DSCR Loans Massachusetts: Growing Your Portfolio Quickly Without Income Verification

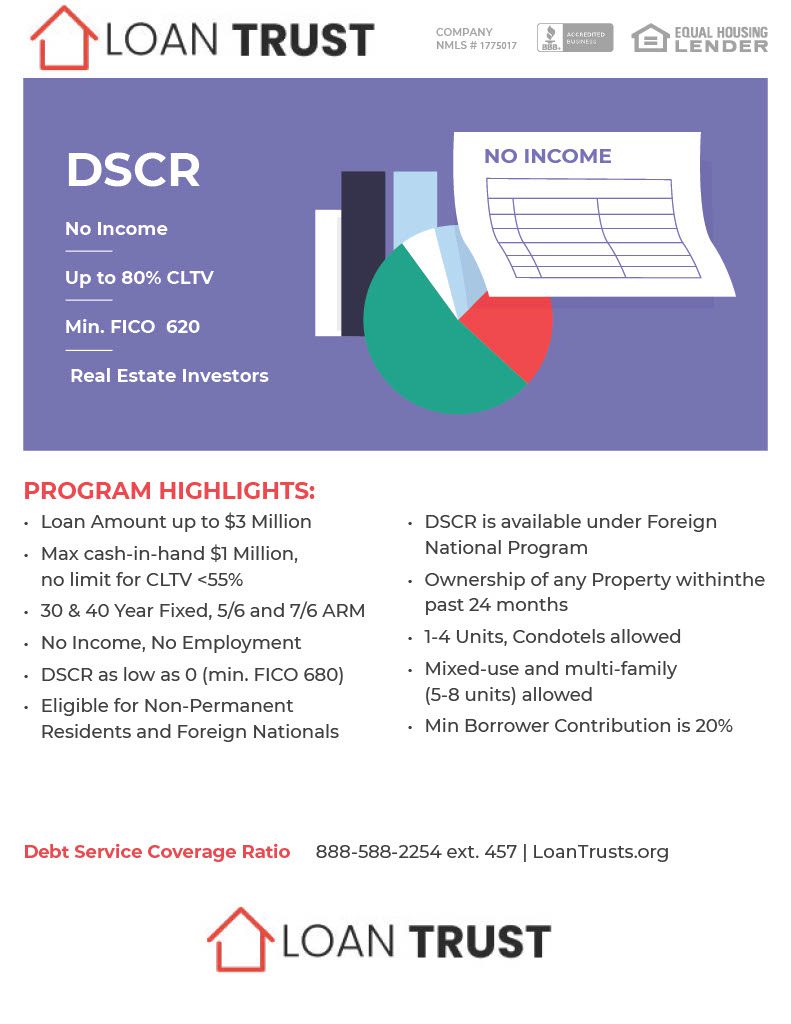

New England has many investment property opportunities that suit almost everyone’s budgets. DSCR loans offer investors a chance and flexibility for expansion without requiring verification of income.

What is the minimum and maximum loan amounts for rental loans near Boston, MA offered by Loan Trust?

Loan Trust loan amounts are $50K minimum up to a maximum of $125 Million.

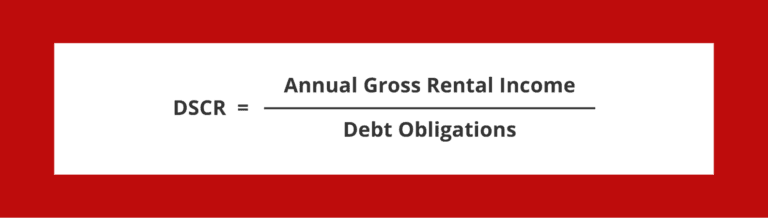

What is Debt Service Coverage Ratio (DSCR)?

DSCR stands for debt service coverage ratio, and is used to assess if a property has sufficient income to cover the mortgage debt. This economic metric is used by lenders to evaluate loan applications or borrowers refinancing.

What is a Net Operating Income in DSCR Investor Loans?

NOI or net operating earnings are the key indicators for the DSCR calculation. For properties to qualify for a loan under DRCR, the rental income should be equal or greater than the debt service. The NOI was calculated using removing every operating expense from the property’s total earnings per year. NOI = Total revenues – vacancies loss – operating costs NOI above mortgage payments means that the DSCR ratio is over 1. This is DSCR’s preferred ratio for lending institutions to grant loans.

DEBT SERVICE COVERAGE RATIO Loans In Michigan

Massachusetts commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

DSCR Calculation: Real Estate vs. Business Loans

For real estate loan the debts and expenses are calculated using the dividing of the net operating profit from the asset from the total debt service, which includes principal and interest payments for the mortgage loan. The calculations used by DSCR for loans involve division of the profit from the cash flows that can be used to repay debts by the total amount. The cash flow available for debt servicing is usually measured by subtraction of the business operations costs, including fixed costs, from net profits.

Median Listing Prices for Rental Properties in Boston, MA

Realty investors looking to sell rented properties should analyze a listing average of properties located within Boston, Massachusetts. If a business owner has purchased a property, he may sell it or use it as a rental property before he sells a home. Prices in Boston Massachusetts are high so sellers can increase their asking rates on rental properties and successfully close at these asking prices.

Does my rental property have to be leased before closing?

No it doesn’t, but you might be better off applying for a bank statement loan as opposed to a DSCR loan in Massachusetts since there isn’t any rental income on the property.

DSCR Calculation and 1007 Rent Schedule

When you apply for a loan, your lender will calculate your DSCR ratio that must exceed 1 for approval. In addition, most lenders will order a 1007 rent schedule, ensuring you are able to cover the mortgage payments.

Average Days on the Market for Rental Investment Properties in Boston, MA

The length of time that a rental property that has been on the marketplace is useful for rental investors. Shorter days on the market means people purchase and sell their home faster. Alternatively the vacant property for longer periods may indicate an oversupply of demand in real estate market in Boston, Massachusetts, or may have been triggered by an unsatisfactory supply in Boston.

Eligibility for Property

The DSCR mortgage allows a number of properties prohibited by regular investment property loans such as the sale and leasing of non-warrantable apartments. Unlike most mortgages, LLCs can be held on real property that cannot be guaranteed under standard mortgages. Most lending agencies also have no restrictions on renting the properties you have financed, which can make the investment process easier.

Do you need a downpayment on the DSCR loan?

The majority of DSCR loan applicants require an upfront payment. Most DSCR loans are typically backed by a 20-25% deposit. Because DSCR mortgage is a more risky type of loan than traditional loans, lenders want to ensure the borrower has sufficient cash flow and enough equity to invest in the property in their possession in order to recover potential loss incurred if they fail.

Submit Proof of Income from Your Property

You must also demonstrate that your own property income covers your mortgage payments. So you must produce the necessary documentation showing your income in terms of a loan.

What are the Program Costs and Fees of DSCR?

Generally, DSCR loans are more costly than conventional loan on property and are generally cheaper for the consumer. They include higher starting charges, point or recompense penalties. The total costs of the loans also generally are high since LTVs ratios typically are around 80%.

Compare Rates from Best DSCR Lenders

Apply today for investors cash flow loans with a minimum of rental income *Our services will absolutely competitive to anyone!

Are DSCR loans good?

DSCR loans have become a popular way of financing a property’s investment. Lenders are more concerned with rent earnings relating to properties compared to mortgage rates and access to the borrower’s personal income to evaluate if they qualify.

What states does Loan Trust offers its rental loan products?

Loan Trusts specializes in the lending real estate investment loans in almost any state.

Connect with the Best DSCR Lenders

Compare multiple lenders and find a suitable one! Our services are competitive in the real lending marketplace.

20-25% Down payment

DSCR loans will require an initial deposit of 20-25 % for your property.

Operating Expenses

Operating expenditure is the cost of running a business. They may include the expenses of maintaining the property and utilities or any additional expenses necessary to manage it. Increasing operating expenses reduces the net income on a property and lowers the ratio to DSCR. Therefore, managing operating expenses is essential to maintain good levels of DSCR ratio.

Who Offers DSCR Loans?

These lenders typically provide DSCR loans to residential property investors through a range of financial institutions including banks, credit unions, and mortgage lenders. One issue for many investors is deciding which lenders meet their specific needs. Researching and comparison of various loan options is often time intensive and overwhelming.

DSCR Loan Refinance

A DSCR loan refinance is a financing solution that a borrower may use as a replacement for a new loan. This loan type and of refinancing focus on the debt service coverage ratio (DSCR) measuring the potential income generated for covering the debts. If a refinancing with the DSCR loans is approved, the lender can assess the current cash flow of maximum loan to value of the property.

DSCR Loan for Commercial Property

DSCR loans on commercial property are aimed at investors with commercial properties in mind. It evaluates property assets’ cashflows and ensures that the property generates sufficient revenue for the repayment of the mortgage payments. The lender determines the ability of the property to pay back debts based upon an evaluation of the various DSCR loan amount. It helps investors get loans for the property if they do not depend on their own personal finances. Having an accurate evaluation of a the property’s cash flow and ability to support mortgage payments enables investors to leverage their income in a variety of commercial property opportunities.

DSCR Loan Massachusetts Real Estate Investment Loans

1. Understanding DSCR Loan Massachusetts DSCR loans in Massachusetts are specialized financing options for real estate investors. These loans focus on the property’s cash flow rather than personal income verification, making them ideal for financing rental properties and investment properties.

2. Benefits for Real Estate Investors DSCR loans in Massachusetts offer several benefits to real estate investors. They consider the property’s cash flow, allowing investors to leverage rental income for loan approval and build a strong real estate portfolio.

3. Evaluating Property’s Cash Flow When applying for a DSCR loan in Massachusetts, lenders carefully assess the property’s cash flow. They want to ensure that the rental income generated by the property can cover the mortgage payments and maintain a positive cash flow.

4. Investing in Massachusetts Real Estate Market Massachusetts has a diverse and robust real estate market. DSCR loans provide an opportunity for real estate investors to enter this market, expand their investment portfolio, and capitalize on the potential for long-term growth.

5. Covering Mortgage Payments with Rental Income One of the main advantages of DSCR loans in Massachusetts is their emphasis on the property’s cash flow. Rental income plays a significant role in covering the mortgage payments, ensuring investors can sustain their investment properties.

6. DSCR Loan Cash Flow and Real Estate Portfolio DSCR loans help real estate investors in Massachusetts build a strong real estate portfolio. By focusing on the cash flow of each property, investors can expand their portfolio and increase their rental income potential.

7. The Role of the Real Estate Market The Massachusetts real estate market plays a crucial role in the success of real estate investments. DSCR loans provide financing options that align with the specific dynamics of the market, allowing investors to seize opportunities.

8. Loan Payments and Cash Flow DSCR loans in Massachusetts consider the property’s cash flow when determining loan payments. This approach ensures that borrowers have sufficient cash flow from rental income to cover their mortgage payments.

9. How Many DSCR Loans Can an Investor Have? The number of DSCR loans an investor can have in Massachusetts depends on the investor’s financial situation and the lender’s criteria. Some investors successfully manage multiple DSCR loans by demonstrating their ability to handle the associated financial obligations.

10. Sufficient Cash Flow for Mortgage Payments To qualify for a DSCR loan in Massachusetts, the property’s cash flow must demonstrate the property’s ability to cover the mortgage payment and maintain positive cash flow. This provides lenders with confidence in the borrower’s ability to manage the investment property.

11. Minimum Credit Score Requirements While DSCR loans in Massachusetts focus more on the property’s cash flow, borrowers are still expected to have a minimum credit score. A good credit score demonstrates financial responsibility and increases the chances of loan approval.

12. Cash-Out Refinancing for Investment Properties DSCR loans in Massachusetts also provide an opportunity for cash-out refinancing. This option allows investors to access equity in their investment properties, providing capital for further investments or property improvements.

13. Private Lenders and DSCR Loans Private lenders in Massachusetts often offer DSCR loans, providing an alternative to traditional lenders. These lenders specialize in real estate investment loans and have a deep understanding of the local market.

14. The Role of the DSCR Lender A DSCR lender in Massachusetts evaluates loan applications based on the property’s cash flow and rental income potential. These lenders have expertise in assessing investment properties and can provide tailored financing solutions for real estate investors.

15. Monthly Payment Calculation DSCR loans in Massachusetts calculate the monthly payment based on the property’s cash flow and rental income potential. This calculation ensures that borrowers have a manageable payment structure aligned with the property’s income generation.

16. Evaluating the Subject Property Lenders consider the subject property’s cash flow and rental income when assessing loan eligibility. This evaluation provides lenders with a clear understanding of the property’s income potential and its ability to sustain the loan.

17. Managing Multiple Properties with DSCR Loans DSCR loans are suitable for real estate investors in Massachusetts who own multiple investment properties. By considering the cash flow from all properties, investors can manage their investments effectively and ensure loan obligations are met.

18. Navigating the Competitive Market Massachusetts, particularly cities like Boston, has a highly competitive real estate market. DSCR loans provide investors with financing options to navigate this market and seize investment opportunities.

19. Closing Costs and DSCR Loans Real estate investors in Massachusetts should consider closing costs when securing DSCR loans. These costs may include appraisal fees, origination fees, title insurance, and other associated expenses.

20. No Tax Returns or Pay Stubs Required Unlike traditional loans, DSCR loans in Massachusetts may not require tax returns or pay stubs for income verification. This streamlined approach simplifies the loan application process for investors, particularly self-employed individuals or those with non-traditional income sources.

21. Long-Term Rental Properties DSCR loans are well-suited for financing long-term rental properties in Massachusetts. Whether it’s single-family homes or multi-unit buildings, investors can secure DSCR loans to finance their rental properties.

22. New Properties and DSCR Loans Investors looking to purchase new properties in Massachusetts can explore DSCR loans. These loans provide the necessary funds to acquire properties and leverage their potential rental income.

23. Favorable Rental Income Consideration DSCR loans in Massachusetts favor the consideration of rental income when assessing loan eligibility. This approach provides more flexibility for investors, especially when their personal income may not align with traditional loan requirements.

24. Qualifying Based on Rents DSCR loans allow investors in Massachusetts to qualify based on the property’s rental income rather than personal income. This opens opportunities for borrowers who generate substantial rental income but may not have significant personal income.

25. The Role of Income Verification While DSCR loans may not require traditional income verification methods, lenders may still evaluate the borrower’s overall financial situation. This assessment helps determine the borrower’s ability to manage loan repayments, cover mortgage payments and maintain the property’s cash flow.

26. Financing Options for Construction Loans DSCR loans in Massachusetts can also be utilized for financing construction projects. These loans provide the necessary capital to fund construction and eventually convert the property into a profitable investment.

27. DSCR Loan Availability Across the Country DSCR loans are not limited to Massachusetts alone. Investors across the country can explore these financing options to support their real estate investment ventures.

28. Benefits for Boston Real Estate Investors Real estate investors in Boston can benefit from DSCR loans as the city offers them access to a profitable real estate market with high rental demand and price appreciation potential. DSCR loans provide an avenue to invest in the Boston market and generate long-term profits.

In summary, DSCR loans in Massachusetts cater to real estate investors by focusing on the property’s cash flow rather than personal income. These loans offer numerous benefits, including financing for both rental properties and investment properties, flexible loan payments, and the potential to build a robust real estate portfolio. Real estate investors in Massachusetts can leverage the opportunities provided by DSCR loans to navigate the competitive market, manage multiple properties, and achieve their investment goals.

DSCR Loans Massachusetts and No Doc Loans

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington