DSCR Loan New York | Debt Service Coverage Ratio Loans NY

.

DSCR loans in New York play a crucial role in the real estate investment landscape, offering a lifeline to savvy real estate investors looking to expand their portfolios. At the heart of these transactions lies the Debt Service Coverage Ratio, or DSCR, a metric that gauges the property’s ability to make down payments and generate sufficient income to cover mortgage payments. New York, with its bustling real estate market, presents a fertile ground for DSCR loans, particularly for rental properties. Real estate investors in the state often turn to DSCR loans to finance their acquisition of income-generating assets, such as apartment buildings or commercial spaces in prime locations.

Who Are DSCR Loans Best Suited for In New York: Real Estate Investors

In New York, a DSCR loan is an ideal financing solution for real estate investors interested in purchasing rental properties. It permits borrowers to finance the entire purchase price of a property, positioning it as an outstanding choice for individuals aiming to acquire their initial investment property. If you’re in search of a loan that encompasses these advantages, then considering a DSCR loan in New York might be the perfect fit for you.

In the dynamic real estate market of New York, Debt Service Coverage Ratio (DSCR) loans have emerged as a strategic financing option, especially notable in Buffalo, NY. These DSCR loans in New York are specifically designed to support investors aiming to purchase or refinance investment properties by focusing on the property’s generated income rather than the investor’s personal financial history. The essence of a DSCR loan in Buffalo, NY, lies in its capacity to evaluate the potential loan amount based on the investment property’s income, ensuring the generated revenue sufficiently covers the debt service. This innovative approach to financing with DSCR loans in New York enables investors to leverage investment properties more effectively, optimizing their portfolios with a keen eye on future growth and sustainability within the vibrant New York real estate sector.

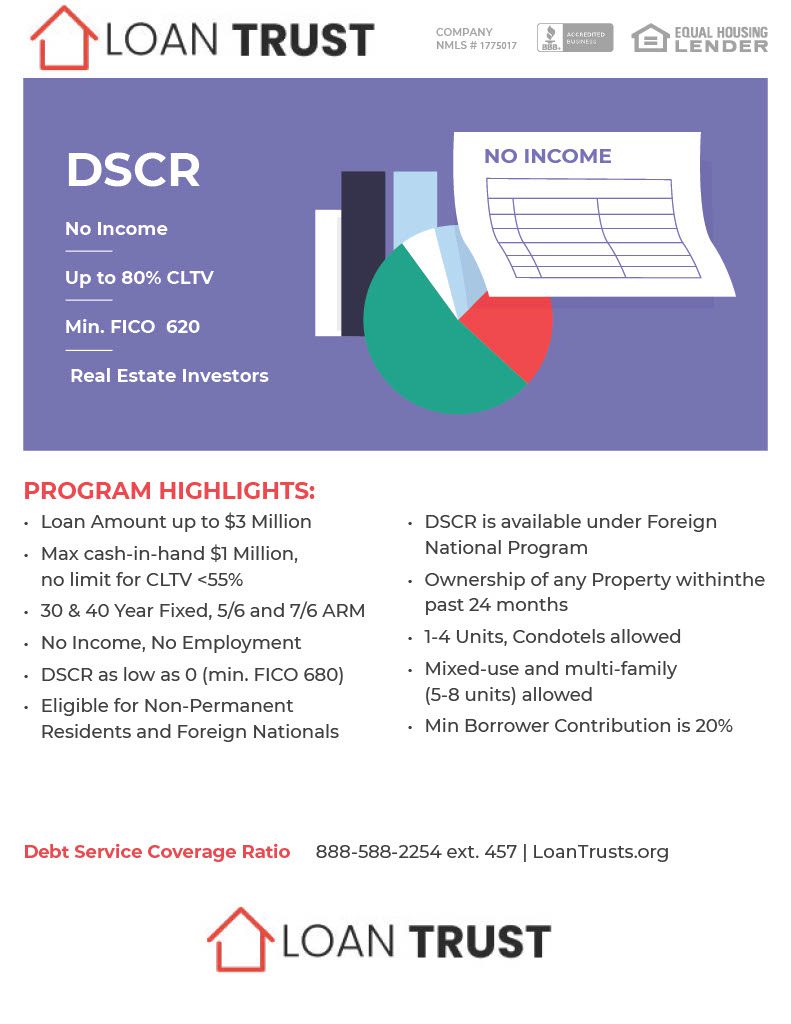

One of the standout advantages of DSCR loans for New York real estate investors is their focus on the property’s cash flow rather than a loan based on the borrower’s personal income or employment verification. This shift in perspective opens up opportunities for those who may not meet the traditional criteria for obtaining a mortgage. Moreover, DSCR loans in New York often come with flexible loan terms and competitive interest rates, accommodating investors seeking to optimize their returns. With a minimum credit score requirement, reasonable mortgage payment terms, and the potential to cash out funds from existing properties, these loans provide a valuable financing option for those looking to grow their real estate portfolios.

DSCR loans in New York also tend to offer lower down payment requirements compared to conventional commercial loans, making it easier for investors to secure the financing they need to acquire new rental properties. Loan officers specializing in New York DSCR loans can guide investors through the intricacies of the application process, ensuring that they meet the minimum loan criteria and understand the unique terms associated with these loans. For real estate investors in New York, DSCR loans serve as a key tool in building and expanding their income-generating rental property holdings, all while navigating the dynamic and competitive real estate landscape of the state.

What DSCR Do Lenders Look for with Commercial Loans?

When banks lend on investments, they look for properties that have a positive DSCR ratio (typically around 1.25 or above). Loan Trust could allow the debt service coverage ratio to be higher down payment lowered or in a range from 0.75 to 1.25 in terms of the cash reserve available. The higher the ratio the less reserve cash is needed. Loan Trust is a mortgage broker and mortgage lender to offer residential financing in New York. Unlike other commercial banks, DSCR loans have only been issued to investors who are investing in property that are leased for investment purposes.

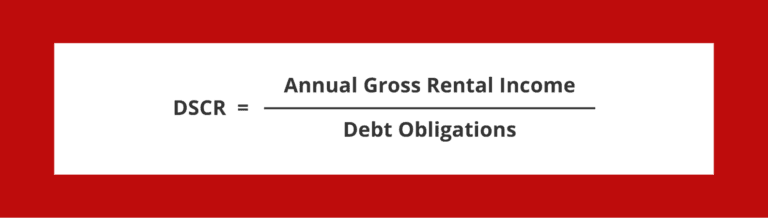

How Is DSCR Calculated for a Commercial Loan?

A DSCR of more than one covers mortgages, but lenders typically want it higher than 1.00. Banks generally want DSCRs greater than 1.20 for guaranteed loan protection. Loan Trust has accepted DSCRs as low as .75. The better DSCR, and the better your credit scores then the better your rate and terms will be on your loan.

DSCR Loans & Mortgages at Loan Trust

Loan Trust has been a national DSCR Mortgage Broker since 2017 and is a leader in online real estate investment loans. We’re the leader in debt service coverage ratio loans in New York and lend throughout the state in cities such as New York, Buffalo, Rochester, Yonkers, Syracuse, Albany, New Rochelle, Mount Vermon, Schenectady, Utica, White Plains, Hempstead, Troy, Niagara Falls, Binghamton, Long Beach and many other areas in the empire state for our DSCR program. We offer interest only and amortizing loans for residents and non permanent residents that many lenders don’t offer. This will increase your investment opportunities with interest only DSCR calculations. We also offer condotel purchases for foreign nationals investment opportunities.

What Are the Benefits of a New York Commercial DSCR Loan?

DSCR is aimed at reducing the risk that traditional loan will be denied to investors.

How DSCR loans work?

A lender thinks DSCR loans will “be effective” as they use investments, real estate portfolio profits, and assets as collateral against the loan. This is based upon Debt Services Insurance Rates DSCR. Borrowers will divide the potential profits from the rental earnings into the interest rates on debt. A positive Cash Flow Ratio is one or more which shows borrowers are able to repay loans using rental income. Lenders find this loan attractive due to their potential investor pools.

Purchase Price or As Is Value

The DSCR calculation applies to purchases when the appraisal reports determine the lower of the purchase price or assessment value. In some cases, it is possible to use ‘as is value’ from an appraisal document.

New York Property Tax Rate

The higher the property tax rate, the lower it gets. New York’s property taxes are higher than the national average of 1%. Please use this DSCR calculator to understand if property taxation limits your LTVs. If your BRRR investor has an equity portfolio you can easily avoid high property taxes because your home was renovated and you refinished it.

What Is a New York DSCR Loan?

DSCR translates to debt service coverage ratios. A commercial DSCR loan is an option loan which is based on cash flow using a debt service coverage ratio. This debt servicing coverage ratio represents a ratio of the net earnings a property generates and the amount that it owes to its owners, which includes interest, tax rates, insurance fees and HOA charges. Please note that your private income does not count towards a mortgage application, just the net operating income.

DSCR Loan Interest Rates

Rates for DSCR loans are historically high competitively to traditional loan programs for investment or bank loans. During a period of economic uncertainty DSCR loan amounts can become volatile as credit-backed securities such as pension funds, reinsurance, and mortgages demand lower interest rates to compensate for perceived risk. Firms aggregated DSCR lending may be requesting a greater yield in such a period. Final conclusion.

New York DSCR Loans

Loan Trust offers DSCR financing to property owners in New York and the DSCR loan is ideal for purchasing, refinancing and renovating commercial and investment properties. DSCR lending is based on the cash flow of the property and the borrower property investor’s ability for repayment. DSCR loans offer greater flexibility than other types of commercial credit and are more readily available than conventional loans. This type of loan is suitable for investors who have average credit and a limited personal income and have less-than-perfect financial history.

DSCR Lenders New York

There are numerous choices available regarding the selection of DSCR lenders in New York City. Loan Trust aims to help you create wealth from real estate investment. All we want is you to get the best customer care and customer service. Less rates of interest. Low origin fees. Higher LTVs. Better services. Better technology. Faster closing time.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington