DEBT-SERVICE COVERAGE RATIO

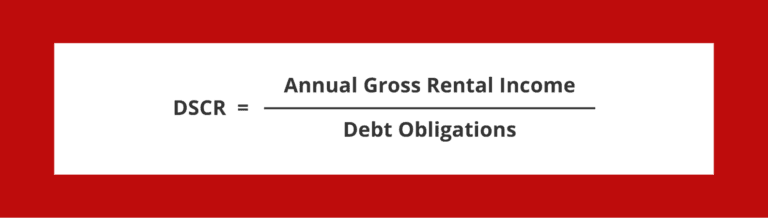

Commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

What Is a Good DSCR Ratio?

Most lenders will require a 1.25 DSCR to qualify for a DSCR mortgage loan. However, Loan Trust allows real estate investors to qualify for a loan with a DSCR as low as 0.00 so that they can qualify with the cash flow of your property. Please note that interest rates are better on DSCR ratios of 1 or above and that a DSCR ratio of less than 1 requires 12 months of reserves.

When considering what a good DSCR ratio is, lenders need to ensure that a borrower is able to pay back the loan.

What is a DCSR Loan?

A DSCR Loan is a Debt Service Coverage Ratio Program. Qualify for a home loan without using your tax returns. As a real estate investor, you can avoid high rates and high points of private loans, lengthy approval processes, and strict lending criteria with a debt service coverage ratio loan, which is a type of no-income loan. Qualify for a loan based on your property’s cash flow, not your income. A DSCR loan is a type of Non-Qualified Mortgage loan for real estate investors. Lenders and Bankers use a DSCR to help qualify real estate investors for a loan because it can easily determine the borrower’s ability to repay without verifying income.

What Is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio is a ratio of a property’s annual net operating income and its annual mortgage debt, including principal and interest. Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property as well as to determine how much income coverage there will be at a specific loan amount.

What are the qualifying guidelines for the DSCR loan?

DSCR Loan Guidelines | ||

|---|---|---|

|

Debt Service Coverage Ratio

- To find your Gross Rental Income we take your annual rental income based on your lease agreement and the appraiser’s comparable rent schedule (form 1007) and use the lesser of the two. In some cases, if you can prove a twelve month history of rental income you can qualify off of that rather than the appraiser’s market rent.

- Next, you’ll need to find your annual debt. Your annual debt for loan qualification purposes equals the total annual principal, interest, taxes, insurance and HOA (if applicable) payments. Annual Debt = Total Annual PITI payments

- Next, you’ll divide your annual gross rental income by your annual debt for your ratio. DSCR = Annual gross rental income/Annual Debt

Investors seeking to capitalize on Florida’s real estate market can benefit from various lending options, including DSCR loans. Whether you’re in Tampa, Fort Lauderdale, or Jacksonville, a DSCR loan can be an attractive alternative to conventional loans, especially for those who prioritize rental income over personal income. A DSCR lender in Tampa, for example, focuses on the property’s income potential to determine eligibility, rather than the borrower’s personal income. For those considering a DSCR loan in Fort Lauderdale, it’s essential to understand the specific requirements, which typically include a minimum credit score. Similarly, a DSCR loan in Jacksonville will have distinct requirements tailored to the local market conditions. Florida DSCR loans provide a flexible financing solution for investors, making it easier to acquire income-producing properties without the stringent requirements of traditional financing methods. An alternative loan for a short term solution is a bridge loan program.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington