DSCR Loans in Georgia | Grow Your Real Estate Portfolio Without Income Verification

Use DSCR Loans to Grow Your Rental Portfolio in Georgia

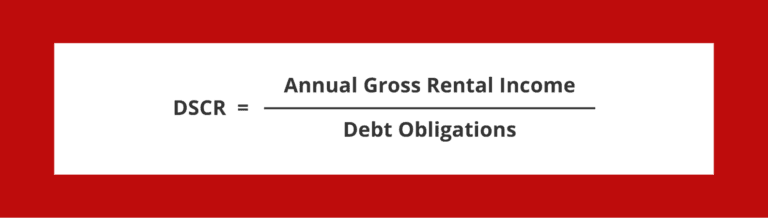

Georgia real estate investors use debt servicing coverage ratios (DSCRs) loans to increase portfolio size. DSCR can calculate the annual rental revenue by dividing this amount by the monthly mortgage payments and expenses such as principal interest, tax rates, insurance and membership fees (PITIA). Final debt service cover ratios indicate the ability of a loan to repay a given amount. Most lenders require a minimum DSCR at 1.2 to demonstrate favorable cash flows. DSCR loans are an ideal investment option for individuals with an extensive portfolio. Their simplified approval processes and loan terms have targeted properties investors in mind.

A debt service insurance coverage ratio (DSCR) loan is a property loan enabling borrowers to apply for a loan on the profit-making property on the basis of the cash flows and not the personal income.

DEBT SERVICE COVERAGE RATIO

Georgia commercial lenders also look at the debt-service coverage ratio (DSCR), which compares a property’s annual net operating income (NOI) to its annual mortgage debt service (including principal and interest), measuring the property’s ability to service its debt. It is calculated by dividing the NOI by the annual debt service. For example, a property with $140,000 in NOI and $100,000 in annual mortgage debt service would have a DSCR of 1.40 ($140,000 ÷ $100,000 = 1.4). The ratio helps lenders determine the maximum loan size based on the cash flow generated by the property.

A DSCR of less than 1 indicates a negative cash flow. For example, a DSCR of .92 means that there is only enough NOI to cover 92% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25 to ensure adequate cash flow. A lower DSCR may be acceptable for loans with shorter amortization periods and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows – for example, hotels, which lack the long-term (and therefore, more predictable) tenant leases common to other types of commercial real estate.

Georgia DSCR Loans Look at Cash Flow Rather than Personal Income

Traditional loan programs rely heavily on debt-to-income ratios and require substantial documentation such as pay stubs, bank accounts and returns. A high debt-in-equity-ratio investor can have trouble meeting the requirements for several mortgage loans. On the one hand, DSCR loans are qualified by an acceptable credit rating and the down payments are funded by the property’s revenue potential.

Why Georgia is a great place to invest in real estate investors

Georgia attracts investment thanks to low rents and low taxes that keep the costs down. Average home price rose by over 6% to $349,900 while average days on the market decreased. Georgia’s south-easterly location provides the visitor and resident with an ideal climate that enables the visitor to enjoy all four seasons with professional and recreational sporting teams, world-class entertainment and global cuisine.

Georgia DSCR Loans Offer Flexible Terms and Fees

With DSCR loans, the borrower can enjoy 30-year terms without ballooning. DSCR loans are generally optional with interest only loans, rate buy-down loans, and penalties for payment buy-down loans. Alternatively, rates can be configured in various ways. Investors can easily tailor DSCR loan programs to suit their investment needs. For example investors who intend on holding onto their rental properties long term can choose fixed rates with low rates, while investors who purchase rental properties or could soon be buying can choose an ARM rate structure.

5 best areas to invest in Georgia

The average home price of 318,331 remains well below the national average. Realtor.com forecasts the price of houses in the greater Atlanta area is likely going to continue to grow in the coming quarters with the median household income increasing by 8.7%. Currently 56% of the renters occupy the land. As Georgia’s oldest city with the greatest eccentricity, Savannah has a rich heritage and culture. Since 2015, Savannah homes have steadily increased in value, presently $277,598, up from property value of $220,000 in August.

Qualities of a Good Lender

You must look at many qualities of a loan provider to ensure you get the most suitable loan. A favorable loan interest rate is an essential consideration when looking for the best mortgage broker. The interest rate gives you an idea of what you will be paying each week for your mortgage payments. In addition, you should ensure the lending program matches the requirements for you. Some lenders have fixed interest rates while others offer variable rates.

What DSCR Do Lenders Look For?

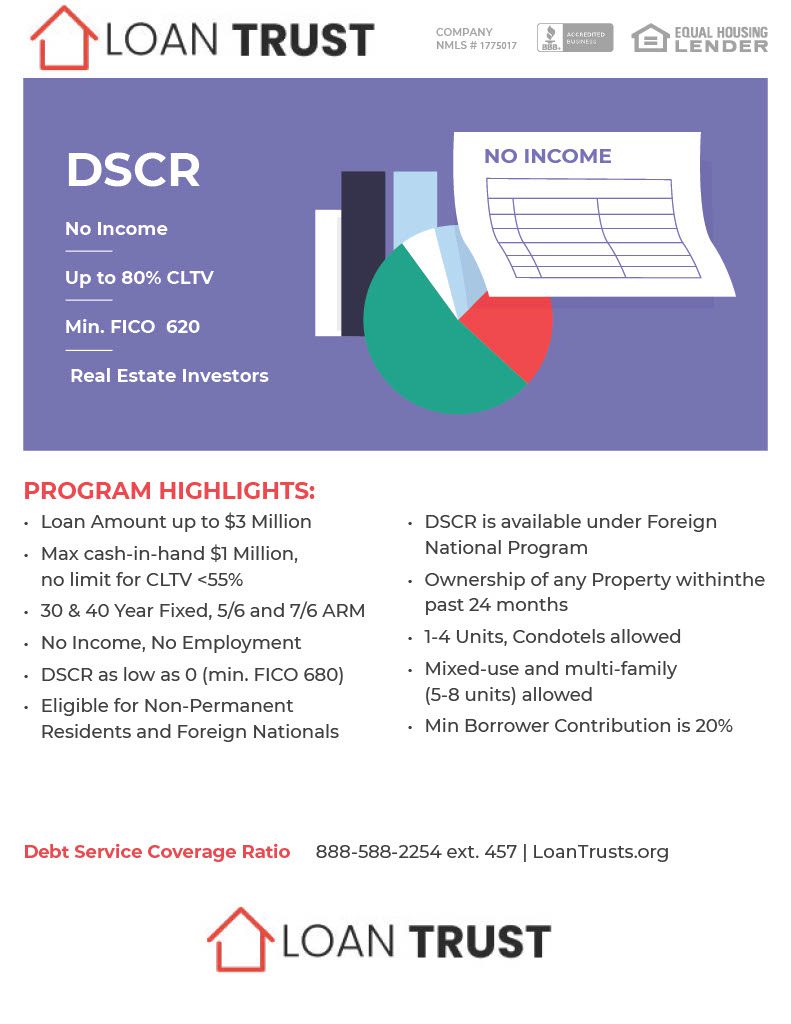

DSCR loans require certain requirements. Loan Trust is a private lender with DSCRs of 0.75 and 1.75 for loans whereas most others require 1.25. DSCRs are used by lenders when they are trying to determine how much rent you have made on taxable property. You can also request additional documentation during the application process to confirm all of the calculations required.

Why do Real Estate Investors Use DSCR Loan Georgia?

In Georgia, borrowers are often utilizing DSCR loans to finance real estate investments. Because it is based on income of property and not on borrowers’ financial history, investors may be more successful in acquiring investment loans. DSCR loans offer many benefits, as investors are able to repay their debt on shorter terms, enabling greater flexibility in terms of repayment and income. A DSCR-financed loan is often less dependent on personal income and requires less documentation such as income tax returns.

Compare Rates from Best DSCR Lenders

Get pre-approved by the lender on the basis of rental income and potential rent-in-income. *This service is absolutely free to you! Loan Trust is the premier DSCR Lender Atlanta source for real estate investors.

How Do You Qualify for a DSCR Loan in Georgia?

In Georgia, the applicant must be the one who invests in the rental sector of the business. DSCR loan applications are not suited for purchasing owner owned homes; therefore, the homeowner may have to consider another Non-QM loan like Interest-only or Recent credit-related loans. You will have an adequate DSCR rating, and ideally the capacity for the down payment. Loan Trust makes the application for Georgia’s debt coverage ratios easy.

DSCR Calculation: Calculate DSCR Loans in Georgia

Calculating the DSCR means that you must divide the annual net profit (NOI) from total credit payments for the calendar year. Your NOI ratio will be determined based on the debt payment ratio.

What is the Net Operating Income of DSCR Investor Loans?

Operating incomes (NOIs) are essential to determine DSCR. NOIs are the sums that the property generate when removing the costs, tax and operating expenses from the property.

DSCR Loan Georgia Interest Rates

Interest rates on DSCR loans vary according to the borrower and loan term. A common practice in the DSCR sector is the increase of 1-2% interest rate on a commercial loan. But those with strong credit ratings will likely receive a much more favorable credit rating. Do you want more information about DSCR Loan terms and conditions?

What Is a Good DSCR Ratio?

Most lending institutions prefer 1.20 DSCR ratio to most of their customers, but this varies by lender needs. A DSCR debt to income ratio of 1.00 was sufficient to obtain a loan and obtain the necessary funds.

Understanding the Debt Service Coverage Ratio (DSCR)

The DSCR Loans Program requires all borrowers to have the required debt services coverage ratio (DSCR) in place.

What are the Program Costs and Fees of DSCR?

The fees associated with a DSCR mortgage in Georgia may differ depending upon the various mortgage lender used. This fee is important for borrowers to thoroughly examine this fee before signing a loan.

What Are Georgia DSCR Loans?

DSCR loans allow borrowers to buy homes but are unlike the other Georgia home loans. Georgia debt-related loans use a Georgia DSCR instead of assets to determine eligibility. Your debt service coverage ratio indicates yearly rent income provided by the rental property relative to monthly payments and to annual costs for loan repayment. DSCR loans are Non-QM loans, so they do not require borrowers to pass through a typical loan approval procedure to qualify for it. Normal, you would need to submit proof of employment to secure an interest loan.

Advantages of Securing a Georgia DSCR Loan

DSCR loans offer many benefits to home-buyers versus traditional lending. It is important for you that you provide proof of income verification and employment verification on non DSCR loan programs in Georgia. DSCR loans are generally more efficient in Georgia and thus have shorter closing periods. When DSCR financing is secured with Loan Trust we will try our hardest to offer favorable loan rates. There is no need to sacrifice an adequate interest rate for an investment to invest in a property.

Work with an experienced lender

Moreover, partnering with experienced DSCR loan lenders increases your chances of approval. Find a lender with DSCR experience and have answers to your business and finance questions. In order to qualify as a borrower many DSCR lenders in Georgia, will require the applicant be able rent the real estate investments.

What Is a Positive Cash Flow for Investment Property, and How Can It Help?

Positive Cash flow means a balance of money accumulated at expenses. It covers the cost for loans and tax returns, for a home, for maintenance and for other expenses as follows: Using rental properties to generate good cashflow will give you money each month. Positive cashflow can help lenders assess the likelihood of a loan being approved. Selecting the right property with the potential to produce adequate monthly rental income will help you to qualify for DSCR loans in Georgia. A DSCR mortgage loan in Georgia gives you access for investing in real estate or other investments in Georgia.

Finding DSCR Lenders in Georgia

Getting loans from lenders can be an intimidating experience. It takes time to choose the best loan provider and the loan type that suits you. Fortunately, you can find a reliable lending company with experienced lenders who can provide you an ideal solution for your DSCR loan. We talk about some ways to find an ideal lender for your DSCR loan program and lending.

Find the Best DSCR Lenders in Georgia

Get an investor cashflow mortgage prequalified for potential rentals. All our assistance is completely available to help you make the right financial decisions on your DSCR loan Georgia program!

Tips for Finding the Right DSCR Loan in Georgia

When looking at DSCR loan options in Georgia, there are several tips to remember when looking for a loan at DSCR, you can get your desired loan. Get expert mortgage lending services for a high-quality Georgia property.

Is it hard to get a DSCR loan in Georgia?

A DSCR loan program can also be secured in Georgia actually very quickly. Loan Trust can close on a DSCR loan Georgia program from 14 – 21 days.

Do banks offer DSCR loans in Georgia?

Yes. There are dozens of banking institutions in Georgia that lend DSCRs. It is however important to shop around and compare different loans in order to obtain an optimal loan term and rate. Alternatively, it can be easier for customers looking for an DSCR lender to use Loan Trust since they have access to hundreds of lenders if they decide not to make the loan directly.

Do DSCR loans in Georgia require a down payment?

A. Generally, the lender will require a down payment from 20% to 25% for DSCR loans in Georgia.

DSCR Loan Georgia Real Estate Investment Loans

Understanding DSCR Loans in Georgia DSCR loans in Georgia are a type of real estate investment loan that focuses on the property’s cash flow and rental income potential. These loans prioritize the Debt Service Coverage Ratio (DSCR) when determining loan eligibility.

The Importance of Monthly Rental Income When applying for a DSCR loan in Georgia, lenders carefully evaluate the property’s monthly rental income. This assessment helps determine if the property generates sufficient income to cover the loan payments and maintain a positive cash flow.

Investment Property Financing in Georgia DSCR loans are particularly beneficial for financing investment properties in Georgia. Whether it’s a residential rental property or a commercial investment property, these loans provide real estate investors with the necessary funds to purchase or refinance their properties.

Minimum Credit Score Requirements While DSCR loans may be more flexible in terms of income verification, borrowers are still expected to have a minimum credit score. A good credit score demonstrates financial responsibility and increases the chances of loan approval.

Exploring Georgia Real Estate Investment Opportunities Georgia offers a diverse and thriving real estate market. From Atlanta to Savannah and beyond, there are ample opportunities for real estate investors to capitalize on the state’s robust market and rental demand.

Evaluating the Property’s Cash Flow and Debt Service Coverage Ratio Lenders in Georgia assess the property’s cash flow and calculate the Debt Service Coverage Ratio (DSCR) to determine loan eligibility. This evaluation ensures that the property’s income is sufficient to cover the loan payments and meet the lender’s criteria.

Working with a Georgia DSCR Loan Lender Finding the right DSCR loan lender in Georgia is crucial for real estate investors. These lenders specialize in real estate investment loans and have an in-depth knowledge of the local market and lending requirements.

Consideration of Rental Properties DSCR loans are designed to cater to rental properties in Georgia. Whether it’s a single-family residence, multi-unit building, or commercial property, these loans take into account the rental income generated by the property.

Understanding Loan Payments DSCR loans in Georgia calculate loan payments based on the property’s cash flow and the rental income it generates. This approach provides investors with a better understanding of their monthly financial obligations and helps ensure the property’s income can cover the loan payments.

The Role of Hard Money Loans and Closing Costs In some cases, real estate investors in Georgia may opt for hard money loans, which provide more flexible lending options. However, it’s important to consider the associated closing costs, such as appraisal fees, origination fees, and title insurance.

Debt-to-Income Ratio and Loan to Value Lenders in Georgia evaluate the borrower’s debt-to-income ratio and the loan-to-value ratio to determine loan eligibility. These factors provide insights into the borrower’s financial situation and the property’s value compared to the loan amount.

Minimum DSCR Requirements Lenders typically require a minimum DSCR of 1.25 or higher for loan approval. This ensures that the property’s income is sufficient to cover the loan payments and maintain a positive cash flow.

Finding Lenders Who Offer DSCR Loans Not all lenders in Georgia offer DSCR loans. It’s important for real estate investors to do thorough research and find lenders who specialize in these types of loans to ensure they receive the best terms and conditions.

Investment Properties and Service Coverage Ratio DSCR DSCR loans are specifically tailored for investment properties in Georgia. These loans focus on the service coverage ratio (DSCR), which considers the property’s gross income and its ability to cover debt service payments.

Comparing DSCR Loans to Traditional Loans DSCR loans differ from traditional loans as they prioritize the property’s income potential rather than the borrower’s personal income. This makes them an attractive option for real estate investors who rely on rental income to repay the loan.

Consideration of Management Fees and Monthly Expenses When calculating the property’s cash flow, it’s important to consider management fees and other monthly expenses associated with the property. These costs impact the property’s net income and, consequently, its ability to meet the lender’s DSCR requirements.

Low Interest Rates for Real Estate Investors Georgia offers competitive interest rates for real estate investors. By leveraging DSCR loans, investors can secure financing at favorable rates, reducing their overall borrowing costs.

Expanding Real Estate Portfolio with DSCR Loans DSCR loans in Georgia provide opportunities for real estate investors to expand their portfolios. These loans allow investors to finance multiple properties and leverage their rental income to support their investment ventures.

Providing Bank Statements and Other Financial Documentation While DSCR loans may not require traditional income verification, lenders may request bank statements and other financial documentation to assess the borrower’s financial situation and the property’s income potential.

Considering Single-Family Homes in Georgia Single-family homes are popular investment options in Georgia. DSCR loans can help investors finance these properties and capitalize on the demand for residential rentals.

Understanding the Importance of Income Real estate investors in Georgia need to demonstrate sufficient income to support their loan applications. While personal income verification may not be required, investors must ensure they have enough income from rental properties to meet the lender’s criteria.

Exploring Opportunities in Rural Areas Georgia offers investment opportunities not only in major cities but also in rural areas. Real estate investors can leverage DSCR loans to finance properties in these regions and benefit from the potential for growth and rental demand.

Benefits of DSCR Loans from Non-Bank Lenders Non-bank lenders in Georgia often offer DSCR loans with more flexibility and streamlined processes. These lenders cater to real estate investors and can provide competitive terms and quick funding options.

Keeping Up with Industry News To stay informed about the real estate market and lending trends in Georgia, investors should follow industry news, attend local networking events, and consult with experienced professionals in the field.

The Advantage of Lower Interest Rates DSCR loans in Georgia often come with lower interest rates compared to other financing options. This can significantly reduce borrowing costs and increase the investor’s overall profitability.

Ensuring Sufficient Funds for Investment Real estate investors in Georgia must have enough capital to cover expenses beyond the loan amount. It’s important to have money left for property repairs, vacancies, and unforeseen expenses to ensure the success of the investment.

The Importance of Income Verification While DSCR loans may offer more flexibility in income verification, it’s still essential for real estate investors to provide accurate information about their income and demonstrate their ability to generate sufficient rental income from their properties.

Investing in Residential Properties DSCR loans are well-suited for financing residential properties in Georgia. Whether it’s single-family homes or multi-unit buildings, these loans provide real estate investors with the necessary funds to purchase and maintain their residential investment properties.

Exploring Different Lenders Real estate investors should explore different lenders and loan options in Georgia. By comparing rates, terms, and fees, investors can find the most suitable lender that aligns with their investment strategy and financial goals.

The Importance of a Competitive DSCR A competitive DSCR helps investors secure DSCR loans in Georgia. Lenders assess the property’s income potential and evaluate if it meets the minimum DSCR requirements set by the lender.

Understanding the Loan Term and Monthly Payments Investors must understand the loan term and monthly payment structure of DSCR loans in Georgia. This includes considering factors such as interest rates, amortization periods, and the impact on the property’s cash flow.

Providing Bank Statements and Documentation DSCR lenders in Georgia may require bank statements and other financial documentation to assess the borrower’s financial situation and the property’s income-generating potential. Providing these documents accurately and promptly can facilitate the loan application process.

The Role of Non-QM Loans DSCR loans in Georgia often fall under the category of Non-QM (Non-Qualified Mortgage) loans. These loans offer flexibility in income verification and cater to borrowers who may not meet the strict criteria of traditional mortgage loans.

The Potential for Interest-Only Periods DSCR loans in Georgia may offer interest-only periods, allowing borrowers to make lower monthly payments during a specific timeframe. This can provide financial flexibility and enable investors to allocate funds to other aspects of their real estate investments.

In summary, DSCR loans in Georgia offer real estate investors flexible financing options based on the property’s cash flow and rental income potential. These loans prioritize the property’s income rather than personal income verification, making them suitable for financing investment properties and rental properties in Georgia. By understanding the loan terms, calculating DSCR, and exploring various lenders and loan options, investors can secure financing at competitive terms and leverage their rental income for successful real estate investments in Georgia.

- DSCR Loan Alabama

- DSCR Loan Arizona

- DSCR Loan Colorado

- DSCR Loan Florida

- DSCR Loan Georgia

- DSCR Loan Hawaii

- DSCR Loan Illinois

- DSCR Loan Indiana

- DSCR Loan Maryland

- DSCR Loan Massachusetts

- DSCR Loan Michigan

- DSCR Loan New York

- DSCR Loan North Carolina

- DSCR Loan Ohio

- DSCR Loan Oregon

- DSCR Loan Tennessee

- DSCR Loan Texas

- DSCR Loan Washington