DSCR Loan Indiana | Debt Service Coverage Ratio Loans Indiana

Indiana DSCR Loans is an Indiana based loan company that provides residential and commercial mortgage loans to rental owners throughout Hoosier State. DSCR loans are widely accepted by Indiana rental properties investors because they do not require income verification or income taxes; this allows them to repay loans faster than conventional loans and banks. DSCR Loans are a fantastic financing solution for any type of property purchase. Find a DSCR Loan Indiana that suits your needs? The process of acquiring a DSCR loan in Indiana isn’t complicated.

Key Benefits of DSCR Business Loans in Indiana

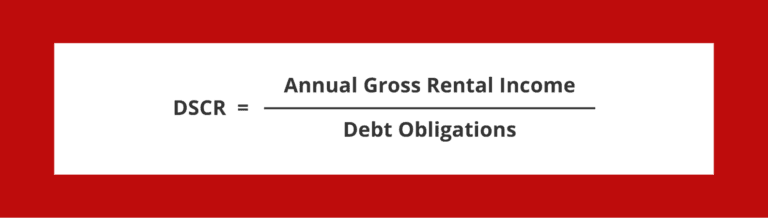

DSCR loans in Indiana are based on cash flow and rent income for investment property rather than a specific borrower’s personal income. As businesses take deductions for tax return payments each year, it may not be possible to report enough earnings to qualify for traditional investment loans. The loan is evaluated by the loan’s ability of the lender in determining the value of the loan as well as its ability to earn.

Loan Trust offers Debt Service Coverage Ratio Loans in Indianapolis, Carmel, Fort Wayne, South Bend, Fishers, Zionsville, Michigan City, Bloomington, Evansville, Westfield, Noblesville, Terre haute, Munster, Brownsburg, Whitestown, Gary, Lafayette, Hammond, Elkhart, Crown Point, New Albany, Portage, Merrillville, Mishawaka and many other cities in Indiana.

Rental Property Loans Near Indianapolis, IN

Loan Trust offers customers a fast, convenient online credit facility with easy online repayment options for a wide variety of products and services. We designed the product for 30 years for investors who are keen for quick growth in the rental market. Typically, these loans offer 80% loan-to-value (LTV) for fixed-rate lending, giving you the cash you need to purchase the properties that you own or lease. Typically the One-Time Rental Loans range from $100K up to $250,000.

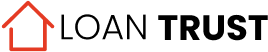

How to determine DSCR income?

Your rental on a residential property is your monthly rental income. Net operating income (NOI) will be used to calculate the business expenses. NOI equals your income plus taxed management fees and maintenance costs. DSCR payments include PITIA, principal interest taxes, insurers, and HOA fees. You can’t determine exactly what the amount is until you work directly with a DSCR lender. You may also improve DSCR by increasing your lease or decreasing your payments. Tell me the effect of higher rents on DSCR? It’s simple better terms.

DSCR Loan vs Conventional Loan

In Indiana, DSCR loans differ from conventional loan for investment properties. Conventional loan programs for investment opportunities are commonly called complete programs as the traditional loans have strict underwriting guidelines. If you do not have W2’s or Tax Return Income, you may not qualify for a regular loan. In the conventional lending industry, rates for borrowers are slightly lower than those in the DSCR loan market.

What type of documentation is required for Loan Trust rental loans near Indianapolis, IN?

Basically, you just need a property with cash flow and even if the property is vacant, then we can use the market rents from commercial property and the 1007 Schedule Rents of the property types the Uniform Residential Appraisal Report for qualifying income.

What is the minimum and maximum loan amounts for rental loans near Indianapolis, IN offered by Loan Trust?

Loan Turst loan for rentals starts at $50K. Maximum loan amount is up to $2M.

Appraisal for Indiana DSCR Loans

In some states, the DSCR loan application for Indiana requires the following form. Your appraisal may be ordered through an appraisal management firm (AMC), or through your lender’s appraisal directly. Loan Trust uses both of these techniques and gives our customers the option of hiring a preferred appraiser. We gather and submit appraisal price and availability requests by using Appraisal Price or Availability Request. The price and availability are determined. The AMC can usually save you $250 and can lead to shorter turnaround times.

Cash Out Refi DSCR Loan

Typically Indiana has 75% LTV on refinancing DSCR loans. DSCR loans in Indiana require 6 months of seasoning and you can pay refinancing without seasoning. We need merely verification of the added value of the property and the leased property’s cash flow and secured security deposits. Real estate investors need a quick cash recycler to do more business. You shouldn’t face penalties for a renter that has done well to repair their property. We are Indiana’s private lender with direct loans for borrowers who are renting properties who use BRRR.

Does my rental property have to be leased before closing?

No, at Loan Trust we will provide Debt service coverage ratio loans on vacant properties.

Can I live in one of my rental properties or rent it to a family member near Indianapolis, IN?

No, Loan Trust offers commercial loans only for non-resident investment properties.

Ready to get started with a rental loan lender that knows the Indianapolis market?

Select the loan you want from an Indianapolis mortgage based investment property or call 888-588-2254 ext 457 and ask to speak with a local real estate professional.

Average Days on the Market for Rental Investment Properties in Indianapolis, IN

How long an apartment market is in existence helps rental investors understand supply and demand for Indianapolis Indiana. Shorter time in the market means buyers or tenants are purchasing houses quicker. The longer the rental property investors say has remained on the market, the greater the potential for the buyer and the high demand for the tenant.

Work With the Best DSCR Lender in Indiana

DSCR lending offers an easy way of borrowing as an investment and business owner. Investing in income from a your property’s income, rather than other benefits other than personal income, is easier to obtain. Loan Trust offers direct loan products specifically tailored to your needs. Contact us today for a home loan.

What is the minimum credit score to get a DSCR loan in Indiana?

DSCR loans require credit scores of 600 or higher in Indiana. All lenders have their own criteria though. Certain policies may require you to improve your credit score to get the best result. Before getting a loan it is important that you conduct research since credit score affects eligibility interest rate and loan value.

What states does Loan Trust offer its rental loan products?

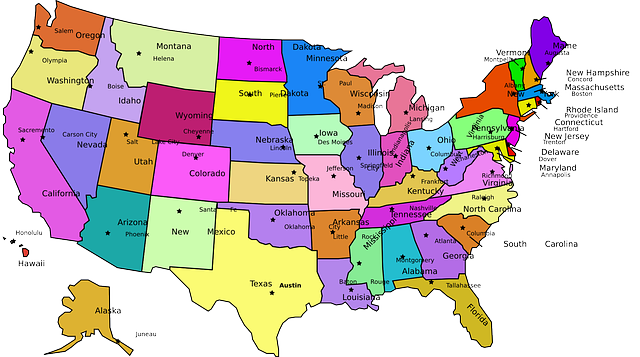

Loan Trust is a lending agency headquartered in the state of Florida and lending in 47 states and the ‘District of Columbia.

What type of properties are eligible for rental loans offered by Loan Trust?

Residential and Commercial properties.

DSCR Loan Indianapolis

Indianapolis offers excellent opportunities to invest your real estate portfolio to increase the value price appreciation of the property.

What is a good DSCR ratio in Indiana?

Almost all DSCR lending companies require a DSCR score of at least 1.20 for eligibility. Loan Trust allows DSCRs to be 0.75. You should remember that the higher your DSCR the less desirable it will get.

Is there a prepayment penalty?

On most of our DSCR loans we don’t require prepayment penalty, but it varies depending on the lending guidelines per the property type per state.

Do DSCR lenders need a license in Indiana?

Unlike other private DSCR lenders, they say most lenders don’t need NMLS licenses, as they have business-oriented borrowers.

- Conventional

- FHA

- VA

- USDA

- AirBNB Loans

- Condotel

- Non-QM

- DSCR

- No Doc Loans

- Mortgage Rates

- Bridge Loan Las Vegas

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington