DSCR Loan Colorado | How To Break Into The Colorado Real Estate Market With DSCR Loans

DSCR loans can be used to finance the purchase or sale of homes. Population growth in Colorado is one reason for Colorado’s high return on investment property here. Nearby communities grow. With over 300 days of sunshine each year there is a strong appeal for a Rocky Mountain High state. A DSCR loan Colorado program can simplify your mortgage application with no need for income verification

How to maximize your real estate investing potential with DSCR loans

The real estate industry is characterized by many moving parts, particularly the mortgage process when negotiating the sale and purchase of properties. From negotiation to appraisal to contracts it can take several separate steps, with numerous partners involved in the process. Another important factor which may help make the real estate deal close is a DSCR loan in Colorado with a higher repayment rate. DSCR loans are a type of loan designed specifically to allow borrowers to borrow using cash flow derived from investment properties instead of traditional income.

DEBT SERVICE COVERAGE RATIO

Colorado commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

What Are Colorado DSCR Loans?

Debt service coverage ratio loans, also called DSCR loans are different in terms of payments and tax returns. This non-QM loan is designed to assist people unable to afford the conventional mortgage. The DSCR loans work almost the same for all of the US states, however the property values and rates vary in the regions. Unlike conventional Colorado mortgages DSCR is intended to help real investors.

DSCR income calculation

Property: The Income reflects monthly rental income. Commercial property: Income is net operating income. the property value NOI is net operating income less expenses in the year. NOI can be hard to calculate, so contact Loan Trust a direct private lender for assistance.

How To Calculate Your DSCR?

Calculate your DSCR by multiplying the NOI of your property by the debt service of your loan (as determined annually). Find your net profit based upon subtracting the reasonably necessary operating cost of your home from the gross rental income derived. Calculation of DSCR and NOI Debit Services. Keep in mind that the monthly rental income generated is a huge factor.

DSCR payment calculation

This payment covers the full monthly rent costs. It typically consists of mortgage principal interest rates, mortgage tax rates, insurance fees, HOA fees, etc. Generally speaking, DSCR loans require lender approval. Pro tip for boosting your DSCR approval odds: Increase your DSCR proportions. Typically, a borrower with greater than 1.0 DSCR will be approved by a DSCR lender.

How to calculate DSCR

Calculating DSCRs is easy. Divide Net Revenues (NOIs) by Total Debt Services (TDSs).

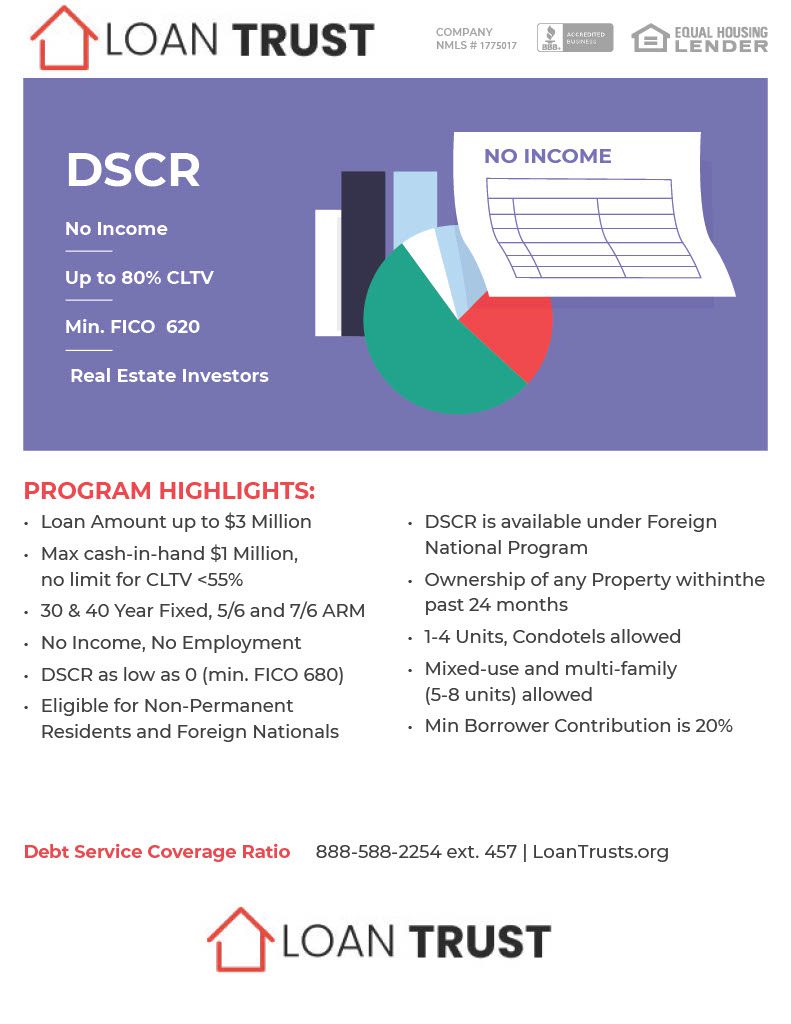

Colorado DSCR loan requirements

Because DSCR loan applications take into account income in real estate rather than borrowers’ income, borrowers are more likely to qualify for a mortgage than other types of mortgages. DSCR loans may be the right solution when your earnings can’t be verified. W2’s aren’t necessary for qualifying for a DSCR loan in Colorado. Usually, borrowers who earn too few dollars at work may be able to get DSCR loans if they can afford the loan based upon the ratio.

What DSCR Do Lenders Look for?

Usually, all DSCRs above one are good, although other lenders can help you if a DSCR remains low. Bank statements, loans & assets loans are both a good alternative to a loan that cannot meet the minimum repayment ratio for the Colorado DSCR Loan Program. Loan Trust offers DSCR loans for individuals who have DSCR below 0.75. You will still have a low rate and more favorable loan if your DSCR is greater than 1.00.

Who is a good fit for a DSCR loan?

The loan is ideal for real estate investors who do not want a job or tax returns to be reviewed by the lender. Alternatively, investors with a number of properties with credit beyond 10 can apply for a DSCR loan.

What Are the Down Payment Requirements for a DSCR loan?

Although DSCR loans are a traditional loan, DSCR loans require a small deposit in order to secure DSCR loans. Loan Trust is able to give you DSCR financing with down payment up to 20%. Nevertheless, a larger down payment may reduce your monthly payments, so it may be worth investing more money.

What Are the Benefits of a DSCR Loan?

DSCR loans are an option that can be easily applied when investing in rental property. Do DSCR loans offer a range of investment advantages for Colorado investors? Talk to our loan specialists now!

Personal income is irrelevant

The DSCR loan is not evaluated by individual income and therefore it is more accessible if eligible borrowers do not have substantial savings or other assets.

DSCR Loan Programs in Colorado

1. Understanding DSCR Loan Programs in Colorado DSCR loan programs in Colorado are designed to provide financing options for real estate investors based on the Debt Service Coverage Ratio (DSCR). This ratio measures the property’s cash flow against the required mortgage payments.

2. Benefits of DSCR Loans in Colorado DSCR loans offer several benefits to real estate investors in Colorado. These include flexible income or employment verification requirements, consideration of rental income, and an emphasis on cash flow rather than personal finances.

3. DSCR and Cash Flow Importance The debt service coverage ratio (DSCR) is a critical factor for obtaining DSCR loans in Colorado. Lenders assess the property’s cash flow to determine its ability to cover mortgage payments, ensuring the borrower can sustain the investment.

4. Minimum Credit Score Requirements While DSCR loans in Colorado may have more lenient income verification requirements, borrowers are still expected to have a minimum credit score. Maintaining a good credit score demonstrates financial responsibility and increases the likelihood of loan approval.

5. Collaborating with Mortgage Brokers Working with experienced mortgage brokers who specialize in DSCR loans can significantly benefit real estate investors in Colorado. These professionals have access to multiple lenders and can guide borrowers through the application process to find the best loan options.

6. Understanding Mortgage Payments DSCR loan programs in Colorado calculate mortgage payments based on the property’s cash flow and potential rental income. This approach provides investors with more flexibility and a better understanding of their financial obligations.

7. Consideration of Rental Income Unlike traditional mortgages, DSCR loans in Colorado take into account the property’s rental income. This means that investors can leverage their rental properties to generate income and increase their chances of loan approval.

8. Multiple Properties and DSCR Loans DSCR loans are suitable for investors who own multiple properties in Colorado. By considering the cash flow from all rental properties, lenders can determine the borrower’s overall debt-to-income ratio and evaluate their ability to manage multiple investments.

9. Self-Employed Borrowers and DSCR Loans Self-employed borrowers in Colorado often face challenges when applying for traditional mortgages. However, DSCR loans provide a viable option as they focus more on the property’s cash flow rather than personal income verification.

10. Offering DSCR Loans in Colorado Springs Colorado Springs, a vibrant real estate market, offers various opportunities for investors. Many lenders in Colorado Springs offer DSCR loans specifically tailored to meet the needs of local real estate investors.

11. Subject Property and Loan-to-Value Ratio DSCR loans in Colorado consider the subject property and its loan-to-value ratio. This evaluation ensures that the property’s value aligns with the loan amount and helps determine the interest rate and loan terms.

12. Interest Rates for DSCR Loans Interest rates for DSCR loans in Colorado may vary depending on factors such as the borrower’s credit score, the property type, and the loan-to-value ratio. Working with mortgage brokers can help investors find the most competitive interest rates available.

13. Operating Expenses and Cash Flow When evaluating DSCR loan applications, lenders consider the property’s operating expenses. This assessment helps determine the property’s net cash flow and its ability to cover the mortgage payments.

14. Credit Unions and DSCR Loans Credit unions in Colorado often offer DSCR loans to real estate investors. These institutions may have more flexibility in their lending criteria and can be a valuable resource for borrowers seeking financing.

15. Calculating DSCR for Loan Eligibility The DSCR is calculated by dividing the property’s net operating income by the required debt service. Lenders typically require a minimum DSCR of 1.25 or higher for loan eligibility.

16. Taking Advantage of Colorado’s Booming Economy Colorado’s booming economy and strong real estate market make it an attractive destination for real estate investors. DSCR loans can help these investors capitalize on the opportunities presented by the state’s thriving economy.

17. Foreign Nationals and DSCR Loans Foreign nationals interested in investing in Colorado real estate can also explore DSCR loan programs. Some lenders offer financing options specifically designed for non-U.S. citizens seeking to invest in the state.

18. Landlord-Friendly Policies in Colorado Colorado is known for its landlord-friendly policies, making it an ideal location for real estate investment. DSCR loans provide an avenue for investors to finance their properties and benefit from the favorable legal environment.

19. Determining Property Type Eligibility DSCR loan programs in Colorado cater to various property types, including single-family homes, condos, and multi-unit residential properties. Investors can choose the property type that aligns with their investment goals and qualify for suitable financing options.

20. Refinancing Opportunities with DSCR Loans Existing property owners in Colorado can explore DSCR loan refinancing options to capitalize on lower interest rates or to access equity for further investment opportunities. Refinancing can provide financial flexibility and help borrowers achieve their investment objectives.

In summary, DSCR loan programs in Colorado offer real estate investors flexible financing options that consider the property’s cash flow rather than personal income verification. By working with mortgage brokers, understanding the DSCR calculation, and taking advantage of Colorado’s thriving economy, investors can qualify for loans that suit their investment needs. Whether purchasing rental properties, refinancing, or expanding their investment portfolio, DSCR loans provide valuable opportunities for clients in the dynamic Colorado real estate market.

Debt Service Ratio (DSCR) loans have become increasingly vital for property investors, particularly in states like Colorado and Florida. These loans are distinct in their evaluation process, focusing primarily on the potential cash flow of the investment property rather than the personal income of the borrower. This method is especially advantageous for investors who may not qualify for traditional mortgages due to variable income streams.

In Florida, the demand for DSCR loans has seen a noticeable rise. Cities like Jacksonville and Fort Lauderdale are prime examples of this trend. A DSCR lender in Jacksonville typically evaluates the loan based on the property’s generated income versus its operating expenses. The DSCR mortgage in Jacksonville, therefore, becomes an attractive option for investors looking to capitalize on the city’s growing real estate market. Similarly, the DSCR mortgage in Fort Lauderdale caters to investors in a city known for its vibrant real estate market, offering them flexibility and ease in financing investment properties.

Moreover, Florida DSCR loans have become a cornerstone of property investment financing throughout the state. These loans are tailored to meet the unique demands of the Florida real estate market, providing investors with the needed leverage to expand their portfolios. Whether it’s a Florida DSCR loan for a single-family home or a larger multi-unit property, the focus remains on the income-generating potential of the property. This approach is beneficial for investors who might have multiple loans and need an alternative method to traditional lending to continue growing their investments.

In conclusion, DSCR loans represent a significant shift in real estate financing, particularly appealing to property investors in states like Colorado and Florida. They offer an innovative solution for those looking to bypass the limitations of traditional mortgage systems, focusing instead on the income potential of the property in question.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington