DSCR Loan Illinois | How To Get Approved for Real Estate Investment Loans

There is no doubt the reason that many real estate developers are interested in DSCR loans in Illinois is due to the return on investment (ROI). Chicago is a prominent city in the state of Illinois that offers many attractions for families with many opportunities. Art, food and eight major league football clubs attract visitors from all over the world. O’Hare International Airport offers business connectivity across over 200 destinations. DSCR loans may aid in the entry into this lucrative real estate business because approval is based upon the property’s revenue and not your personal income.

If you’re tired of hard money loans, talk to Loan Trust

If you’re tired of hard money loans, talk to Loan Trust

It can take years and sometimes even decades to obtain affordable home financing. Most real estate investors access hard-money loans at rates as low as 9% or more. Loan Trust has more options to refinance rented houses or to refinance hard money loans. Loan Trust also known as Capital Group Private Investor Mortgage Funding, LLC offers solutions – mortgage financing specifically for residential and commercial investors.

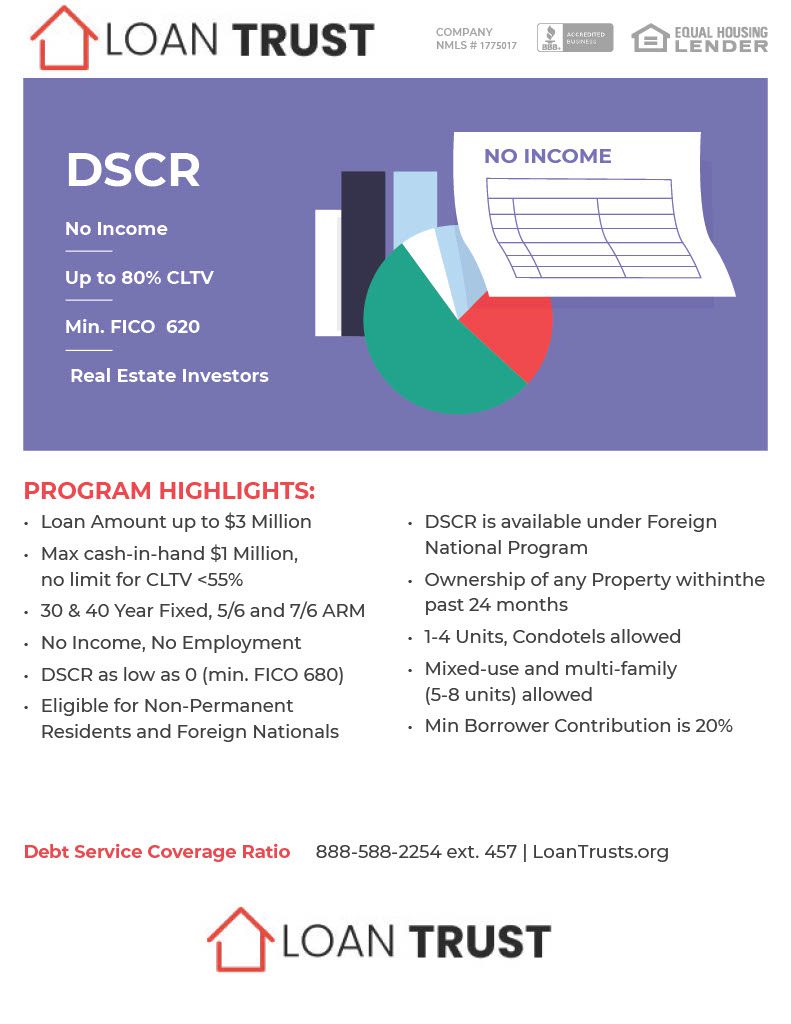

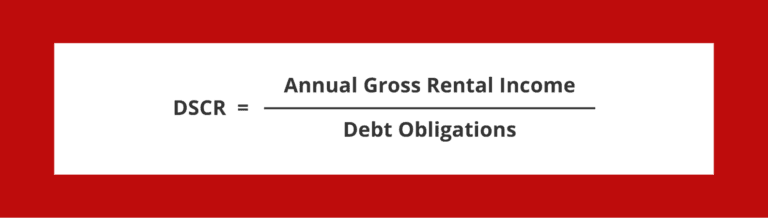

DSCR Loans are based on the property’s Debt Service Coverage Ratio

Loan Trust provides loan services to invest in a property-backed investment model based on Debt Services Coverage Ratios (DSCRs), which can reduce costs by 80%. The DSCR formulas are simple: if rent earnings support your mortgage debt service, then you can qualify most likely. There are 30-year, fixed-rate loans between $50,000 and $30,000,000. No personal income tax is necessary. Our loans are available even for situations where rent is not enough to cover your debt. Contact Loan Trust for information and to cut back on hard-earned taxes with loans.

DEBT SERVICE COVERAGE RATIO

Illinois commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

Investment DSCR Loans Now Accepted from LOs Unlicensed in Some States

Loan Trust is currently accepting investment loan non-QM loans from investment banks in states with no loan officer license for business, including a third state added in May. We offer retail private money loans.

How Does an Illinois DSCR Loan Cost?

It provides an alternative way to obtain an investment property based on income. This requires an inspection which is different for traditional loans. The loan type he is entitled to depends on the recommendation and credit score from the broker and the loan provider.

What Do DSCR Lenders Look for?

The lender looks at borrowers who believe they are not eligible to qualify for QM credit due to the fact that they do not have any income or credit scores. The borrower must meet the eligibility requirements by checking the DSCR. For borrowers who have been denied access to DSCR loans, alternative loans can be used, including assets and bank statements. At Loan Trust, this qualification is usually lower than 0.75. DSCRs above 1.25 may have lower rates or beneficial terms to lend.

Who Is a DSCR Loan Best Suited for?

DSCR loans are best suited to residential and other construction, commercial real estate investors, self-employed people, business owners and small to midsize businesses who have recently experienced unforeseen financial issues and/or unverifiable income.

Cash Flow Loans for Real Estate Investors

A lot of people who invest in residential properties struggle getting mortgages in good terms. They are sometimes forced to take hard-earned credit at 9% interest. Loan Trust is different from the conventional banks which offer loan service rates (DSCR). You will be able to apply if rental revenues cover your debt servicing and insurance needs. We offer fixed rate loans of up to three million dollars for 30-years. Loan Trust allows a private company or a non-warrantable condo to be funded by private capital.

What if Rental Income Doesn’t Cover Your Debt Service?

When the debt services on the rental properties are less than the rents,” it can be particularly tough getting an affordable mortgage. Loan Trust is offering an innovative private loan programs which are able to reduce your interest rate. In that situation, the key to success is your own ownership of the rental property and your credit score. If you hold 25% of your shares in a company with strong FICO scores, you’re eligible for a loan. Sometimes an individual who works in the private sector does not have the ability to prove his income by paying back loans or re-selling their home. No Doc loan borrowers often have options that no loan program offers.

Rental Income

In Illinois, qualifying for Debt Service Coverage Ratio (DSCR) loans often hinges on various factors, with rental income playing a pivotal role. Lenders commonly assess the potential rental income from a property to determine the borrower’s ability to meet loan obligations.

Debt Service Coverage Ratio

The Debt Service Coverage Ratio (DSCR) is a crucial metric used by lenders to evaluate the property’s income relative to its debt obligations. A high DSCR indicates a property’s ability to cover its debt payments adequately.

Rental Income

For individuals seeking DSCR loans in Illinois, showcasing a stable and reliable rental income is imperative. Lenders typically assess the consistency and sustainability of rental earnings to gauge the borrower’s repayment capacity.

DSCR Loan

Securing a DSCR loan involves proving to lenders that the rental property’s income is sufficient to cover the mortgage payments. This assurance is critical in obtaining approval for such loans.

Bank Statement Loans

In some cases, individuals in Illinois might opt for bank statement loans, which rely on bank statements instead of tax returns to demonstrate income. This option can be beneficial for self-employed individuals or those with irregular income streams.

Rental Property

The type of rental property being considered significantly impacts the qualification for DSCR loans. Lenders often differentiate between residential investment properties and commercial properties, each having distinct lending criteria.

Rental Income

Emphasizing the stability and consistency of rental income is essential for obtaining approval for DSCR loans. Documenting rental agreements and lease terms helps bolster the credibility of the income.

Investment Property

For individuals eyeing investment properties in Illinois, particularly rental properties, demonstrating a steady rental income stream is crucial in meeting the requirements for a DSCR loan.

Residential Investment Properties

Lenders scrutinize residential investment properties differently from commercial ones. They may have specific guidelines and criteria for rental income assessment, affecting the loan qualification process.

Minimum Credit Score

In Illinois, meeting the minimum credit score stipulated by lenders is pivotal for DSCR loan approval. A higher credit score typically increases the likelihood of securing favorable loan terms.

Minimum Down Payment

The down payment requirement varies among lenders. However, having a substantial down payment often enhances the borrower’s chances of qualifying for a DSCR loan.

Mortgage Payment

Calculating the mortgage payment is essential in assessing the property’s affordability. Lenders consider this when evaluating a borrower’s eligibility for a DSCR loan.

Debt Obligations

Apart from the mortgage payment, lenders also consider the borrower’s other debt obligations. A lower debt-to-income ratio increases the chances of qualifying for a DSCR loan.

No Tax Returns

Certain DSCR loans in Illinois cater to individuals who might not have traditional tax returns to showcase their income. These loans rely on alternative methods to verify income, such as bank statements.

Monthly Payments

Understanding the monthly payment obligations on the property is crucial. It directly influences the lender’s decision in approving DSCR loans.

No Tax Returns

For those unable to provide tax returns, demonstrating the property’s income through alternative means becomes imperative. This could involve showcasing consistent rental income or utilizing bank statements to validate earnings.

Property’s Income

Highlighting the property’s income and its ability to cover the mortgage payment is fundamental in securing approval for a DSCR loan.

Maximum Loan Amount

Lenders assess the property’s income against the loan amount to determine the maximum loan amount they’re willing to provide. This evaluation directly impacts the approval process for DSCR loans.

Private Lenders

Private lenders might offer DSCR loans with different criteria compared to traditional financial institutions. Exploring options from various lenders in Illinois can help borrowers find suitable terms.

DSCR Ratio

Most DSCR loans require a specific DSCR ratio for approval. Meeting or exceeding this ratio showcases the property’s income adequacy, facilitating loan approval.

Multiple Properties

For investors with multiple properties in Illinois, demonstrating the income from these properties can influence the approval of DSCR loans. Each property’s cash flow contributes to the overall assessment.

Minimum DSCR

Understanding the minimum DSCR required by lenders is crucial. A good DSCR ratio significantly improves the chances of loan approval.

Good DSCR Ratio

A strong DSCR ratio indicates a healthy property’s cash flow and strengthens the borrower’s position when applying for DSCR loans in Illinois.

DSCR Calculation

Knowing how lenders calculate the DSCR assists borrowers in preparing the necessary documentation and presenting a strong case for loan approval.

Property’s Cash Flow

The property’s cash flow, derived from rental income, is a primary factor in determining the property’s ability to cover mortgage payments, thus influencing DSCR loan qualification.

Many Investors

In Illinois, many investors seek DSCR loans for rental properties. Understanding the specific requirements and tailoring applications to meet these criteria is vital in securing loan approval.

Certain Period

Lenders might assess the property’s income over a certain period to determine its consistency and reliability. Meeting income stability requirements aids in qualifying for DSCR loans.

Lower Interest Rates

A favorable DSCR ratio often leads to lower interest rates on loans. Meeting lender requirements can result in more advantageous terms for borrowers in Illinois.

Wide Array

Lenders in Illinois offer a wide array of DSCR loans, each with its own set of criteria. Exploring these options allows borrowers to find loans that suit their financial circumstances.

Interest Rates

Interest rates for DSCR loans can vary based on several factors, including the property type, borrower’s creditworthiness, and the lender’s terms and conditions.

Self Employed

For self-employed individuals in Illinois, securing DSCR loans might require additional documentation to verify income, often differing from conventional employment requirements.

High Rates

In some cases, individuals facing high rates might seek DSCR loans as a means to refinance existing debts, provided the property’s income supports such a move.

Self Employed

Self-employed individuals applying for DSCR loans might face different requirements than traditionally employed borrowers. Providing detailed income documentation becomes essential.

Ratio Loans

DSCR loans heavily rely on ratio assessments, evaluating the property’s income against debt obligations. Understanding and meeting these ratios is crucial for loan approval.

Different Requirements

Different lenders in Illinois may have varying requirements for DSCR loans. Comparing these requirements allows borrowers to find the most suitable loan options.

Loan Amount

Determining the loan amount that aligns with the property’s income and meets lender criteria is essential for successful approval of DSCR loans.

Last Year

Lenders might evaluate the property’s income from the last year to ascertain its performance and stability, a factor influencing DSCR loan approval.

Year Fixed

The term length of a loan, whether a 30-year fixed or short-term loan, affects the qualification process for DSCR loans. Lenders consider these terms when assessing borrower eligibility.

In conclusion, qualifying for DSCR loans in Illinois necessitates a meticulous understanding of the property’s income, debt obligations, and lender requirements. Highlighting stable rental income, meeting minimum ratios, and exploring diverse loan options are crucial steps toward securing approval for these loans. Borrowers must meticulously prepare and provide accurate documentation to support their loan applications, ensuring they align with lender criteria and increase their chances of obtaining favorable terms.

DSCR Loan Programs in Illinois: Exploring Options and Criteria

When it comes to securing Debt Service Coverage Ratio (DSCR) loans, individuals across various states, including Massachusetts and Alabama, seek viable options tailored to their financial goals. DSCR loans are instrumental in real estate investments, especially for financing condominiums or other properties, utilizing the property’s rental income as a primary factor for loan approval.

DSCR Loan Massachusetts

In Massachusetts, DSCR loans cater to individuals eyeing real estate investments, particularly emphasizing the property’s rental income. These loans are structured to evaluate the property’s ability to cover its debt obligations through generated rental revenue.

DSCR Loan Alabama

Similarly, in Alabama, DSCR loans play a pivotal role in financing real estate ventures. Lenders in Alabama scrutinize the property’s income, focusing on the stability and consistency of rental earnings to assess the viability of the loan.

Condo DSCR Investment Loans

Condo DSCR investment loans are a specific category within DSCR lending programs. These loans are designed for individuals seeking financing for condominium investments, utilizing the rental income generated by these properties as a primary consideration for loan approval.

Property’s Rental Income

The property’s rental income is a fundamental aspect in the approval process for DSCR loans. Lenders meticulously evaluate the income generated by the property to ensure it adequately covers the associated debt obligations.

Alabama DSCR Loans

Alabama, like many other states, offers DSCR loans that rely on the property’s rental income to determine loan eligibility. Borrowers in Alabama need to demonstrate the stability and reliability of rental earnings to secure these loans.

Personal Financial Information

To qualify for DSCR loans in Illinois or any state, providing accurate personal financial information is essential. Lenders scrutinize this information to assess the borrower’s capacity to manage loan payments based on their income, assets, and liabilities.

Navigating the landscape of DSCR loan programs in Illinois involves understanding how lenders evaluate the property’s income, especially concerning condominium investments or rental properties. Whether in Massachusetts, Alabama, or any other state, borrowers must highlight the stability of rental income and furnish accurate personal financial details to increase their chances of securing favorable DSCR loan terms. Consulting with financial professionals and exploring various lending options tailored to individual financial circumstances can significantly aid in making informed borrowing decisions.

No Doc Loans and DSCR LOANS

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington