designed for property developers that want to invest in rental property but cannot buy a property owned for sale.

What to Look for in a DSCR Lender

Compare the different DSCR loans and lending companies. Find out which DSCR Lenders offer the lowest rates and that your property will fit their program.

Mortgage Terms

The longer the mortgage loan term is the better DSCR, because the lender has longer to repay it. In other words a property having a 30-year loan term with a 15-year loan term would have a higher DSCR if two of its properties had the similar NOI. This means that short term mortgages may result in lowered DSCRs. You may occasionally hear the term as service coverage ratio DSCR. It’s very rare to find a DSCR loan Florida Program with an adjustable rate mortgage.

How to Calculate the DSCR Loan for Buying Rental Property in Florida?

DSCR, is a measure that depicts the capability and ability of borrowers in making timely repayments. The loan balance is what the borrower has to pay back to the lending lender.

How Does DSCR Affect Loan Eligibility?

The DSCR is crucial when deciding whether to lend to borrowers or not. The high DSCR shows that the borrower will have excellent repayment capacities which make borrowers eligible. In comparison, a lower DSCR suggests borrowers could not repay their debt to income ratio, in time, which means the loan is not available to them.

Do You Need Proof of Income for a DSCR Loan?

Yes, proof of income is typically required for a DSCR (Debt Service Coverage Ratio) loan. Since DSCR loans typically are used to finance income-producing properties, the lender will want to ensure that the property can generate sufficient income to cover the loan payments. The lender will typically require documentation of the property’s net operating income (NOI), which is the income generated by the property after subtracting operating expenses.

DSCR Loan Property Types

Some common types of properties that may qualify for a DSCR loan include:

Commercial Properties: These are non-residential properties that are used for business purposes, such as office buildings, retail stores, warehouses, and industrial properties.

Multi-Family Residential Properties: These are residential properties with two or more units, such as apartment buildings, townhouses, and condominiums.

Mixed-Use Properties: These are properties that have both commercial and residential units, such as a building with retail stores on the ground floor and apartments above.

Hospitality Properties: These are properties that provide lodging and other services to guests, such as hotels, motels, AirBNB and resorts.

Healthcare Properties: These are properties that provide medical and healthcare services, such as hospitals, clinics, and assisted living facilities.

Special Use Properties: These are properties that have unique or specialized uses, such as schools, churches, and recreational facilities.

Overall, the property must have a history of stable occupancy and positive cash flow to be considered for a DSCR loan. The lender will also consider the borrower’s qualifications and financial strength to ensure that they can manage the property and repay the loan. The specific property types that may qualify for a DSCR loan may vary depending on the lender and the market conditions.

Debt Service

Debt service refers to the amount of money required to make regular debt service payments on a debt, such as a loan or bond. Debt service includes both principal and interest payments and is typically calculated as a fixed amount that must be paid on a regular basis, such as monthly, quarterly, or annually. The debt service amount is determined by the terms of the loan or bond, including the interest rate, repayment period, and payment schedule. In the context of a business or investment property, the debt service is an important factor in determining the property’s cash flow and profitability, as it represents a fixed expense that must be paid before any profits can be realized. This is the debt service coverage ratio.

What Are the Requirements for a DSCR Loan in Florida?

The underwriting requirements for a Debt Service Coverage Ratio or a DSCR loans are generally similar to those in other states. However, there may be some specific requirements or guidelines that are unique to Florida. Some of the common underwriting requirements for a DSCR loan in Florida include:

Debt Service Coverage Ratio (DSCR): As mentioned earlier, the DSCR is a key factor in underwriting a DSCR loan. In Florida, lenders typically require a minimum DSCR of 1.20 to 1.25 for commercial properties and 1.15 to 1.20 for multi-family residential properties.

Loan-to-Value Ratio (LTV): The LTV ratio is another important underwriting requirement for a DSCR loan. In Florida, lenders typically require an LTV of no more than 75% to 80% for commercial properties and 80% to 85% for multi-family residential properties.

Property Type: In Florida, DSCR loans are typically available for commercial and multi-family residential properties. The property must have a history of stable occupancy and cash flow.

Borrower Qualifications: Lenders in Florida will also consider the borrower’s creditworthiness, experience in managing similar properties, and financial strength. A minimum credit score may be required, and borrowers must demonstrate a successful track record of property management.

Property Condition: The property must be in good condition and meet local building codes and zoning requirements. Lenders may require a property inspection and appraisal to verify its condition and value.

Insurance Requirements: In Florida, lenders may require that the property be insured against hurricanes, floods, and other natural disasters.

It’s important to note that these underwriting requirements may vary depending on the lender and the specific circumstances of the loan. It’s always a good idea to consult with a qualified lender or financial advisor to understand the requirements and options available for a DSCR loan.

Terms

What are the lenders rate and fees?

This information should be accompanied by an accurate price list and should give you an estimate of the cost of purchase loans. It would be a shame if you had to leave with unexpected expenses. Almost every lender has an origination fee and administrative fee (invoice fee and documentation fee). Real estate investors love these loans although the rates are higher.

They come with faster application and closing times

DSCR loans typically have an efficient quick application process because no personal documents are required. This is often a necessity for real estate investors. Keep in mine they buy investment properties to grow their real estate investment portfolio.

Lenders don’t consider personal income

The fact that most DSCR lenders‘ loans don’t take into account personal data is much easier for borrowers who may not need a lot of cash. However, this will vary based on the DSCR lenders and what the monthly payment will be since some real estate lenders don’t want higher mortgage payments.

What is the Minimum DSCR to Qualify for the DSCR Loan Florida?

Most lenders recommend an DSCR of 1. The DSCR is an important factor lenders take into consideration when granting the loan because they understand whether they are able to repay the monthly loan required by the lender’s loan terms. Lenders feel confident that their loan will generate 25% of monthly debt payments from its total earnings. If a home’s monthly loan payment is $1,000, a loan is guaranteed that it will repay that debt by generating at least $15,000 in income. If you want an enormous loan amount it is necessary that you pay 1.4 for the loans. Please remember that.

Pros and Cons of DSCR Loans

The other loan based, option has grew in popularity in recent times because it uses rental income as opposed to personal income to determine the eligibility for the loans. It is easy to qualify for than banks or agencies loans and is cheaper than cash loans for investment in property purchases. However these loans have drawbacks. One of the things that can impact qualifying for a DSCR loan program is high property taxes.

Is the lender focused on and experienced in working with investors?

We find it to be the most crucial aspect. Lenders working on investor projects often recognize the facets of finance and develop programs tailored to the requirements of the investor. DSCR loans are becoming very popular. Here is a list of ways to improve your experience with an established lender.

What Are the Requirements for a DSCR Loan in Florida?

If you wanted a traditional loan as oppose to a DSCR loan, the lender would need your paycheck, bank statement and your credit history proofs. DSCR loans for Florida can only be obtained by calculating DSCRs on your rental properties and applying the same for loans. The minimum rental income DSCR is one means if your rental income is at least $1.50, the annual debt for the property can be easily repaid. If you apply for a DSCR credit from Griffin funding, you will require an additional down payment, usually between 30% and 40%. The credit limit must be minimal.

Overall, the underwriting requirements for a DSCR loan are designed to ensure that the property can generate sufficient cash flow to repay the loan and that the borrower is financially qualified and capable of managing the property effectively.

What Is a Good DSCR?

DSCRs must be deposited in the state for a loan to be eligible for a Florida loan. As your DSCR gets higher, the more rent you must pay for it. A good DSCR may provide better terms and reduced down payment rates as well as fewer interest rates for customers. In Florida, Loan Trust offers low-interest credit scores that range from 0.75 to 1.75.

Compare Rates from DSCR Lenders

Make a prequalified offer on Investor Cashflow mortgages if the property demonstrates potential rental income.

Loan-To-Value Ratio

This final step determines the ratio of loans to values. It is done by dividing loan amounts by property value. LTV measures the degree of risk on an asset. Typically borrowers with a higher value of property will get more interest and risky loans. DSCR loans require much more time for analysis of properties, making this a good investment for the investor.

Mortgage Rate

Higher mortgage rates will increase the DSCR, increasing the need for service of the debts. Nevertheless, lower rates on home loans could affect DSCR borrower’s ability. For instance – When 2 Florida homes have identical nominated mortgage terms and the same mortgage terms, the other property has an interest rate of 6.7% versus the property has an interest rate of 4%, this property would have a better DSCR. As of September 2022 DSCR loans with 25% down payments and 1.2 DSCR % have DSCR loan rates of 7.732%.

Is it hard to get a DSCR loan?

DSCR loans are made based on cash flow of your property making qualification more convenient for applicants. Once approved by your lender, it may be more difficult to get approved for conventional loan. Besides, applications can be faster streamlined and DSCR Loan applications are generally less rigorous than other financings compared to a dscr loan.

Borrower types

Typically a landlord or investor will finance properties within a company and this lend has its own peculiarities in itself. In some cases entity documentation is required. It is just another way to get more information about DSCR Mortgages. Visio Lending has been mastering the niche market for more than 10 years and the loan originated over $22bn and included over 641m of vacation rental. Learn more about DSCR loans at Wikipedia.

Associated Fees

In addition, the fees for loan can decrease the debt service coverage ratio (DSCR). This includes origination costs, appraisal costs and closing costs. This increases total interest rate and increases the debt service required in the payment. When looking at loan applications you need to compare the DSCRs of various lenders. This will help you determine what loan provider offers a best deal. The best way to do this is by using debt service insurance ratio calculator. So it makes sense to get a great loan.

What are the interest rates on a DSCR loan?

The DSCR rate is 7.722% on 30-year Fixed Loans with 50% down and a 1.

DSCR Loan Program

Debt Service Coverage Ratio (DSCR) loans are an essential tool for real estate investors who are looking to finance their rental properties. These loans provide a way to ensure that the rental income generated by the property is sufficient to cover the monthly loan payments and other debt obligations. In Florida, DSCR loans on condos are particularly popular among investors who are interested in the real estate market and want to invest in rental properties.

A DSCR loan is a type of conventional loan that is designed for real estate investors who want to purchase or refinance an investment property. The loan is structured around the borrower’s ability to generate sufficient cash flow from the property to cover the annual debt obligation. This cash flow is determined by calculating the property’s annual rental income and subtracting any expenses, such as property taxes, insurance, and maintenance costs. The resulting number is the property’s net operating income (NOI).

Florida DSCR Loans: Unlocking Investment Potential

Florida, often referred to as the Sunshine State, boasts a thriving real estate market, with its warm climate and strong demand for rental properties making it an attractive destination for property investors. In this context, Florida DSCR loans have emerged as a valuable financing tool for investors seeking to maximize returns in the state’s real estate sector.

The Essence of Florida DSCR Loans

Florida DSCR loans, also known as Debt Service Coverage Ratio loans, are a specialized form of financing designed for rental and investment properties. These loans prioritize the property’s potential cash flow over the borrower’s personal income or credit score, making them particularly well-suited for property investors.

DSCR Loan Eligibility: The Key Requirements

To qualify for a Florida DSCR loan, investors must meet specific criteria, such as a minimum credit score, down payment, and minimum DSCR ratio. Unlike traditional mortgages, these loans often do not require extensive documentation, such as tax returns or pay stubs. This streamlines the application process and appeals to investors looking for a more efficient route to securing funding for their Florida rental properties.

The Benefits of Florida DSCR Loans

Florida DSCR loans offer several advantages to property investors. Firstly, they focus on the property’s ability to generate rental income, allowing investors to leverage potential rental income when assessing loan eligibility. This flexibility is especially beneficial for investors who may have limited personal income but strong potential rental income.

Exploring the Florida DSCR Loan Process

The Florida DSCR loan process typically involves an underwriting process that evaluates the property’s potential to generate cash flow. This assessment considers factors such as average monthly rent, potential rental income, and the property’s net operating income (NOI). The lender calculates the DSCR ratio to ensure that the property’s cash flow can comfortably cover the loan repayment.

Interest Rates and Closing Costs

Florida DSCR loans offer competitive interest rates, enhancing the overall affordability of these loans. Moreover, investors can benefit from shorter closing times compared to traditional mortgages. However, it is essential to consider closing costs, which may vary depending on the lender and the specific terms of the loan.

DSCR Loans: Unlocking Opportunities in Florida Real Estate Investment

DSCR loans, also known as debt service coverage ratio loans, are a popular financing option for individuals looking to invest in rental properties and engage in real estate investing in Florida. These loans provide investors with the necessary capital to acquire rental properties and generate a steady stream of income. Let’s delve into the key aspects of DSCR loans and how they can be leveraged for successful Florida real estate investments.

The primary goal of a DSCR loan is to evaluate the property’s cash flow potential rather than solely relying on the borrower’s credit score or personal income. This approach makes DSCR loans particularly attractive for real estate investors, as it allows them to secure financing even if their credit score is less than stellar. Instead, lenders focus on the property’s ability to generate sufficient income to cover the monthly mortgage payments.

In Florida, where real estate investment is thriving, DSCR loans have gained significant popularity. Investors can leverage these loans to acquire rental properties across the state, taking advantage of its robust rental market and favorable investment climate. With a diverse range of properties available, including residential homes, vacation rentals, and commercial spaces, Florida offers ample opportunities for aspiring real estate investors.

One of the key requirements for obtaining a DSCR loan is meeting the minimum credit score set by the lender. While creditworthiness is still a factor, it holds less weight compared to traditional loans. This flexibility widens the door for individuals with limited credit history or past financial setbacks, enabling them to pursue their real estate investment goals.

DSCR lenders evaluate the property’s cash flow potential by considering various factors. These include the property’s rental income, operating expenses, and the debt obligation associated with the loan. To verify income, lenders may require investors to provide documentation such as bank statements, rental agreements, and tax returns. This thorough analysis ensures that the property’s income is sufficient to cover the monthly mortgage payments.

For real estate investors, DSCR loans offer several advantages. Firstly, they can use the property’s monthly rental income to qualify for a higher loan amount, giving them greater purchasing power. This feature enables investors to acquire properties that generate more rental income, leading to enhanced profitability and return on investment.

Additionally, DSCR loans focus on the property’s cash flow rather than the borrower’s personal income. As a result, investors with multiple rental properties can take advantage of the combined income to secure financing for additional investments. This scalability allows investors to expand their real estate portfolios and capitalize on Florida’s thriving rental market.

Another benefit of DSCR loans is the flexibility they offer in terms of employment history. Traditional mortgage loans often require borrowers to demonstrate a stable employment history, whereas DSCR loans prioritize the property’s income potential. This is particularly advantageous for self-employed individuals or those with irregular employment patterns, who may face challenges when seeking traditional financing options.

In conclusion, DSCR loans provide an excellent avenue for individuals looking to engage in Florida real estate investing, particularly in rental properties. By focusing on the property’s cash flow potential and considering factors beyond personal credit scores, DSCR loans offer flexibility and accessibility to a broader range of investors. With its vibrant rental market and favorable investment climate, Florida presents a prime opportunity for real estate investors to leverage DSCR loans and build profitable portfolios.

The Spectrum of Investment Opportunities

Florida’s real estate market offers a spectrum of investment opportunities, from single-family homes to short-term rentals. DSCR loans are versatile and can cater to various property types, making them a valuable tool for investors seeking to diversify their portfolios in the Sunshine State.

The Advantage of Flexible Terms

Florida DSCR loans provide investors with flexible terms and loan types. Investors can explore fixed-rate or variable-rate options and customize the terms to align with their investment strategy. This flexibility ensures that investors can adapt their financing to suit their unique goals and preferences.

Non QM Loans: Expanding Possibilities

Some Florida DSCR loans fall into the category of Non-Qualified Mortgage (Non-QM) loans. These loans offer even greater flexibility by not adhering to the stringent requirements of traditional mortgage products. Borrowers may find Non-QM loans more accessible, especially when dealing with complex income statements or non-warrantable condos.

In conclusion, Florida DSCR loans present a compelling option for property investors in the Sunshine State. With their focus on the property’s income potential, streamlined application process, and competitive terms, these loans are well-aligned with the needs of investors seeking to capitalize on Florida’s robust real estate market. Whether it’s single-family homes, short-term rentals, or other property types, Florida DSCR loans offer an efficient and effective path to realizing investment potential in this vibrant and dynamic real estate landscape.

DSCR loans are readily available in major Florida cities like Jacksonville, Miami, and Tampa, with DSCR lenders in Jacksonville, FL, catering to the unique real estate investment needs of these urban centers. Loan Trust is well sought our for DSCR loan Miami programs.

Florida has emerged as a hotbed for real estate investment, and DSCR loans have become a game-changer for investors in the Sunshine State. DSCR loans in Florida for investors offer unique advantages, making them an attractive choice for those seeking financing for rental properties. Unlike conventional loans, DSCR loans don’t require tax returns, pay stubs, or proof of personal income, making them ideal for investors focused solely on their investment properties.

One of the most significant benefits of DSCR loans in Florida is the freedom from complicated income statements and employment history. These loans are primarily based on the cash flow of the subject property, not the borrower’s job history or personal income verification. This flexibility caters to the needs of self-employed individuals, who often face hurdles when seeking conventional financing options. It’s also an excellent solution for investors with multiple properties who rely on the income from their investments to secure additional financing.

Another advantage is the lower minimum down payment requirement. While most conventional loans demand a substantial down payment, DSCR loans typically have more lenient down payment requirements. This can be a game-changer for investors who want to expand their portfolio without tying up large sums of cash.

DSCR loans in Florida are also available for various property types, including single-family homes, non-warrantable condos, and other investment properties. Moreover, the DSCR ratio requirements are more flexible than what most conventional lenders demand. A good DSCR, which signifies positive cash flow and enough rental income to cover the mortgage payments, is often the primary focus for DSCR lenders.

Faster closing times are another notable advantage of DSCR loans. The absence of extensive income verification and the borrower’s ability to repay based on the property’s income stream can lead to quicker loan approvals and closings. This can be crucial in the competitive Florida real estate market, where swift action is often necessary to secure attractive investment opportunities.

In conclusion, DSCR loans in Florida for investors have several benefits that set them apart from conventional loans. These loans cater to the unique needs of real estate investors, offering flexibility, lower down payment requirements, and faster closing times. By focusing on the property’s cash flow and the borrower’s ability to repay based on rental income, DSCR loans provide a practical financing solution for those looking to capitalize on the booming Florida rental property market without the complications of traditional mortgage loans.

How to Get Approved for a DSCR Loan in Florida

Investing in real estate can be a lucrative venture, especially in a thriving market like Florida. However, financing your investment properties can be a significant hurdle. One option to consider is obtaining a Debt Service Coverage Ratio (DSCR) loan. DSCR loans are specifically designed for real estate investors who generate rental income. They focus on the cash flow from the property rather than personal income. Explore the key factors to consider and steps to take in order to increase your chances of getting approved for a DSCR loan in Florida.

Understand the DSCR Loan:

Before diving into the loan application process, it’s essential to have a clear understanding of what a DSCR loan entails. DSCR is a financial ratio used by lenders to determine the borrower’s ability to cover their debt obligations. The higher the DSCR, the better chances you have of getting approved for the loan. Most lenders prefer a DSCR ratio of at least 1.25, meaning that the property’s annual net operating income should be 25% higher than the annual debt obligation.

Prepare Detailed Financial Documentation:

Although DSCR loans rely heavily on property cash flow, lenders still require certain financial documents for assessment. While these loans may not require tax returns or traditional income verification methods, it’s crucial to have other supporting documents ready. Prepare detailed financial statements, including profit and loss statements, bank statements, and documentation of rental income. This documentation will demonstrate the property’s cash flow and its ability to cover the monthly mortgage payments.

Save for a Down Payment:

Like any other loan, DSCR loans often require a down payment. While the specific amount may vary depending on the lender and the property, it’s advisable to save for a significant down payment. A substantial down payment not only reduces the loan amount but also demonstrates your commitment to the investment. This increases your chances of approval and may even lead to more favorable loan terms.

Research DSCR Loan Lenders in Florida:

It’s essential to find lenders who specialize in DSCR loans and operate in Florida. Conduct thorough research and identify reputable lenders with experience in providing DSCR loans for investment properties. Look for lenders who have a track record of working with real estate investors in Florida and have a deep understanding of the local market. Engage in conversations with multiple lenders to compare terms, interest rates, and eligibility criteria.

Optimize Property Cash Flow:

Lenders evaluate the rental income generated by your investment property to determine the loan eligibility. To increase your chances of approval, focus on optimizing the property’s cash flow. Consider strategies such as increasing monthly rent, reducing vacancies, and minimizing expenses. By demonstrating a healthy and sustainable cash flow, you strengthen your case for loan approval.

Calculate DSCR and Loan Eligibility:

Before applying for a DSCR loan, it’s essential to calculate the Debt Service Coverage Ratio for your property. This ratio will give you an idea of your eligibility and help you determine if you meet the lender’s requirements. Calculate the DSCR by dividing the property’s annual net operating income by the annual debt obligation. If the result is above 1.25, you have a better chance of getting approved.

Seek Professional Guidance:

Navigating the world of real estate financing can be complex, especially when it comes to specialized loans like DSCR loans. Consider seeking guidance from professionals who specialize in real estate investing and financing. Engage with mortgage brokers, financial advisors, or real estate attorneys who can provide valuable insights and assist you throughout the loan application process.

In conclusion, obtaining a DSCR loan for your Florida real estate investment requires careful preparation and understanding of the loan requirements. By focusing on property cash flow, preparing detailed financial documentation, saving for a down payment, and researching reputable lenders, you increase your chances of getting approved for a DSCR loan. Remember to optimize your property’s cash flow, calculate the DSCR, and seek professional guidance when needed. With thorough preparation and the right approach, you can secure the financing you need to pursue your Florida real estate investment goals.

Many real estate investors aren’t aware of a DSCR loan and are missing out on opportunities. By applying for a DSCR loan in Florida and other states you don’t usually need to show any personal income, because Florida DSCR loans only are concerned about rental income covering the debt service unlike a traditional conventional loan. Many investors have grown their Florida rental property portfolio by utilizing a DSCR loan. The DSCR loan has been a tremendous program for Florida rental property investors because DSCR loans in Florida have been in the spotlight for many real estate investors. These programs can be used for condo loans which are in great demand in Florida.

Other Loan Programs

- Conventional

- FHA

- VA

- USDA

- AirBNB

- Condotel

- Non-QM

- DSCR

- No Doc Loans

- Mortgage Rates

- 5/1 Arms

- Condo Mortgage Rates

- No Doc Mortgage Florida

- FHA Rates

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington