DSCR Loans Maryland | The No Income Verification Way To Grow Your Real Estate Portfolio

It is home to a large percentage of Maryland residents renting out a home. DSCR loans in Maryland offer investors a unique opportunity of boosting their investment portfolio quickly without income verification by reducing debt servicing costs.

Get Flexible Financing Option for Real Estate Investment

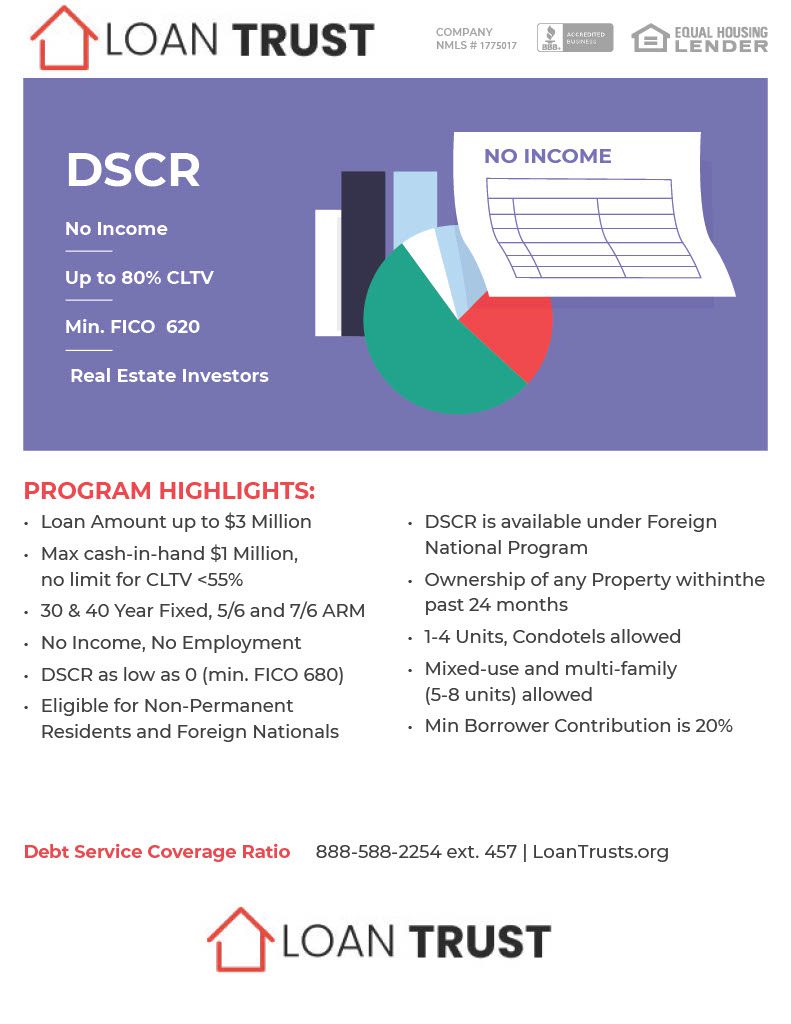

Are you searching to invest in real estate in Maryland? Get financing to support you at Loan Trust. DSCR Loans provide debt protection ratios mortgage payments in Maryland. Loan Trust has DSCR loan options for financing your real estate investment needs. The primary private lender to offer DSCR loans is Loan Trust.

What is a DSCR Loan Program? And How Do DSCR Investor Loans Work?

DSCR Loans is designed specifically to assist real estate investment investors with their loan eligibility. This method provides another alternative method to the traditional loan and methods that require tax returns and job documentation. By using the DSCR loan only, borrowers can assess their ability to repay a loan with no additional income checks needed. Typically borrowers do not meet the conventional mortgage verification requirements.

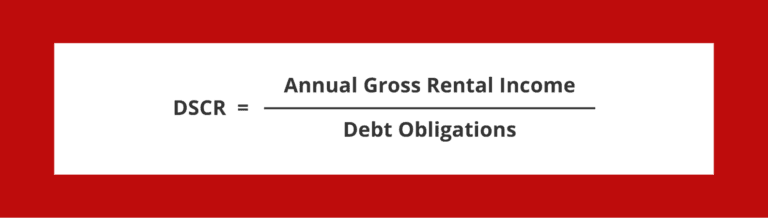

DEBT SERVICE COVERAGE RATIO

Maryland Commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

Maryland Cities the Loan Trust Offers DSCR Investment Loans

- Rockville

- Frederick

- Chevy Chase

- Kensington

- Baltimore

- Ocean City

- Cumberland

- Annapolis

- Gaithersburg

- Hagerstown

- Bowie

- Greenbelt

- Hyattsville

- Laurel

- New Carrollton

- College Park

Other Types of Loans for Borrowers with Low DSCR

If you’re unable to get a DSCR Loan because your DSCR is not high enough, then you have other Non-QM loans that you may qualify for an approval.

What is a Net Operating Income in DSCR Investor Loans?

Net Operating Income has been used in DSCR calculations as a key indicator. A property may require DSCR financing up to a yearly payment if NOI exceeds the loan amount. The NOI can be calculated by subtracting the operating costs from the gross profits. DSCR ratio = The most preferable ratio for lending to the borrower is 1.50 or greater.

Appraisal and Rent Schedule

The lender will request a property appraisal and 1007 rent schedule analysis for property values. Single-family dwellings are furnished according to Forms 1007 for the assessment of the income of small dwellings.

Benefits of Maryland DSCR Loans

It can be good to apply for DSCR loan Maryland program if your lender is not offering a conventional Maryland mortgage. Some people choose to use DSCR loans because they cannot apply for more traditional loan financing through their banks. DSCR loan Maryland programs have several advantages over traditional conventional loans, including the following: Loan Trust offers various kinds of loans to suit real estate investors. We will work with you to find out how best to borrow to suit your situation.

What is Debt Service Coverage Ratio (DSCR)?

DSCR loan Maryland programs is an acronym for debt service coverage ratio which is used to evaluate investment, property, income and debt obligations and is used by lenders to determine loan application or refinance.

Find DSCR Lenders Near Me

Below are a few lenders and states that also offer DSCR loans and lending programs that help investors buy homes with the DSCR loan Maryland program.

Submit Proof of Income from Your Property

As your creditworthiness is rated by the amount of cash you earn from the property you purchase, you must show that the property’s income is covered by a mortgage payment. Also, give documentation that will show the amount of your investment in terms of the maximum loan amount.

Eligibility for Property

DSCR mortgages typically permit a variety of properties excluded from regular investment property loans, including non-warrantable apartment homes with more than four units. LLCs have a right to own other assets which are prohibited by mortgage laws. In addition, many banks are not limiting how much property you can borrow and this can increase the value of your home portfolio faster. How a DSCR lender helped borrowers make a real estate investment: A young person approached Loan Trust aiming to create wealth by purchasing real estate investments and was able to secure financing based on the property’s net operating income.

Who Offers DSCR Loans?

DSCR loans are commonly offered by many different private lenders such as banks, credit unions and mortgage lenders. But locating the right lender will help investors get their money back. Search and compare different loan options are time-consuming and difficult. Loan Trust will work with you in the best possible way for DSCR lending or DSCR loan Maryland program.

DSCR Loan Cash-Out Refinance

Refinancing a specific loan payments a type of DSCR loan refinance that lets borrowers obtain a share in equity for their properties. The borrower may also borrow additional money to pay back their outstanding balance. The amount of cash will vary depending on property equity and lenders guidance. Cash-out refinancing is an excellent option for borrowers looking to use equity to fund renovations, consolidate debt, or make other investments in rental properties.

What are the Program Costs and Fees of DSCR?

DSCR loans typically charge greater fees than typical investment mortgages. This can be a higher source fees, credit score, or payment penalty. The total cost is generally more expensive as the average maximum loan to value ratio is usually 80%.

Loan To Value (LTV) Ratio

In the case of a loan from an unsecured lender the LTV ratio is usually 80% and the minimum 20% of the total loan amount is required. It is possible you will have to reduce your minimum down payment for options too, although interest generally will rise when you deposit fewer amounts.

Compare Rates from Best DSCR Lenders

Get prequalified for investors cash flow loans, based on the possibility of rental income!

Are DSCR loans good?

I think that DSCR loans are the perfect way of investing in property investment. During a loan process, most lenders look for rent income as well as the personal income of the borrowers to determine the eligibility of the borrower and many investors are growing their wealth with DSCR loan Maryland programs or debt service coverage ratio loan programs.

Appraisal for Maryland DSCR Loans

In Maryland, a DSCR appraisal requires the following documents for different types of properties. Your appraisal can be ordered from an appraisal manager or through direct DSCR approval from the DSCR lender. At appraisal management companies, the client can use two methods and request one of the appraised appraisers. Our Appraisal Price and availability request is an efficient method for generating competitive bids by appraisers in our network and direct our appraisals to the most competitive applicants.

Connect with the Best DSCR Lenders

Get quotes from countless lenders for comparison and selection. This service is completely free for you at Loan Trust.

620 or Higher Credit score

Generally speaking how many DSCR loans for mortgages require a credit score of 620, similar in comparison with a conventional loan on an investment property. In general though, minimum that most DSCR lenders for mortgages require minimum credit scores varies according to lenders and other criteria. However, there are some guidelines for DSCR loan Maryland scenarios that will allow for you to have a lower credit score.

20-25% Down payment

A DSCR loan can be used to buy or sell investment property. It’s one of easiest ways to be approved for a mortgage loan without verifying personal income.

DSCR mortgage rates Maryland

Maryland’s rates for DSCR mortgages are generally higher than traditional rates. However, many investors and self-employed borrowers see this slight improvement as an advantage because they can’t verify their income. Maryland is home to diversified and strong economics supported by aerospace, defense, manufacturing, cybersecurity and other industries. Maryland is close enough to Washington DC for many working in the capital Annapolis of Maryland to prefer its cheaper costs for their living. About 80% of Baltimore’s 62274 people reside in rental homes.

How Can You Qualify for a DSCR Loan? Step By Step Process

Application for DSCR Loans may be made via an unsecured lender working with a mortgage brokerage. When you contact a bank, the bank needs to ask questions about their investment property. The process includes the following:

10 Best Places to Buy Rental Property with DSCR Loan

The DSCR loan Maryland program is perfect for the state of Maryland and the surrounding suburbs because of the high rents in the area.

DSCR Loan LLC

DSCR loans are a financing choice designed for businesses that are formed as LLCs. The loan evaluated LLCs ability to generate enough earnings to fund the loan repayment. The Debt Services Covered Ratio (DSCRs) is determined by assessing cash flow and comparison with the Company’s annual debt service payments and due obligation. Using the resulting financing the LLCs can obtain the funds they want in support of their growth and expansion.

What type of property can I buy with a DSCR Loan?

The DSCR loan lets the real estate investor purchase a variety of properties for different uses such as short-term and extended rent. The rental property may serve as an interim or permanent residence if you are able to show the rental property generates good money flow.

DSCR Loan for Commercial Property

The DSCR loans are intended for property owners who own residential or other business assets. A lender will assess the borrower’s credit score and cash flow to ensure that the properties generate enough revenue in order to pay off the mortgages that have been paid off. In addition, the loan officer will assess the ability of the home to manage debt. It provides investors with an alternative option of relying solely on personal funds for the financing of their investment in commercial properties. The report reveals a reliable estimate of the ability of the property to repay the loans, thus aiding investors in leveraging income from commercial properties.

DSCR Loan Maryland Real Estate Investment Loans

1. Understanding DSCR Loans in Maryland

DSCR loans in Maryland provide real estate investors with financing options based on the property’s cash flow rather than personal income verification. These loans focus on the Debt Service Coverage Ratio (DSCR) to determine loan eligibility.

2. Benefits for Real Estate Investors

DSCR loans offer several benefits to real estate investors in Maryland. They provide financing for rental properties, consider the property’s cash flow, and enable investors to build a strong real estate portfolio.

3. Financing Rental Properties with DSCR Loans DSCR loans are ideal for financing rental properties in Maryland. These loans focus on the property’s rental income potential, allowing investors to leverage their rental properties for loan approval.

4. Working with DSCR Loan Lenders Finding the best DSCR loan lenders in Maryland is essential for real estate investors. These lenders specialize in real estate investment loans and understand the unique dynamics of the Maryland real estate investor market.

5. Calculating the Debt Service Coverage Ratio (DSCR) The Debt Service Coverage Ratio (DSCR) is calculated by dividing the property’s net operating income by the annual debt obligations. Lenders in Maryland use this ratio to assess the property’s ability to generate sufficient cash flow to cover mortgage payments.

6. DSCR Loans vs. Traditional Loans DSCR loans differ from traditional loans in that they prioritize the property’s income potential rather than personal income verification. This makes them suitable for real estate investments where rental income is the primary source of repayment.

7. Loan Terms and Down Payment Requirements DSCR loans in Maryland offer flexible loan terms and down payment options. While specific requirements may vary, lenders typically look for a reasonable down payment and a debt-to-income ratio that aligns with the property’s cash flow.

8. Minimum Credit Score and Income Verification While most DSCR loan programs focus on the property’s cash flow, borrowers are still expected to have a minimum credit score. Lenders may also require some form of income verification, such as bank statements or complex tax returns.

9. Managing Multiple DSCR Loans DSCR loan programs allow an investor in Maryland to have multiple investment DSCR loans. Some investors successfully manage multiple DSCR loans by demonstrating their ability to handle multiple rental properties.

10. Private Lenders for DSCR Loans Private lenders are often the best choice for DSCR loans in Maryland. These non-bank lenders provide more flexibility in underwriting and do not require income verification or complex tax returns like traditional lenders.

11. Loan Payments and Property’s Cash Flow DSCR loans ensure that loan payments are covered by the property’s cash flow. Lenders evaluate the property’s income potential to determine if it generates sufficient cash flow to cover both mortgage payments and other debt service payments.

12. Benefits for Seasoned Real Estate Investors Experienced investors seasoned real estate investor in Maryland can benefit greatly from DSCR loans. These loans provide an avenue for seasoned real estate investor to finance new acquisitions, expand their real estate portfolio, and take advantage of investment opportunities.

13. Competitive Interest Rates for DSCR Loans DSCR loans in Maryland often offer competitive interest rates to attract real estate investors. By leveraging the property’s income potential, borrowers can secure financing at favorable terms.

14. The Role of Credit History While DSCR loans focus on the property’s cash flow, most lenders still consider the borrower’s credit history. A solid credit history demonstrates financial responsibility and increases the chances of loan approval.

15. Consideration of Multiple Rental Properties DSCR loans in Maryland consider the income potential of experienced investor with multiple rental properties. Investors with a portfolio of rental properties can use their overall rental income to strengthen their loan application.

16. No Pay Stubs Required and NO TAX Returns Unlike traditional loans, DSCR loans in Maryland often do not require tax returns or pay stubs for income verification. This streamlined approach simplifies the loan application process for investors, particularly self-employed individuals or those with non-traditional income sources.

17. Loan Term Options DSCR loans in Maryland offer various loan term options, including interest-only periods. These flexible terms allow borrowers to customize their loan structure based on their investment strategy and cash flow projections.

18. The Role of Non-QM Loans DSCR loans are often categorized as Non-QM (Non-Qualified Mortgage) loans. These loans provide alternative financing options for borrowers who may not meet the strict criteria of traditional mortgage loans.

19. Real Estate Closing Costs and DSCR Loans Real estate investors in Maryland should consider closing costs when securing DSCR loans. These costs may include appraisal fees, origination fees, title insurance, and other associated expenses.

20. Calculating DSCR for Loan Eligibility Lenders calculate the minimum DSCR used to determine loan eligibility. Generally, a minimum DSCR of 1.25 or higher is preferred to ensure the property generates sufficient income to cover the mortgage payment and other debt service obligations.

DSCR Loan Maryland Investment Loans

Understanding DSCR Loans in Maryland DSCR loans in Maryland provide real estate investors with a financing option based on the Debt Service Coverage Ratio (DSCR). These loans focus on the property’s cash flow and rental income potential.

Benefits of DSCR Loans for Investment Properties DSCR loans offer several benefits to real estate investors in Maryland. Much different than traditional loans, they prioritize the property’s cash flow rather than personal income verification, making them ideal for financing rental properties and investment properties.

How DSCR is Calculated for Loan Eligibility The Debt Service Coverage Ratio (DSCR) is calculated by dividing the property’s net operating income by the annual debt service payments. Lenders in Maryland use this ratio to determine if the property generates sufficient cash flow to cover the monthly mortgage payments.

Advantages of DSCR Loans over Traditional Loans Compared to traditional loans, DSCR loans in Maryland focus on the property’s rental income potential rather than the borrower’s personal income. This provides more flexibility for real estate investors and allows them to leverage rental income for loan approval.

Evaluating the Property’s Cash Flow and Rental Income When applying for a DSCR loan in Maryland, lenders carefully evaluate the property’s cash flow and rental income. This assessment helps determine the property’s ability to generate sufficient income to cover the full monthly mortgage payments, and maintain a positive cash flow.

Flexibility in Loan Options The best DSCR loans in Maryland offer flexible terms and options. Investors can choose between fixed-rate or adjustable-rate mortgages, interest-only periods, and customize their loan structure based on their investment strategy and financial goals.

In summary, the best DSCR loan Maryland programs provide real estate investors with flexible financing options based on the property’s cash flow and rental income potential. DSCR loans prioritize the property’s income rather than personal income verification, making them ideal for financing rental properties and investment properties. By understanding the calculation of DSCR, evaluating the property’s cash flow, and exploring the flexibility offered by DSCR loans, investors can find the best loan option to finance their real estate investments with Maryland DSCR loans.

DSCR loan Maryland programs offer real estate investors flexible financing options based on the property and borrower’s ability and cash flow. These loans prioritize rental income and provide an avenue for investors to finance rental properties, expand their real estate portfolio, and capitalize on investment potential. By working with experienced lenders, understanding the loan terms, and leveraging the property and borrower’s credit score and income potential, investors can secure DSCR loans at competitive interest rates and achieve their real estate investment goals in Maryland.

DSCR Loan Maryland and NO Doc Loans

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington